Crypto ETPs see $1.7B in outflows, longest streak since 2015

Cryptocurrency exchange-traded products (ETPs) continued seeing massive selling last week, recording the fifth week of outflows in a row, with $1.7 billion leaving the market.

After seeing slightly softened outflows of $876 million in the previous week, crypto ETP liquidations accelerated during the past trading week, bringing the total five-week outflows to $6.4 billion, CoinShares reported on March 17.

The ongoing outflow strike has also marked the 17th straight day of outflows, the longest negative streak since CoinShares started records in 2015, CoinShares’ James Butterfill wrote.

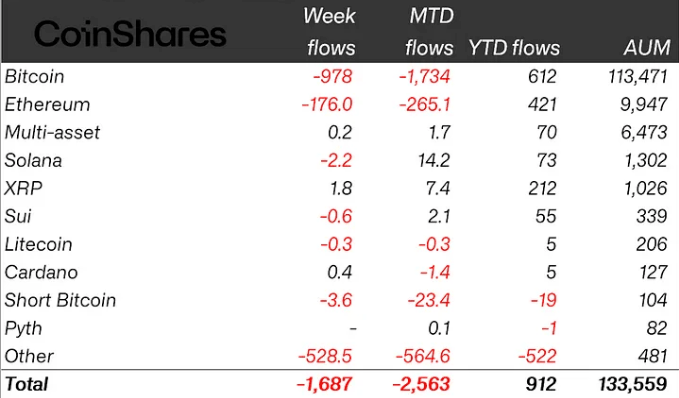

Despite notable negative sentiment, year-to-date (YTD) inflows remain positive at $912 million, he added.

Bitcoin ETP outflows: $5.4 billion in five weeks

After seeing $756 million outflows in the first week of March, Bitcoin (BTC $83,314) ETPs saw increased selling in the trading week from March 10 to March 14, seeing a further $978 million outflows.

The five-week selling streak brought total BTC ETP outflows to $5.4 billion, leaving just $612 million of YTD inflows by March 14.

Flows by asset (in millions of US dollars). Source: CoinShares

Both Ether (ETH $1,910) and Solana (SOL $128.66) ETPs saw $175 million and $2.2 million outflows, respectively. XRP (XRP $2.32) ETPs continued to go against the trend, seeing a further $1.8 million in inflows.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.