Could seasonality help Bitcoin to recover in April?

-

BTC recovers from 81.7k to 84k.

-

11% Q1 losses are the worst since 2018’s 49% drop.

-

Q2 is historically a solid quarter & April typically sees 27% gains.

-

Whales accumulate & LTHs halt selling, but economic uncertainties remain.

- Bitcoin technical analysis.

Bitcoin has recovered from its low of 81.7k this week to current levels around 84k but remains below the 200-day simple moving average (SMA). BTC started the new month and quarter on the front foot, rising 3% on April 1, after ending March in the red- the second consecutive monthly decline and after falling 11% in Q1.

Bitcoin tumbled 11% across the first three months of the year, its worst Q1 performance since 2018. This was worse than the 10.8% loss in Q1 2010 but still above Q1 2018's dramatic 49.7% plunge.

Profit-taking after reaching a record high in January, disappointment over Trump’s initial crypto policies, and concerns about the economic outlook under the new President have pulled Bitcoin down over 20% from its record high. The mood remains cautious ahead of Trump’s Liberation Day announcement, when he will unveil global reciprocal tariffs. While details are scarce so far, Trump has warned that it will involve all countries.

We know that markets hate uncertainty. Could it mean that once the details are announced and the market digests Trump’s plan, risk assets, including Bitcoin, stage a recovery?

April seasonality is a tailwind

According to data from Coinglass, the average gain in Q2 since 2013 has been 26%, while the median gain has been 7.3% across the April to June period.

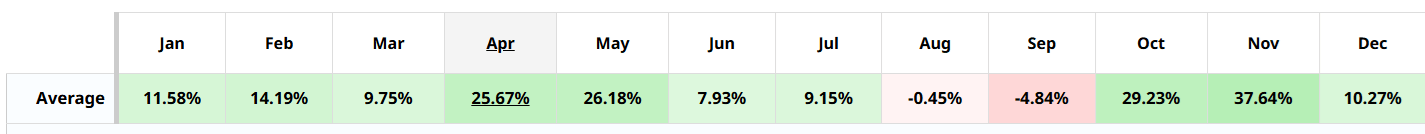

If history is any indication, April might bring a glimmer of hope for Bitcoin bulls. Historically, April has been one of Bitcoin’s strongest months. Since 2010, April has delivered an average return of 25% for Bitcoin, according to Bar Chart data. This ranks April as the fourth-best month, with November, October and May being the other three months with the highest returns at 38%, 29% and 26% gains, respectively.

While seasonality alone is not a reliable indicator, when combined with other factors, such as whale accumulation and the recent halt in selling by long-term holders, it could provide the much-needed positive momentum that the crypto market needs.

However, there are still plenty of risks that remain, particularly regarding the economic backdrop. Trump’s volatile approach to setting policy is unlikely to change anytime soon, which could keep uncertainty elevated and demand for riskier assets, such as Bitcoin, weak.

BTC technical analysis

BTC/USD recovered from the 76.6k March low, running into the falling trendline resistance at 88.7k, and rebounded lower. This marked a lower high, and the price broke back below the 200 SMA—the RSI around 50, which is neutral.

Should the recovery continue, buyers would need to rise above the 200 SMA at 86k and the recent high of 88.7k to create a higher high, thereby changing the chart's structure and bringing 90k into focus.

Sellers will need to break support levels around 80k and 76.7k to create a lower low, extending the bearish trend. Below 70k comes into play.

Start trading with PrimeXBT

Start trading with PrimeXBT

Author

PrimeXBT Research Team

PrimeXBT

PrimeXBT is a leading Crypto and CFD broker that offers an all-in-one trading platform to buy, sell and store Cryptocurrencies and trade over 100 popular markets, including Crypto Futures, Copy Trading and CFDs on Crypto, Forex, I

-638791742227503907.png&w=1536&q=95)