Cardano price to enter buy zone before surging to $1.30

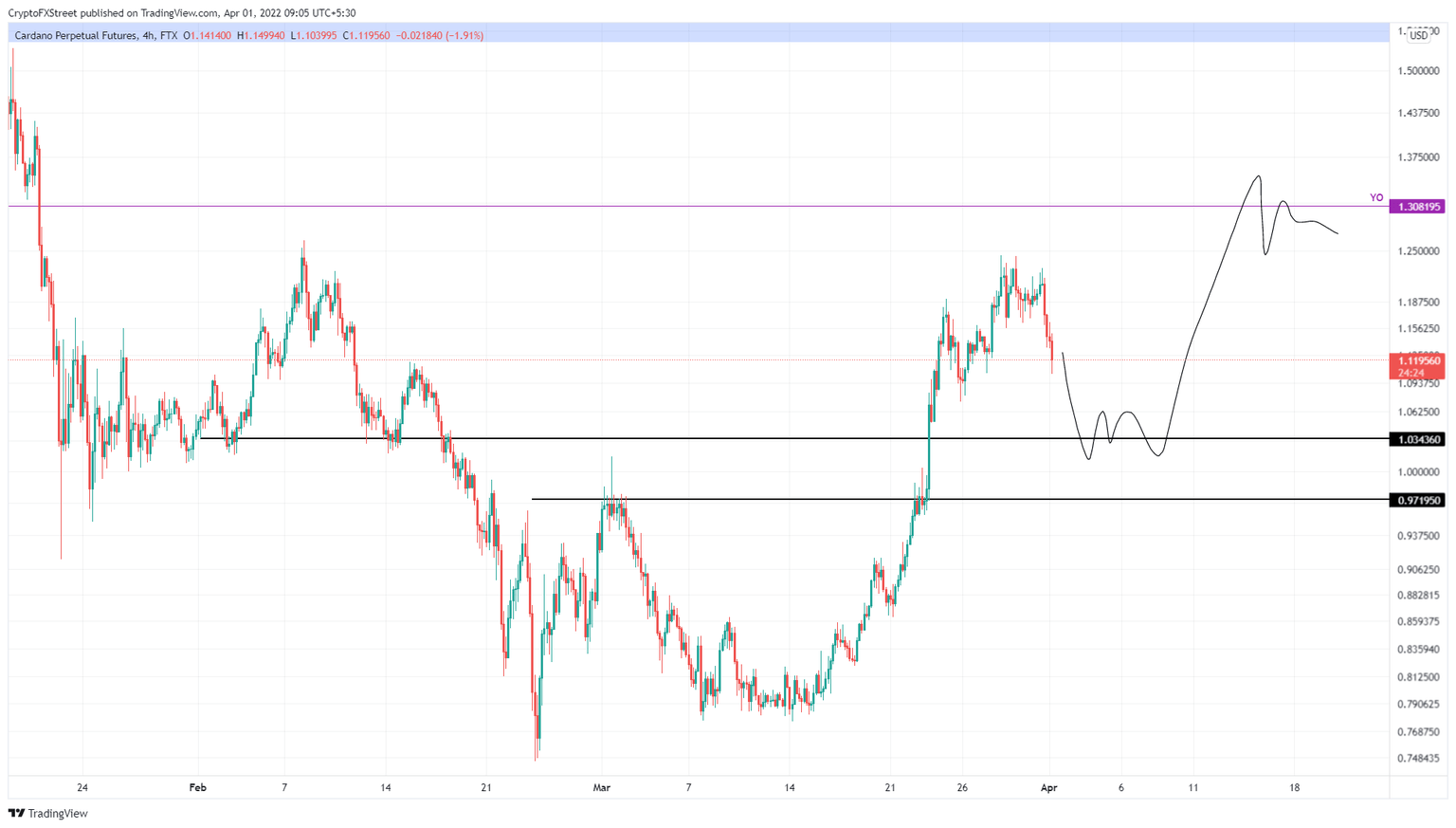

- Cardano price is taking a breather by retracing to the immediate support levels at $1.03 and $0.97.

- This pullback will allow sidelined buyers to kick-start a 25% upswing to a yearly open at $1.31.

- A daily candlestick close below $0.971 will invalidate the bullish thesis for ADA.

Cardano price is experiencing a sudden surge in buying pressure due to the mini-crash observed in Bitcoin. Regardless of the correlation between ADA and BTC, the so-called “Ethereum-killer” was due for a quick retracement anyway due to its exponential rally.

Cardano price needs replenishments

Cardano price rallied 51% between March 18 and 28, setting up a swing high at $1.24. It is likely bulls faced exhaustion after this impressive run-up, and, as a result, AD dropped 10% to trade at $1.12.

While a recovery is likely, there is a chance for ADA to drop lower and retest the immediate support level at $1.03. Doing so will allow Cardano price to set a base before launching higher. As for the upside objective, the bulls are likely to target the yearly open at $1.31.

From $1.03, the move would constitute a 25% ascent and is likely where the upside is capped for ADA. However, if Cardano price decides to revisit the $0.971 support floor, the rally would constitute a 35% ascent.

ADA/USDT 4-hour chart

Additionally, the bullish thesis for Cardano price is completely dependent on Bitcoin’s directional bias. A surge in sell orders that triggers a flash crash for the big crypto will easily cross-contaminate Cardano and other altcoins.

So, a daily candlestick close below $0.971 will invalidate the bullish thesis for Cardano price, by undoing the 51% gains. This move would further sow seeds of doubt and trigger a potential crash to $0.86.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.