TRUMP meme coin claws back gains as top holders notified of dinner with President Trump

- TRUMP meme coin slides after a sentiment-driven rally, reflecting widespread profit-taking.

- The top 220 TRUMP holders on the leaderboard received May 22 dinner notifications ahead of background checks.

- TRUMP meme coin competition ends with participants receiving TRUMP NFTs.

- TRUMP meme coin could uphold confluence support at $12.11, established by the 12-hour 50- and 100 EMAs.

TRUMP meme coin has slashed gains to hover at $12.51 at the time of writing on Tuesday. The broad-based bearish wave has seen Bitcoin (BTC) retrace below $101,000, reflecting potential profit-taking after almost a week of persistent gains. Meanwhile, the top 220 holders on the leaderboard have been notified of the exclusive dinner with United States (US) President Donald Trump.

Top 220 TRUMP meme coin holders receive dinner invitations

The TRUMP meme coin team announced on Monday that they had notified the top 220 holders with details of the exclusive dinner with President Trump on May 22. According to the post on X, "there will be background checks that need to be completed," before the final list of attendees is released. The dinner will take place at Trump National Golf Club in Washington, D.C.

A more exclusive invite will be extended to the top 25 holders who will receive a special White House dinner and TRUMP NFTs.

The TRUMP meme coin team also notified the community that everybody who registered for the leaderboard will receive "exclusive NFTs."

"There will also be unique NFTs for only the top 220 holders of the TRUMP MEME COIN! These will be in your wallet shortly after the Gala Dinner," the team said in an X post.

Additional perks will be extended to holders with the same amount of TRUMP tokens at the dinner as on the final leaderboard. This holder cohort will receive "a TRUMP DIAMOND HAND limited edition TRUMP SOLANA NFT."

The First $TRUMP Competition is officially over! Details and what's next for $TRUMP Below:

— TrumpMeme (@GetTrumpMemes) May 12, 2025

If you were in the top 220 on the leaderboard, check the email you signed up with for details on the Dinner with President Trump as soon as possible. There will be background checks that…

The TRUMP meme coin team added that it officially launched the "TRUMP REWARDS POINTS PROGRAM," urging holders to connect their wallets and earn.

TRUMP meme coin exploded after the dinner announcement in April, accelerating recovery from the tariff-triggered crash. The token's on-chain activity soared, mirroring renewed investor interest in the meme coin.

TRUMP meme coin slides, testing key support level

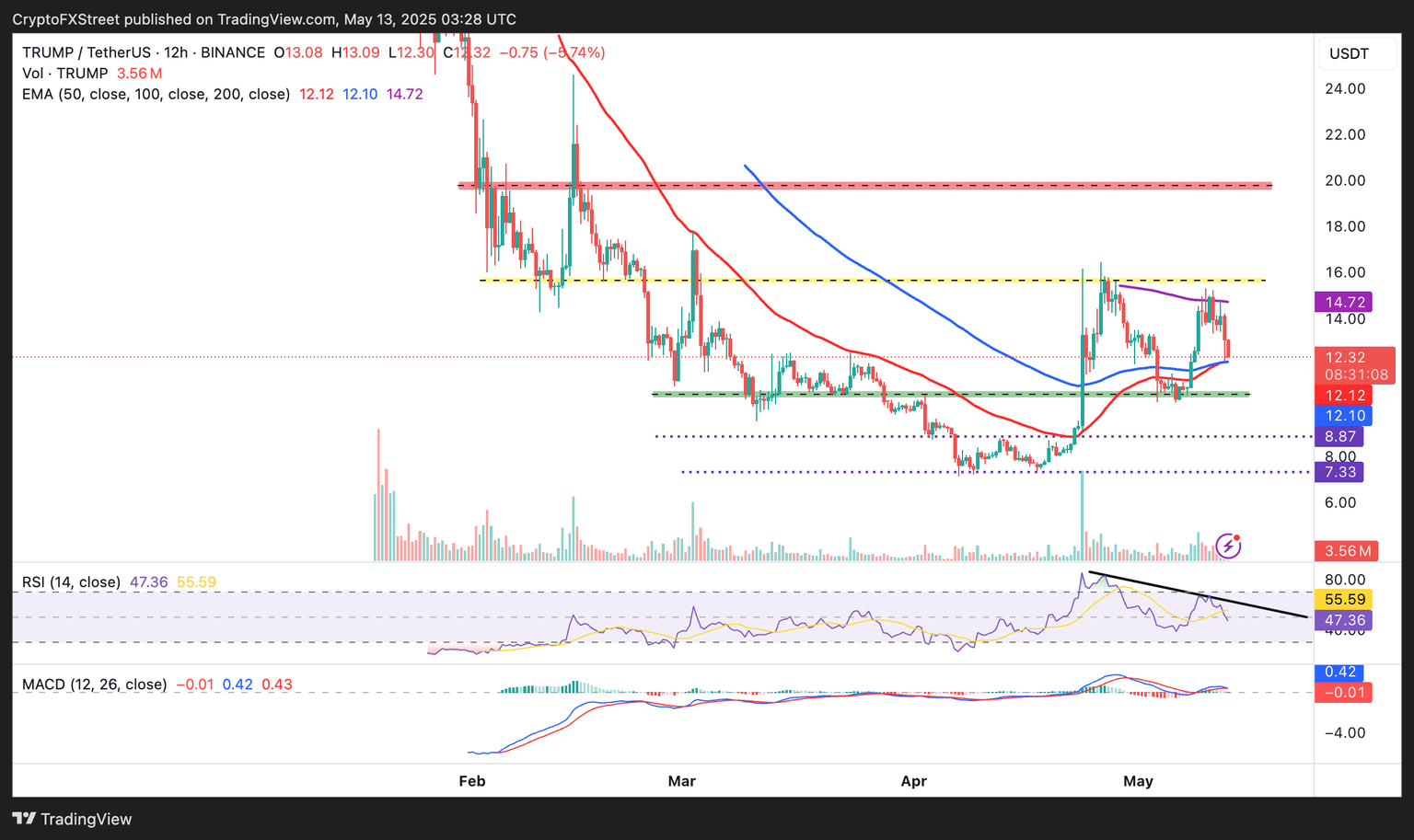

The Official Trump meme coin's uptrend from the previous week's support at $10.00 hit a roadblock, reflecting immense liquidity at the 12-hour 200 Exponential Moving Average (EMA), currently at $14.72.

The larger cryptocurrency market also retreated following a major risk-on sentiment-initiated rally as investors digested the impact of trade talks between the US and China.

TRUMP's price currently hovers at $12.51, while testing a confluence support around $12.11, established by the 50- and 100 EMAs as illustrated on the daily chart.

The Relative Strength Index (RSI) indicator's downward trend at 48.30 signals an intensifying bearish momentum likely to accelerate the retracement below the confluence support.

TRUMP/USDT 12-hour chart

For now, traders would focus on the ability of the confluence support area at $12.11 to absorb the selling pressure. However, if TRUMP's declines overshadow the support, the next tentative level at $10.00 could be tested.

On the other hand, traders should temper bearish projections, especially with the exclusive dinner with President Trump approaching. Interest in the meme coin could surge, creating demand and igniting a larger-than-expected rally.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren