Cardano (ADA) Price Prediction: A sweep of the summer lows in the making

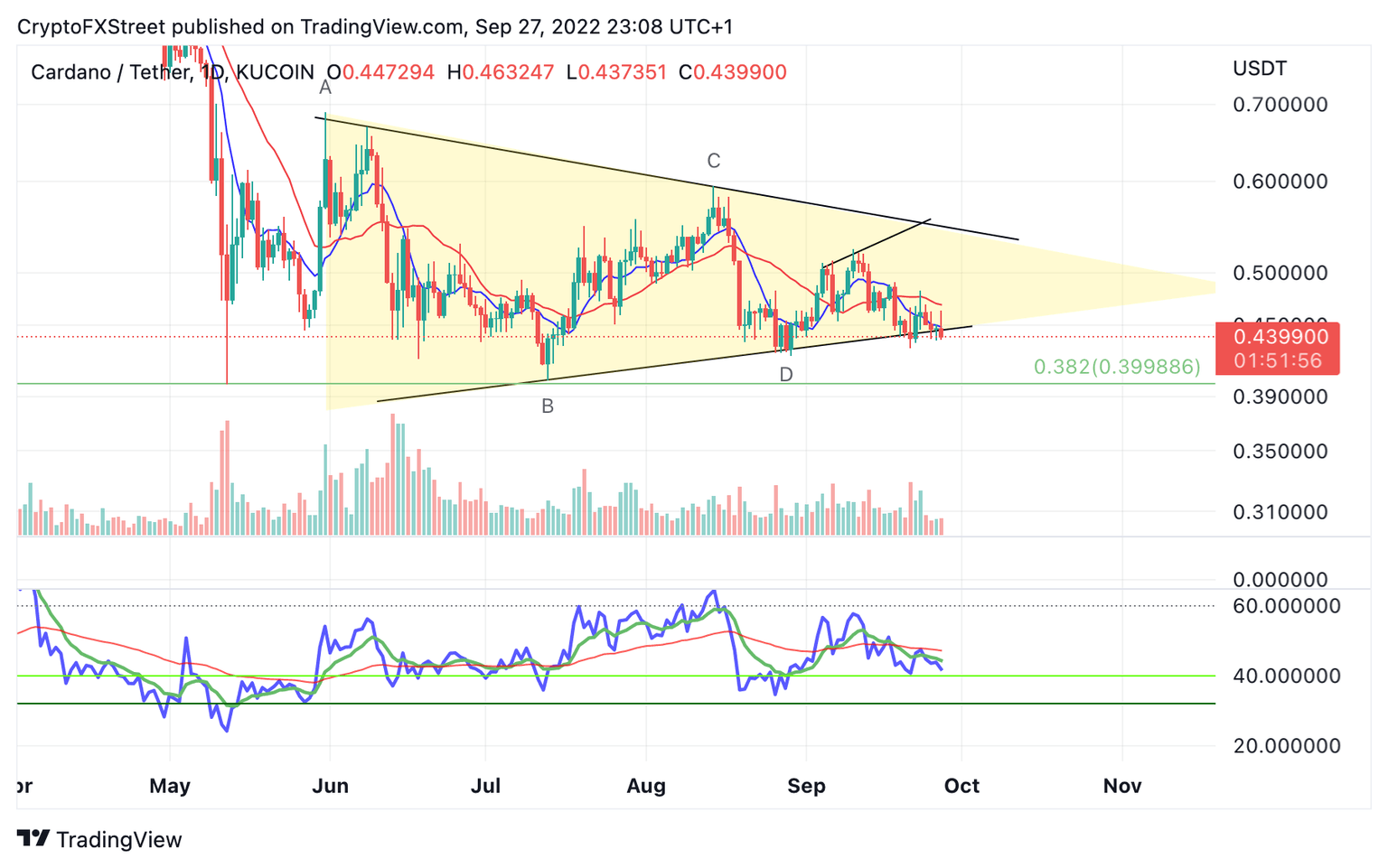

- Cardano price continues to coil in triangular fashion.

- The bulls have been rejected from the 8-day exponential moving average.

- Invalidation of the bearish thesis is a settle above $0.47.

Cardano price congestive nature continues during the final week of September. Despite the rest of the market experiencing volatile moves this week, Cardano price has been quite stagnant.

Cardano price points south

]Cardano price currently auctions at $0.44 as the bears have prompted a 4% drop in market value. The decline places the ADA price back below the 8-day exponential moving average, although ADA still hovers above supportive territory on the Relative Strength Index. The RSI has been known to be a lagging indicator during pivotal moments in the market.

Traders should entertain the idea of a ‘sweep the lows’ event targeting the May 11 lows at $0.40 in the coming days. Such a move could bring a large influx of volatility to the market as breakout bears likely have orders near the region in anticipation of a sharp triangle breakout. The influx of liquidity could resolve the mundane price action Cardano experienced throughout the summer.

ADA USDT 1-Day Chart

Invalidation of the bearish thesis is a daily close above the 21-day simple moving average currently positioned at $0.47. A hurdle of this magnitude could trigger a buyers frenzy with a unified goal of taking out the September high at $0.52. Said price action would result in a 19% increase from the current Cardano price.

In the following video, our analysts deep dive into the price action of Cardano, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.