Cronos price likely to set a new 2023 low as CRO bulls disappear

- Cronos price sees bulls absent as price action goes nowhere.

- CRO could sell off further by 13% as volatility and crypto woes increase by the day.

- At the current pace, Cronos could hit a new low for 2023 at the start of next week.

Cronos (CRO) sees traders becoming a nervous wreck this week as the pace at which negative news is hitting crypto traders is almost incomprehensible. As if the Silvergate Capital collapse was not enough, another commercial bank in the US is on the brink of default as markets are going into risk-off mode with the US equities again firmly in the red these past few days. The number of dark clouds and tail risks at hand is unbearable for bulls to stay in their long positions, which means that CRO will tank at least another 13% toward $0.0550

Cronos price soon back to square one for 2023

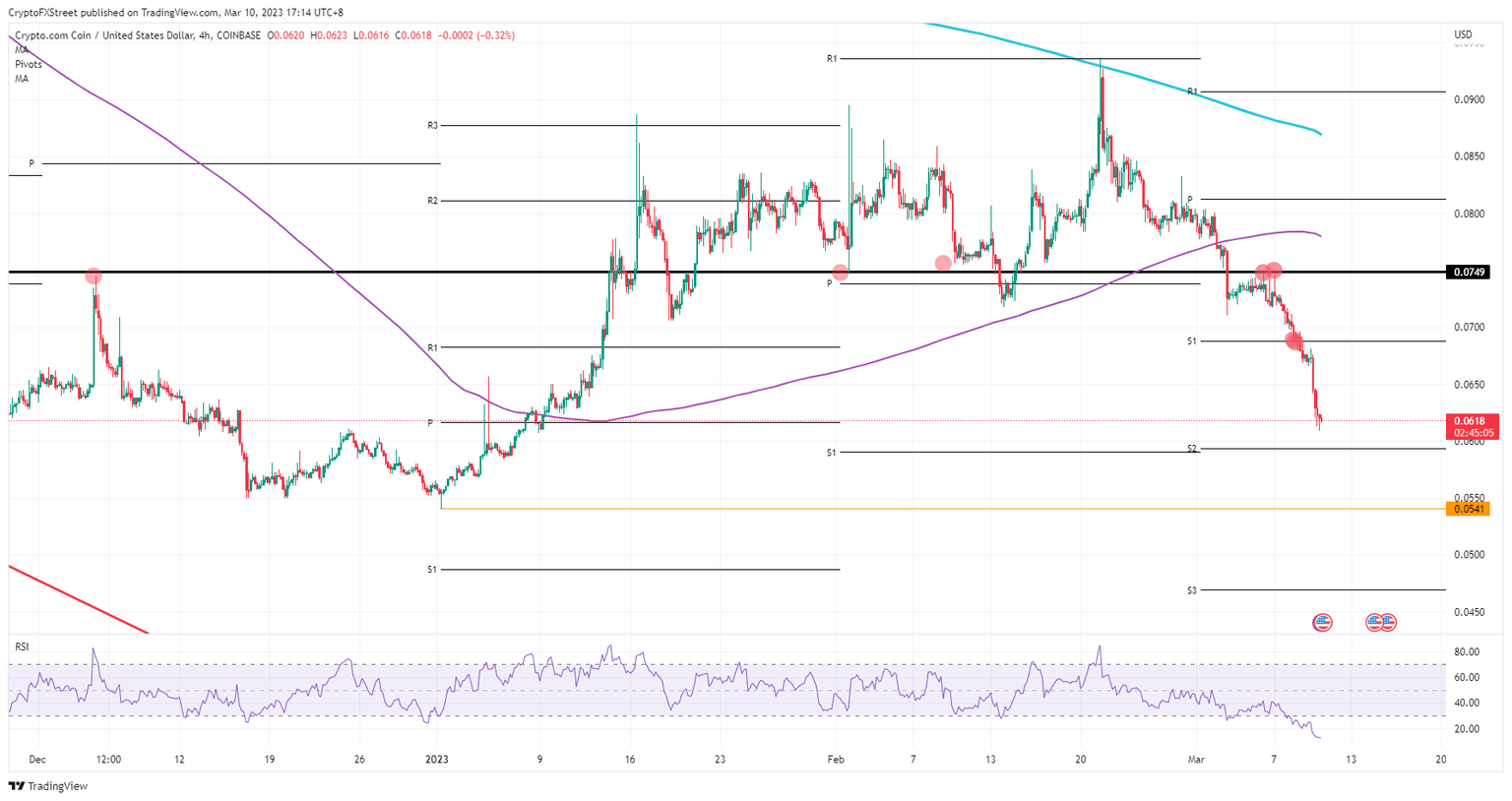

Cronos price is on a negative trajectory with at risk the rally of 2023. With only one technical element in its way, it looks like bears are going for the kill and will try to squeeze the bulls as much as they can. Translated into CRO price action that boils down to a full unwind of the bull run from January and February with a 42% negative return from top to bottom.

CRO still has some bulls reluctant to sell as price action could still get support at the monthly S2 support level of around $0.0600. Once that area is breached with lower numbers, expect even the last standing bulls to get out of the trade quickly. Bears will have plenty of room to push price action lower toward $0.0540 and even print a new low for 2023 as this bull run is being completely erased in the process.

CRO/USD 4H-chart

Although it is very hard to see or tell at the moment with all these dark clouds, there might be some buying happening near $0.0600 at that already mentioned S2 support level. Imagine bargain hunters who missed the early bull run from January wanting to be part of the market. That could provide some pushback and might see Cronos price turn back to $0.0650.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.