Cryptocurrencies Price Prediction: Axie, Maker & Bitcoin – European Wrap 15 January

Axie Infinity and Bitcoin Cash hold up despite high ratio of shorts

The green light from the US Securities and Exchange Commission (SEC) for the Bitcoin Spot ETF caused a notable surge among many altcoins, which benefited from an overnight increase in their prices with either new capital inflow or capital rotation.

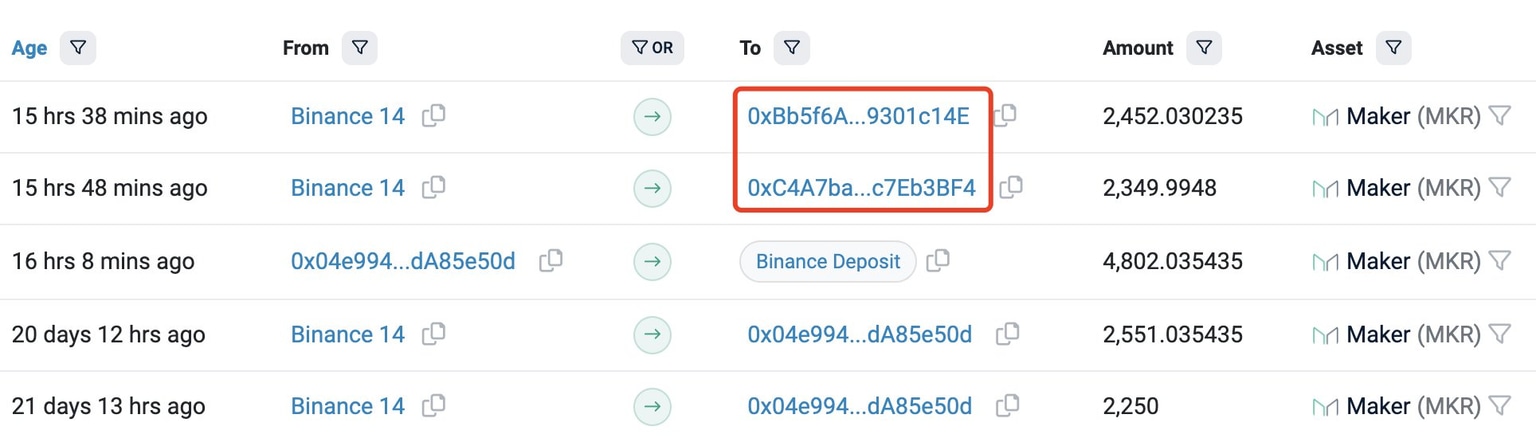

Maker whale transactions pick up pace in January, large wallets accumulate MKR

Maker (MKR), the token of a smart contract platform built on the Ethereum blockchain that is focused on improving peer-to-peer transactions, is on the rise. Recent activity in MKR indicates that the token is being accumulated by large wallet addresses, throughout January 2024.

Bitcoin and financial inclusion

Latin America has been recognized as one of the most complex economic regions worldwide.

The Latin American continent has different financial challenges, such as high inflationary economies and a lack of financial inclusion, among others.

Inflation is usually characterized as one of the biggest structural problems within the region's economies, with currency depreciation resulting in a loss of economic capacity for the residents.

Author

FXStreet Team

FXStreet