Crypto.com price saved from an almost 20% plunge as CEO confirms minimal exposure to FTX

- Crypto.com price tagged 21-month lows during its downswing to $0.050 earlier this week.

- CEO of Crypto.com confirmed that their balance sheet is "very strong" amid rumors about the exchange's collapse.

- Kris Marszalek also reassured that customers' funds are intact and that their Proof-of-Reserves is on the way.

After the cryptocurrency exchange FTX's collapse, skeptics in the community were expecting Crypto.com to be the next exchange to fall. However, the company's Chief Executive Officer (CEO) Kris Marszalek has come forth to put the investors' worries to rest by addressing and clearing up the rumors. This prevented another critical decline in Cronos' price.

Crypto.com is safe

FTX's collapse made crypto users dubious about exchanges, and a certain revelation about Crypto.com did not help the cause either. Last month, a recovery of $400 million worth of Ethereum raised eyebrows in the industry.

Although the cryptocurrency exchange confirmed that it was an accidental transfer and that the funds were recovered, it did not sit well with the investors.

Furthermore, rumors of Crypto.com's exposure to FTT also made rounds, which were once again put to rest by Marszalek. During a live streaming session on November 14, Marszalek addressed the ongoing concerns, stating that the exchange's balance sheet is"very strong". He stated that the users do not have to worry about their money as the exchange's reserves cover all its users' assets.

Additionally, he reiterated that the exchange has less than $10 million exposure to FTX, reassuring Cronos is not used as collateral for loans. The exchange is also putting together a Proof-of-Reserves, expected to come out over the next few weeks to provide solace to its clients.

Please expect a full audited Proof of Reserves from us in the next couple of weeks, confirming the full 1:1 reserve of all customer assets.

— Kris | Crypto.com (@kris) November 11, 2022

Crypto.com price reacts accordingly

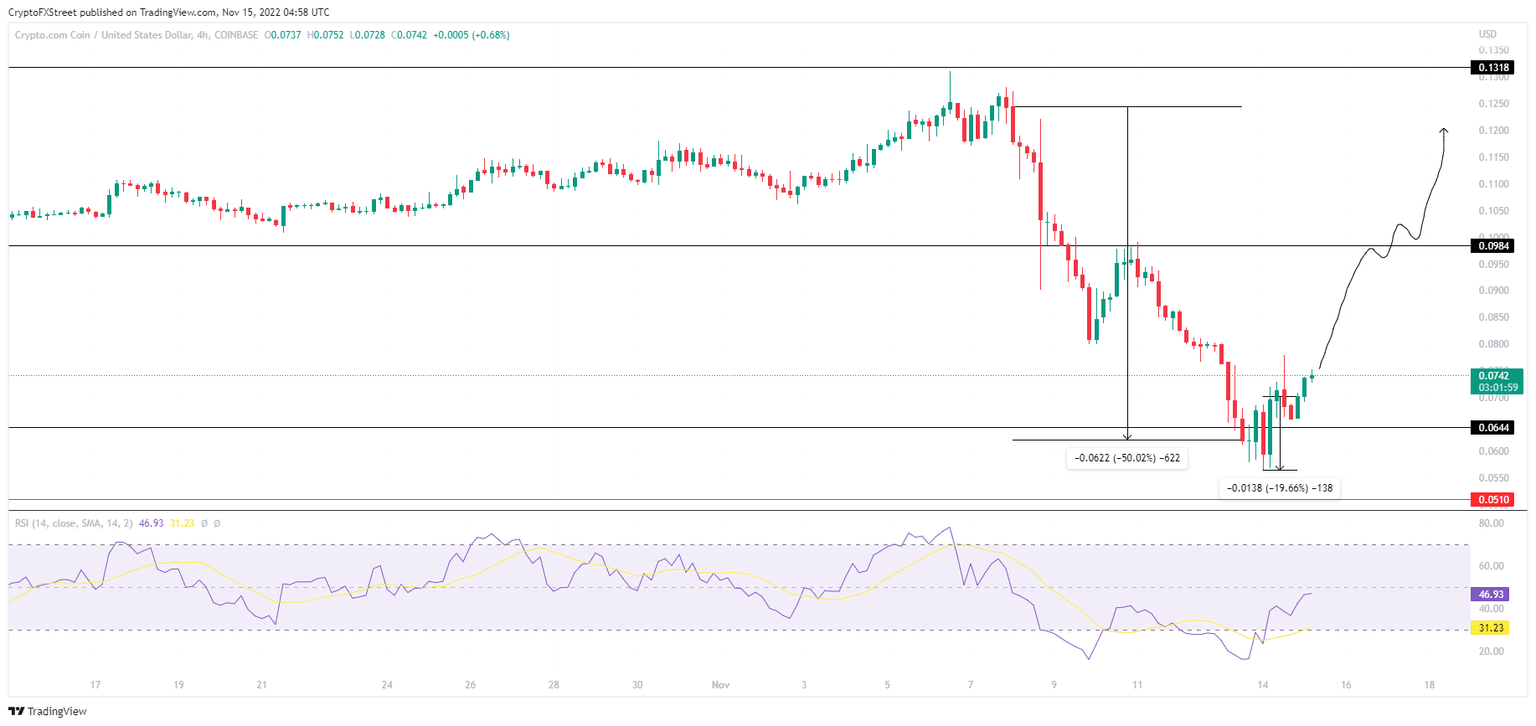

Crypto.com price was painting red consistently for the last few days, losing 50% of its market value in the span of seven days. Cronos would have noted another 20% decline if it was not for the CEO's assurances. Currently trading at $0.073, CRO is gradually rising towards the $0.098 resistance level.

If bullish momentum builds up over the next couple of days, CRO is bound to maintain its position between $0.064 and $0.098. This is necessary for the altcoin to ensure a recovery rally, which would be initiated once the candles test $0.098 as the support level.

CROUSD 4-hour chart

However, an unfavorable turn of events could turn this optimism around and push CRO's price toward its immediate support of $0.064. A drawdown from this level would result in Crypto.com price testing the support floor of $0.050, which was last tested in April 2020.

At the moment, all eyes are on the FIFA World Cup 2022 since Crypto.com's partnership with the global event could prevent the build-up of negative momentum.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.