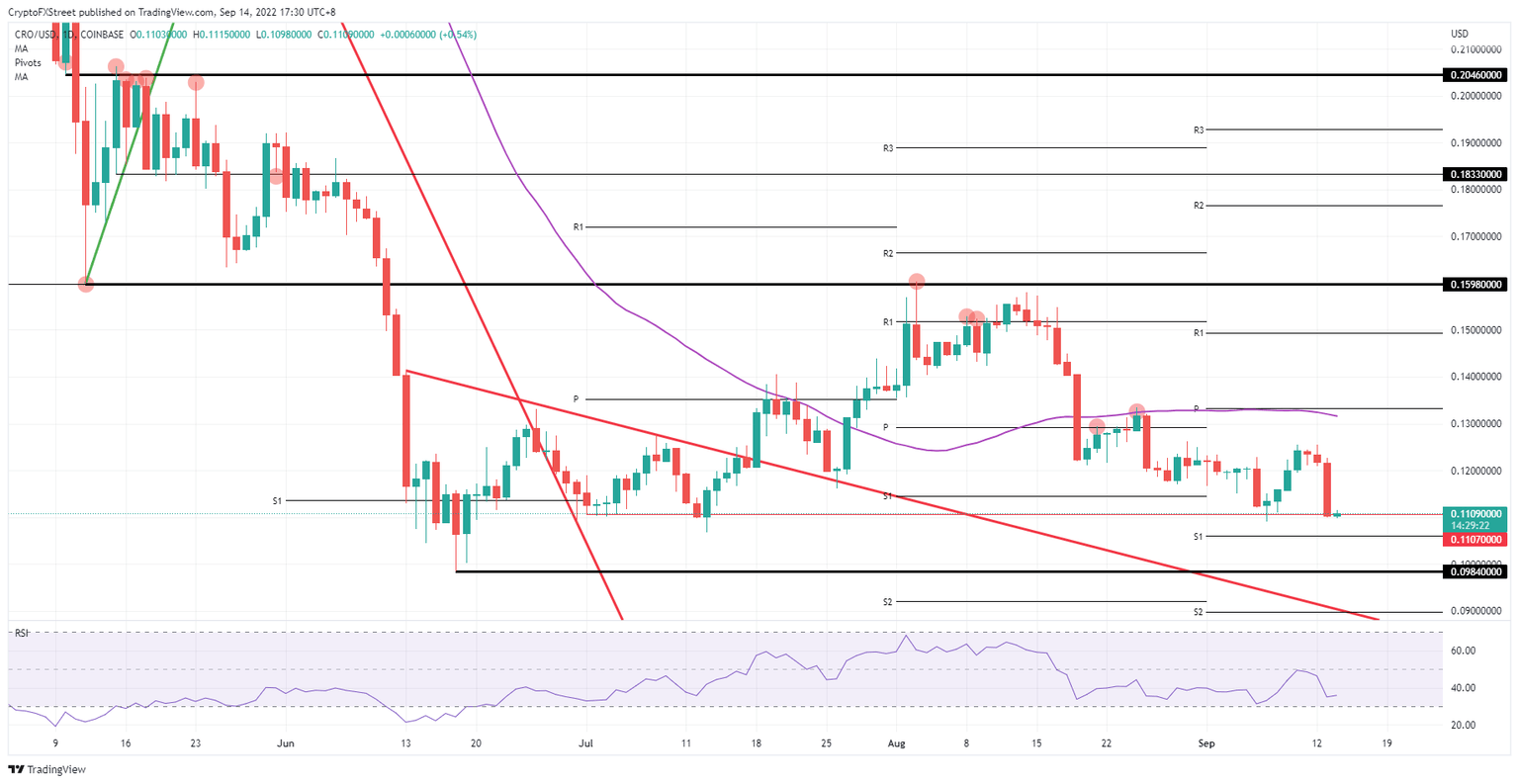

Crypto.com coin price gets broken and could dip below $0.10

- Crypto.com coin price undergoes a staggering 10% drop in the US trading session on Tuesday.

- CRO price gets smashed against a floor at around $0.11 as bulls try to salvage the breakdown.

- Expect to see another leg lower should more US data point to more severe actions from the Fed.

Crypto.com price (CRO) was a reminder on Tuesday that markets clearly understand that the current macroeconomic backdrop is still very much in play. Cryptocurrencies are allowed to rally in a limited time frame in a very limited area to the upside, as bulls will quickly be reminded of the fact that inflation is still high and central banks are further tightening their monetary policy, triggering a drought in the cash flow stream into cryptocurrencies. This means that CRO price will soon collapse, as more bulls pull out their money with no new cash coming in to support the price action.

CRO price set to implode as cash river dries up

Crypto.com coin price had a jaw-opening move on the back of the inflation numbers out of the US. Although markets are normally quite quick to reassess the situation, even the most experienced trader must wrap his head around what happened on Tuesday. Overall, the picture is quite clear: the current macro environment does not support risk assets and does not look to open up anytime soon.

CRO price thus can only go one way as more traders start to understand this and pull their cash out of cryptocurrencies to allocate it elsewhere. The much-needed cash flow into cryptocurrencies will start to dry up and could see the market capitalization drop again, with all major cryptocurrencies trading below important handles. The same goes for Crypto.com coin price that could start to trade below $0.1000 once $0.1100 breaks, with $0.0984 as the year's low to test and possibly break before printing at $0.0900.

CRO/USD Daily chart

At the same time, some paring back of the losses from Tuesday would be a normal market reaction. Certainly, for bulls that are always looking to scoop up some bargains and CRO price trading at a discount after the drop. Expect to see gains on the board that could go as far as $0.1200, with bulls trying to reboot the rally from last week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.