Cronos price is the altcoin to watch this week for a breakout trade that could bear a 90% gain by summer

- Cronos price is going against the stream after receiving a firm rejection on the topside earlier this week.

- CRO sees very supportive tailwinds coming in from the rally in Bitcoin price this Friday.

- On a broader timeframe, only two elements stand in the way for CRO bulls to make a killing this year.

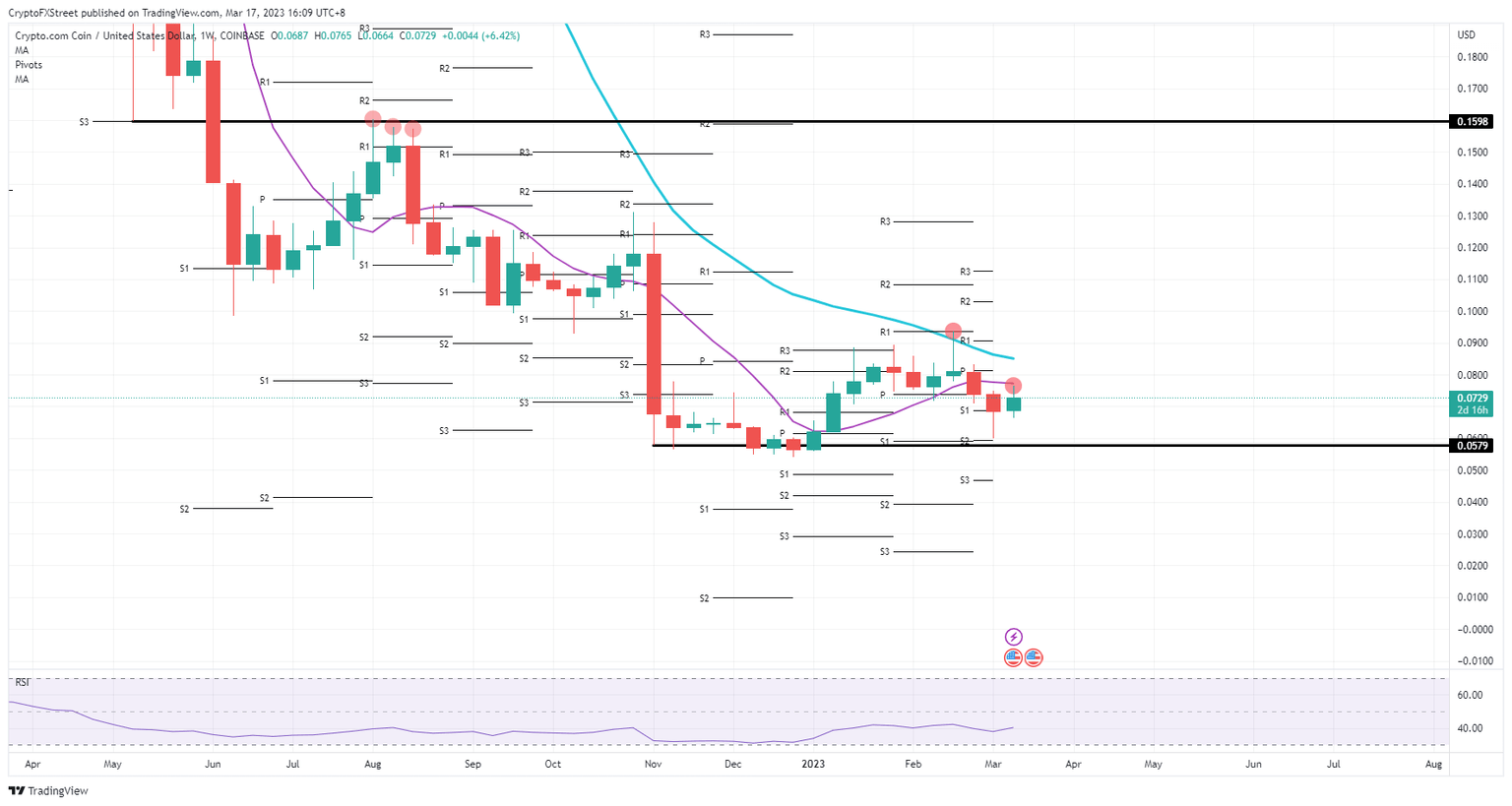

Cronos (CRO) price is holding all the cards here this Friday as it goes against several of its brothers and sisters in the altcoin space. Price action is up over 6% for the week, and with the rally in Bitcoin price this Friday, another tailwind moves in favor of CRO. Should CRO be able to break the 55-day Simple Moving Average (SMA) to the upside, just one more element stands in between bulls and a 90% gain by the summer of this year.

Cronos price could rally from here in coming months

Cronos price is delivering some very bullish signs this Friday before starting the weekend as it is up over 6% for the week. Although it had received a firm rejection earlier in the week, it becomes quite clear that bulls are strongly participating in the price action, and the tailwinds from Bitcoin price only add more fuel to the bullish bonfire. With market tensions settling over the weekend, expect that bulls have a fair opportunity at breaking that 55-day SMA at $0.0765.

CRO would next face the 200-day SMA going into next week at $0.0851, which might prove a bit tricky. Certainly seeing the weekly performance from February, where a false break triggered a near-full decline of all gains from that same week, traders are aware what they are up against. Should Bitcoin price rally further, expect that to be enough for CRO to break above the 200-day SMA and have a wide area open for the coming months with $0.16 as the profit target.

CRO/USD weekly chart

As mentioned in the above paragraph, a repetition of the events of February could happen again. That would mean bulls push through the 200-day SMA and are met with a wave of bears that push price action back below the moving average and might even trigger a full squeeze below the 55-day SMA. This would stop out many bulls and see price action falling back toward $0.0579.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.