Chainlink (LINK) 10% jump dwarfs Bitcoin’s weak bullish muscle

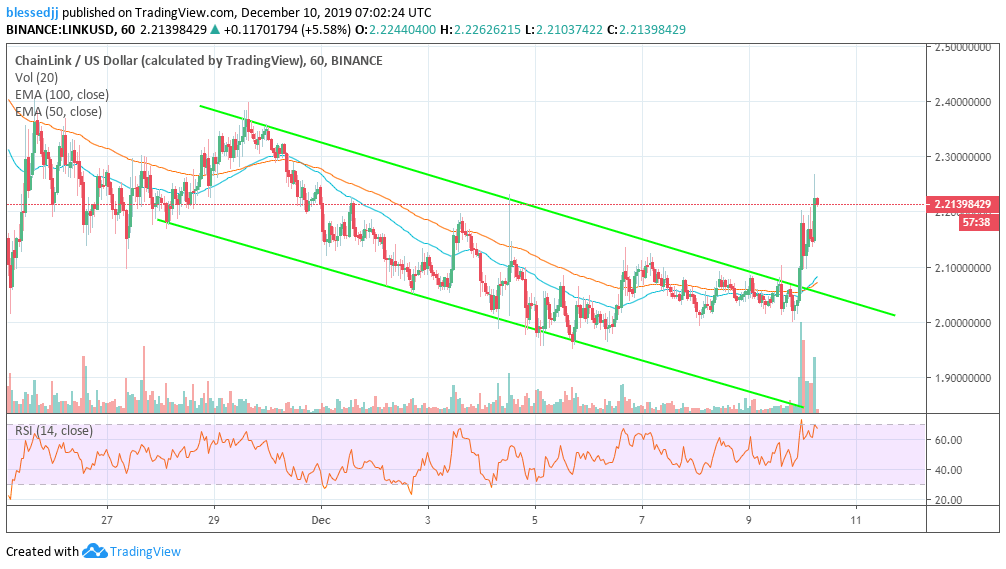

- Link breaks out of both the narrow ranging channel and the descending channel.

- The RSI is almost crossing above 70 as the bulls eye $2.30 seller congestions zone.

The cryptocurrency market is mostly bearish accept for selected cryptocurrencies such as Bitcoin and Chainlink. Bitcoin is up 0.5% on the day, while Chainlink leads the market with over 10% recovery.

Read more: Bitcoin Price Analysis: BTC/USD rises again on defending $7,300 crucial support

Like many cryptoassets, Chainlink has been on a downward spiral within a descending channel. The recent low formed around $1.95 marked the end of the downtrend. The following phased was consolidative with LINK locked between $2.0 and $2.1.

However, the increasing volume coupled with the improving technical picture as seen the price zoom out of the descending channel. LINK also made it above both the EMA 100 and EMA 50 on the 1-hour chart.

The uptrend has formed an intraday high at $2.26. With the RSI almost crossing into the overbought, Chainlink could brush shoulders with $2.30. On the other hand, the traders should be alert to watch for a reversal, perhaps due to the likely overbought conditions.

LINK/USD 1-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren