Cryptocurrencies Price Prediction: Axie Infinity, Chainlink & Celestia — Asian Wrap 15 January

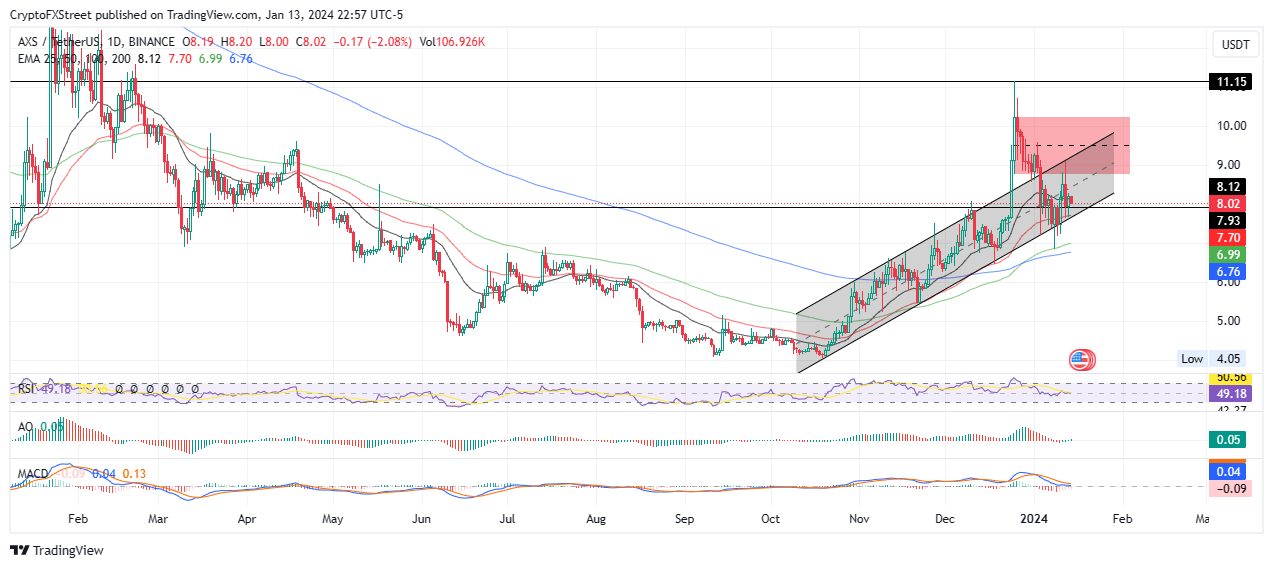

Axie Infinity Prediction: AXS reclaiming the Christmas high of $11.15 will remain hopium unless this happens

Axie Infinity (AXS) price is trading with a bullish bias despite the recent crash. It comes after recording an intra-day high of $11.15 on December 25, with the bulls pushing to reclaim this level. Meanwhile, markets are anticipating a bounce after the recent slump, save for AXS and Bitcoin Cash (BCH), which Santiment analysts say are recording higher ratio of shorts than longs this weekend.

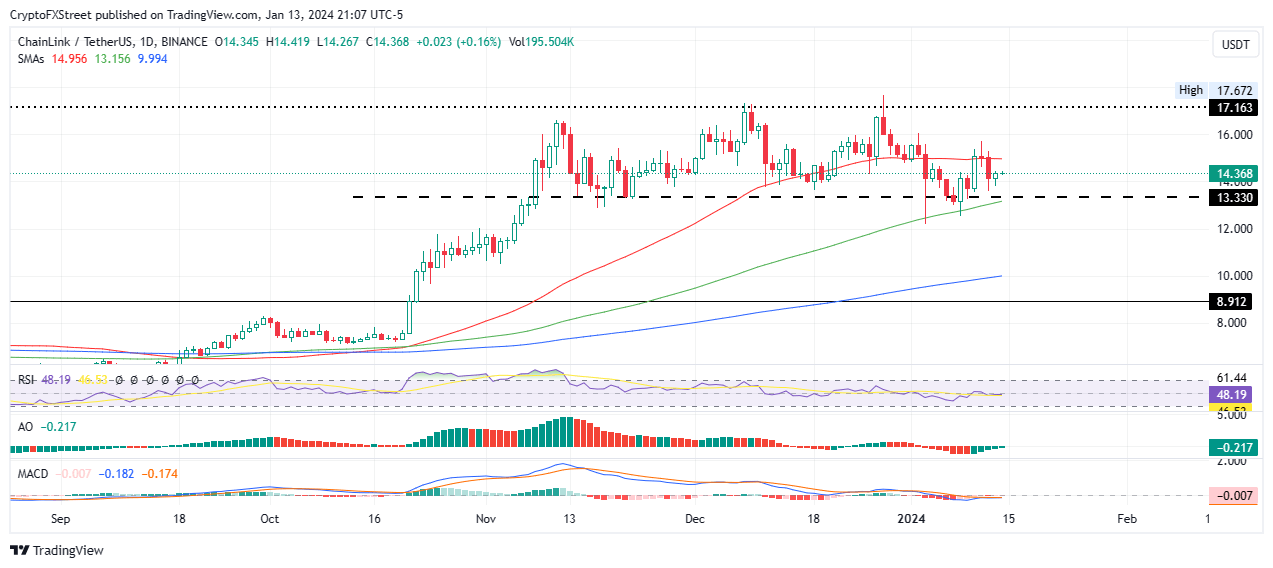

Chainlink price teases with a 20% upside potential as LINK coils up for its next move

Chainlink (LINK) price has been consolidating between the $13.330 and the $17.163 market range since November 8. The ensuing price action has been typical of a market full swing market cycle, presenting clear opportunities for perpetual traders to ride the series of trends, with the next one likely to be a recovery with FXStreet’s reporter Ekta Mourya detailing the on-chain drivers recently.

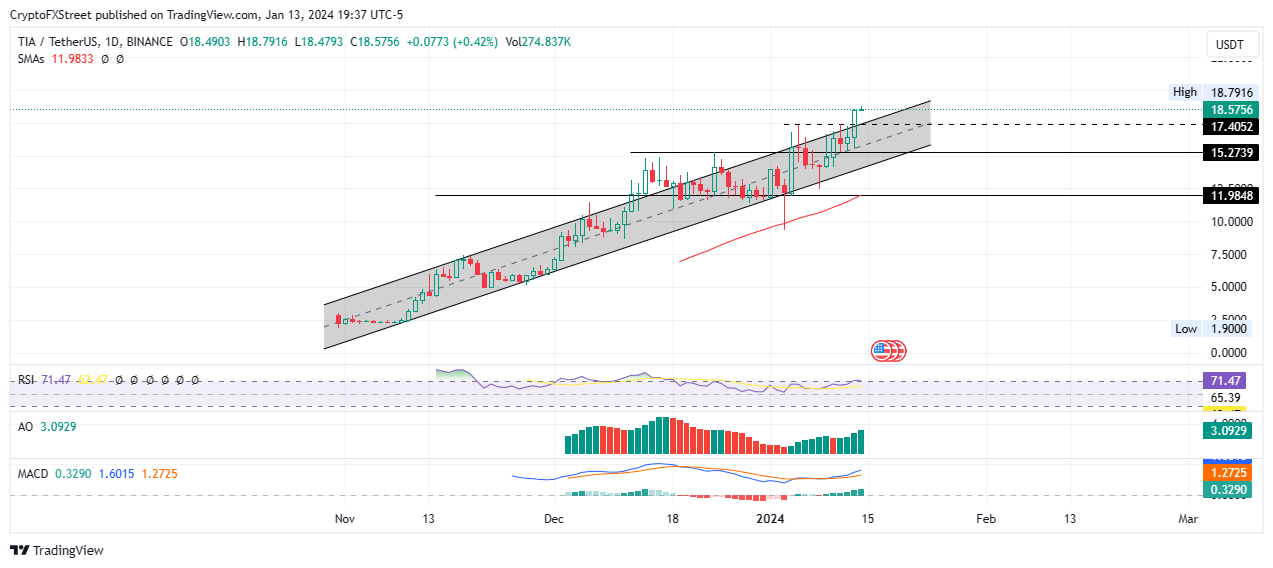

Celestia price tops out with a possible 10% correction for TIA before another buying opportunity

Celestia (TIA) price action since late October has been characterized by strong interest among the bulls to capitalize on every correction. Resultantly, each dip was countered by aggressive buying that saw TIA market value quickly pullback north. With TIA now overbought, the altcoin may be due for a correction before another foray north.

Author

FXStreet Team

FXStreet