Cryptocurrencies continue up Bitcoin at $9000

Cryptocurrencies continued climbing yesterday amid worries of the coronavirus spread and the Lebanese banking crisis. After two days of ascents, Bitcoin (+4.48%) has recovered its $9,000 level.

Among the top capitalized, the most bullish movers of the day are ADA (+16.95%), Ethereum Classic (+7.7%), EOS(+6.82%), Litecoin (+6.57%) and Bitcoin SV(+5.42%). On the Ethereum token section, the best performers of the day among the main capitalized are HEDG(+9.44%), SNX(+11.5%), and NEXO (+12.2%), but many more show gains over five percent.

Fig 1 - 24H Crypto Heat Map

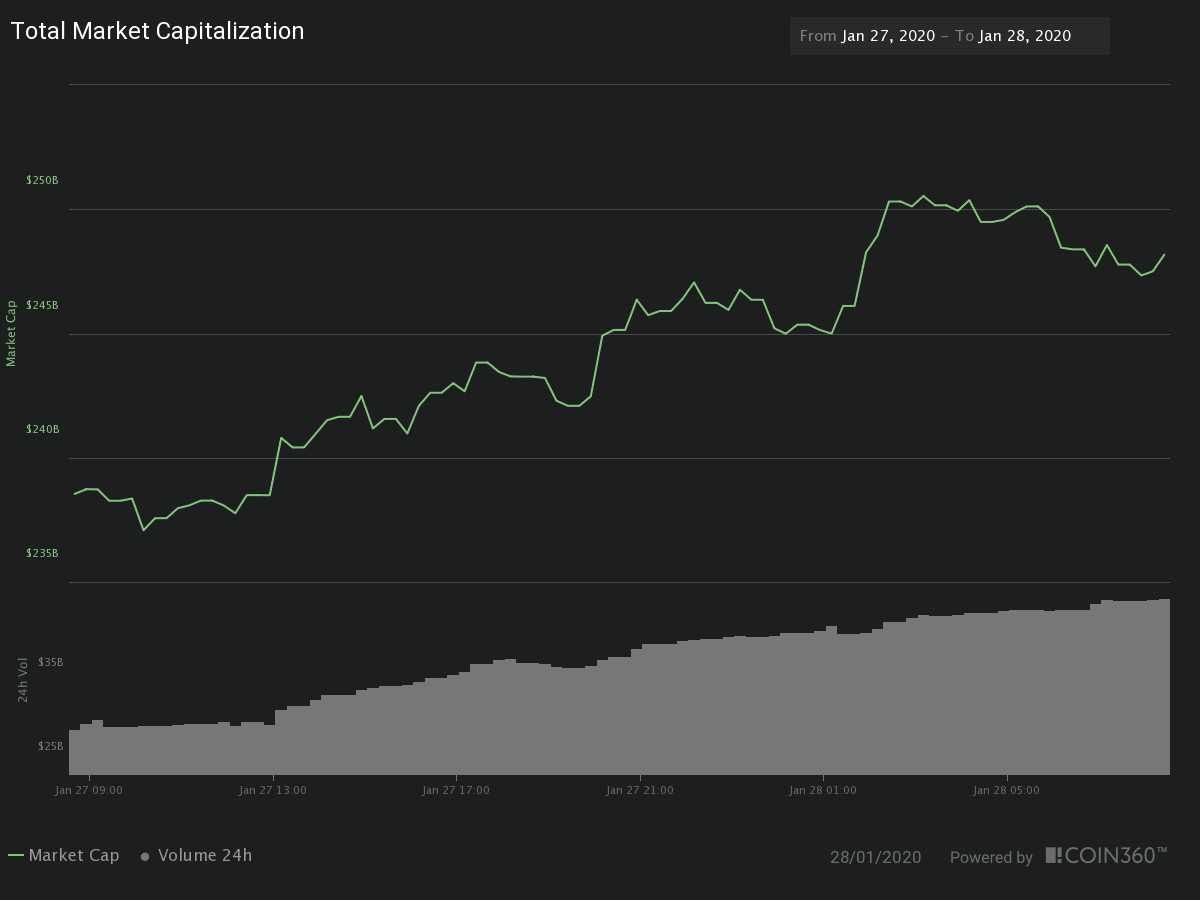

The market capitalization of the sector grew to $248.17 billion (+4.85%) on a traded volume of $45.07 billion in the last 24 hours, a 66 percent growth. The dominance of Bitcoin moved up slightly and is now 66.06%.

Hot News

Lebanon is facing a severe banking crisis, that emerged when Prime Minister Hariri, flee to Saudi Arabia and announced his resignation in October 2019. Subsequently, bank deposits plummeted, and interest rates rocketed. Currently, Lebanese banks are on the brink of insolvency, and citizens can't get their money out. The country is heavily indebted and is facing bond repayments in March and April amounting to over $1.4 billion of interest and $842 million of principal. Analysts think a restructuring of the debt is coming soon.

The new Singapore Payment Services Act requires crypto businesses willing to operate in the country to be registered and licensed. Singapore's Monetary Authority stated that the new law was aimed to strengthen consumer protection and encourage electronic payments.

Technical Analysis - Bitcoin

Chart 1 - Bitcoin 4H Chart

Bitcoin continued climbing in the last 24 hours, its price moving above its +1SD line and almost touching its +3SD line. That shows the bullish momentum of this asset. Currently, the price is fighting to overcome the $9100 level and move to its next $9,500 target. As we see on the chart, the price has been running near the oversold levels for almost two days. Thus, a pause in the way up is likely.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

8,760 |

8,840 |

9,100 |

|

8,450 |

9,250 | |

|

8,200 |

9,500 |

Ripple

Chart 2 - Ripple 4H Chart

Ripple has been following the upward push of the crypto market. Its price moved about 6% in two days, similar to Ethereum, but less than Litecoin or Bitcoin Cash. Currently, it moves above its +1SD line, and its MACD is in a bullish phase. But, XRP is entering a resistance zone that has its upper boundary at $0.24. Thus, this level needs to be broken to call for more buyers. The +1SD line of the Bollinger bands is acting as trendline; therefore, we keep our bullish bias.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.2250 |

0.2300 |

0.2340 |

|

0.2200 |

0.2400 | |

|

0.2160 |

0.2500 |

Ethereum

Chart 3 - Ethereum 4H Chart

Ethereum has continued showing strength, as its price has recently broken its $170 level and is looking to overcome the last highs made on Jan 18. The price is currently building a short retracement, but still moving above its +1SD line and also above its 50-period SMA.

All indicators and price action point to more upward movement, although a consolidation may be needed first.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

167.00 |

169.00 |

173.00 |

|

162.00 |

177.00 | |

|

157.00 |

180.00 |

Litecoin

Chart 4 - Litecoin 4H Chart

Litecoin is advancing guided by its +1SD line. Its price has reached resistance levels, and show signs of consolidation, but with small traded volume. As with Ethereum, Litecoin's technical indicators show strength: Price above +1SD line, Bollinger Bands pointing up, Price above 20, 50 and 200 Period SMA and MACD in a bullish phase and above the zero-line. Thus, we keep out bullish bias for LTC.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

55.90 |

58.40 |

60.00 |

|

54.40 |

62.50 | |

|

53.00 |

64.50 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and