Cardano price remains under heavy pressure ahead of Hoskinson testimony

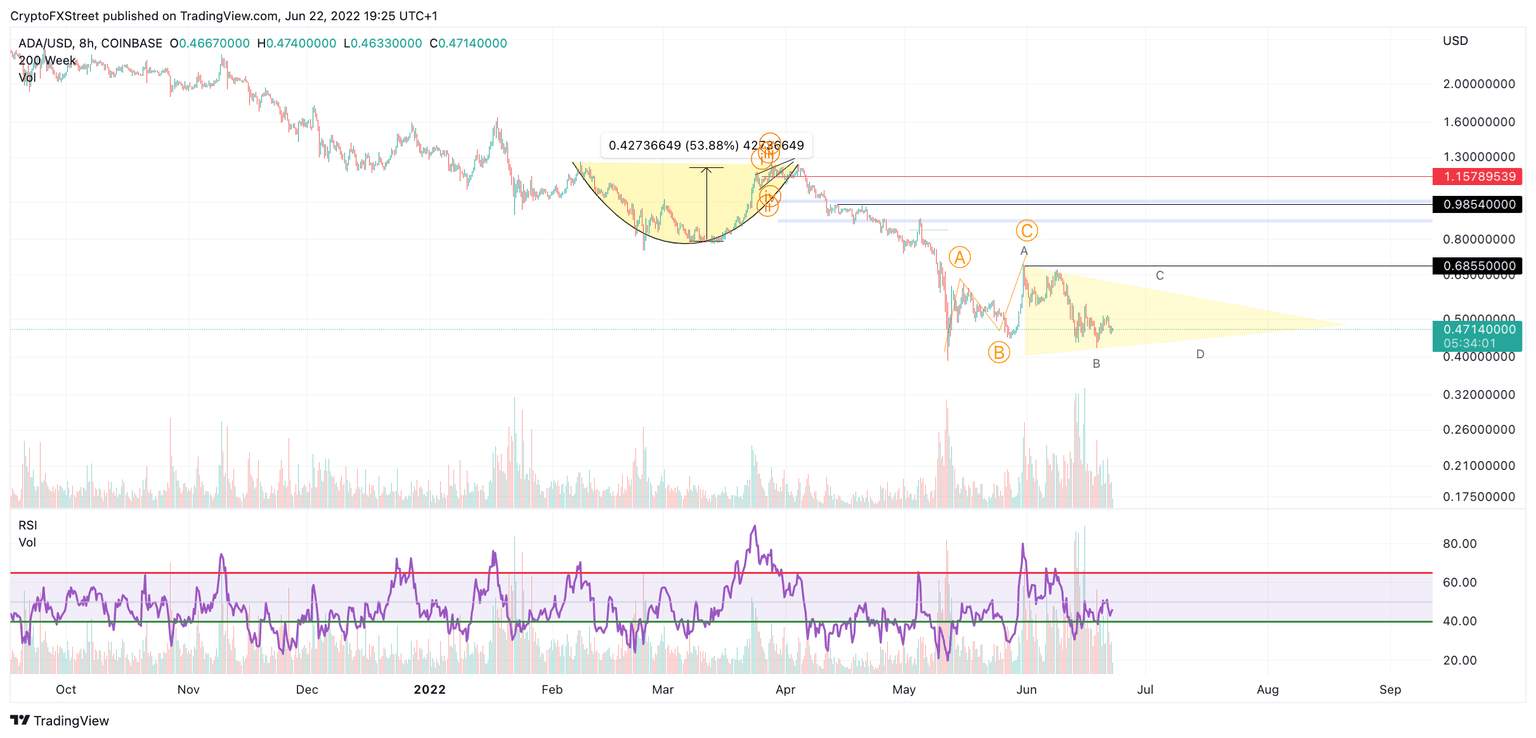

- Cardano price sees rejection at the $0.50 area.

- A breach below the May 11 swing low at $0.39 could trigger a massive decline to $0.30.

- Invalidation of the bearish downtrend is a breach above $0.685.

UPDATE: Cardano price remains under pressure despite experiencing a bounce-back Thursday at the time of this update (11.30 GMT). ADA price again found support at the $0.45 support on a negative Wednesday for most cryptocurrency markets. This level, which had not been seen since June from last year, has become the only remaining lifeline for Cardano bulls, having acted as support three times in the last month. Still, buyers of the layer 1 token are not showing up, which is reflected in the lower highs that each relief rally attempt in the past two weeks has finished at. News surrounding the delay of the Vasil hard fork is not helping one bit, but the testimony later in the day of Cardano founder Charles Hoskinson in the US House of Representatives could help bulls get some life and initiate a potential ADA price turnaround.

REMINDER: In 18 hours, Charles will speak before the U.S. House of Representatives Committee on Agriculture about "The Future of Digital Asset Regulation".

— Cardano Quick News (@CardanoNOW) June 22, 2022

⭐️Link to watch live in reply.#Cardano #ada $ada #crypto pic.twitter.com/JKTS90RTcp

Cardano price is still too early to call, a dollar-cost averaging approach could succumb to substantial losses in the short term.

Cardano price is under substantial pressure

Cardano price shows bearish signals, which may steer investors away from dollar-cost averaging the self-proclaimed Ethereum Killer Smart Contract token. On Wednesday, June 22, ADA price trades within the lower boundary of the range at $0.46. The bears have managed to produce a rejection from the psychological $0.50 area. The technicals could be read as a local double bottom, which may entice many traders and long-term investors to take a nibble at the current price action.

As mentioned in previous articles, Cardano price still has bearish confluence targets in the $0.30 and $0.20 areas. Traders should be careful not to get overzealous at the tempting double-bottom formation. A breach at $0.39 could be the catalyst to descend ADA price to $0.30.

ADA/USDT 8-Hour Chart

The safer option for investors will be to wait for the invalidation point at $0.685 to get breached. If this bullish event happens, the price will continue to rise towards $0.75. A 3-wave pullback will eventually occur after the bullish trend exhausts. Traders will then have plenty of opportunities to go long with bullish momentum in their favor. Cardano price could rally towards the $1.40 zone, resulting in a 195% increase from the current ADA price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.