Crypto market liquidation tops $730 million as Bitcoin drops below $102,000; 73% were long

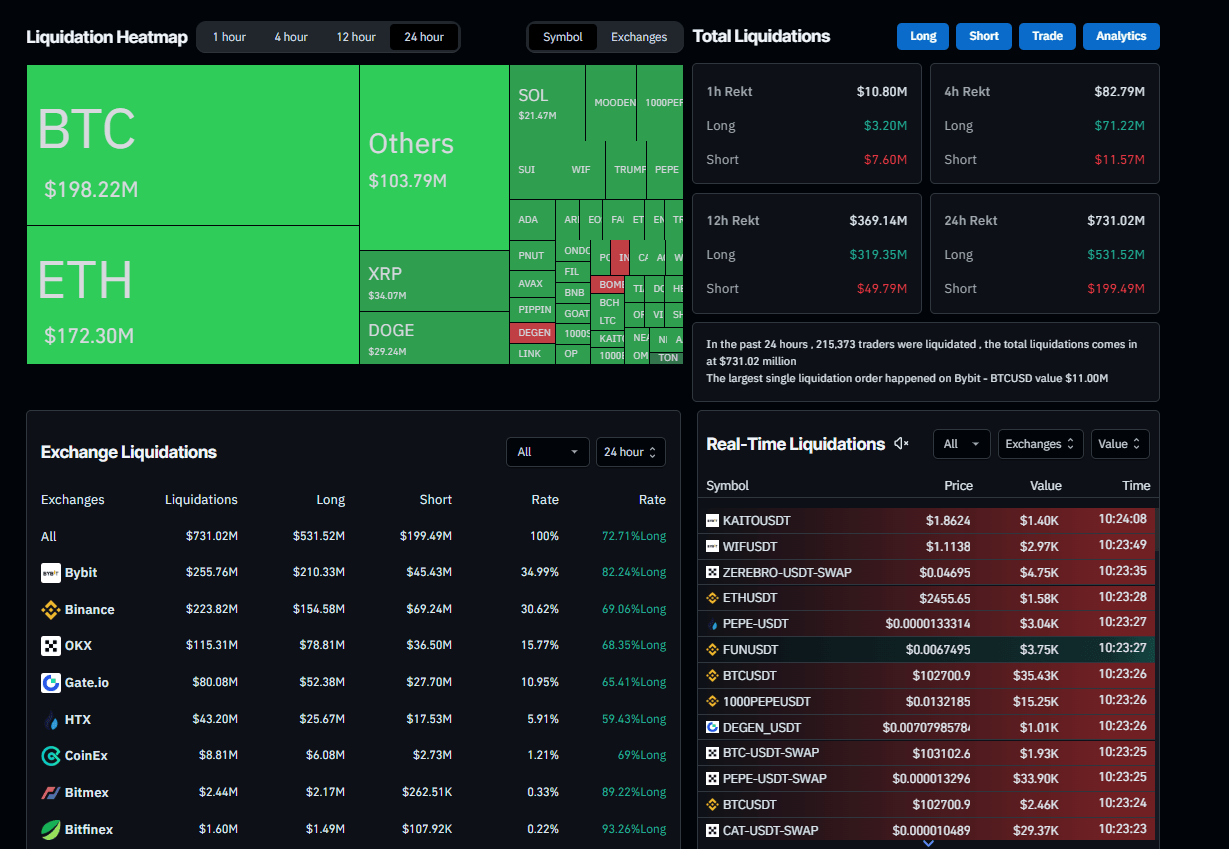

- CoinGlass data show that over $730 million in leveraged positions were wiped out across crypto markets in the past 24 hours.

- These liquidation positions were 73% long, and the largest single liquidation was an $11 million BTCUSD order on Bybit.

- Traders should be cautious as the upcoming US CPI could bring more volatility to the crypto markets.

The cryptocurrency market has experienced a sharp downturn in the past 24 hours, with total liquidations surpassing $730 million, according to Coinglass data, as Bitcoin dipped below the $102,000 mark. Of these, 73% were longs, highlighting the bullish overexposure among traders.

With market sentiment on edge, all eyes are on Tuesday’s upcoming US Consumer Price Index (CPI) data releases, which could introduce further volatility across the digital asset space.

Overleveraged traders are being wiped out

The week began positively for the crypto market, with prices climbing during the Asian session on Monday, as the news came in that the US-China had agreed to a tariff reduction for 90 days. However, those gains were largely erased during the New York session as Bitcoin, the largest cryptocurrency by market cap, dropped sharply below $102,000, hitting an intraday low of $100,700.

This sudden pullback sparked a wave of liquidations across the market, with over $730 million in leveraged positions wiped out, according to Coinglass data. Notably, 73% were long positions, underscoring the market’s overly bullish positioning. The largest single liquidation occurred on Bybit, where a BTCUSD position worth $11 million got liquidated.

Liquidation Heatmap chart. Source: Coinglass

US CPI data release could bring more volatility to the crypto market

The upcoming US CPI data release on Tuesday would be another catalyst to trigger volatility and liquidations in the cryptocurrency market, which traders should watch for.

FXStreet reports that, as measured by the CPI, inflation in the US is forecast to rise at an annual rate of 2.4% in April, at the same pace as in March. The core CPI inflation, which excludes the volatile food and energy categories, is expected to stay at 2.8% year-over-year (YoY) in the reported period, as against a 2.8% growth in the previous month. On a monthly basis, the CPI and the core CPI are projected to rise by 0.3% each.

Previewing the report, analysts at BBH highlighted: “Keep an eye on super core (core services less housing), a key measure of underlying inflation. In March, super core inflation fell to a four-year low of 2.9% YoY vs. 3.8% in February. Higher tariffs can ultimately derail the disinflationary process.”

A surprise uptick in the annual headline CPI inflation print could affirm bets that the Fed will hold the policy in June. In this case, the USD could see another leg higher in an immediate reaction, triggering risk-off sentiment in the market that would cause a fall in the prices of risky assets like cryptocurrencies.

Conversely, a softer-than-expected reading could revive the USD downtrend on renewed dovish Fed expectations, often boosting investor confidence across risk markets, leading to rallies in cryptos.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.