Bitfarms plunges 18% after plan to wind down Bitcoin mining ops

Bitfarms’ stock has plunged after the company announced it would be shuttering its Bitcoin mining operations over the next two years and converting them to artificial intelligence and high-compute data centers.

The company said on Thursday that its 18-megawatt Bitcoin mining site in the US state of Washington will be the first to be fully converted to support AI and high-performance computing, with completion expected in December 2026.

“Despite being less than 1% of our total developable portfolio, we believe that the conversion of just our Washington site to GPU-as-a-Service could potentially produce more net operating income than we have ever generated with Bitcoin mining,” said Bitfarms CEO Ben Gagnon.

He added the conversion would help the company as it winds down its Bitcoin mining business in 2026 and 2027.

Bitfarms’ crypto mining rivals have also begun to shift some operations toward AI as the sector has boomed. Earlier in November, Bitcoin miner IREN signed a multi-year $9.7 billion deal with Microsoft to give the tech giant access to its AI compute.

AI “best opportunity” for most US Bitcoin miners: CEO

Gagnon told investors on an earnings call that Bitcoin miners are likely to “rotate out to lower and lower cost jurisdictions” as the difficulty and cost of mining the cryptocurrency rise.

“One of the big dynamics that is taking place is that the public miners represented almost a third of the entire network, and they all seem very keen on moving over to the higher economics associated with HPC and AI,” he added.

Ben Gagnon speaking on stage at a Las Vegas Bitcoin conference in April. Source: YouTube

Gagnon said that Bitcoin mining has started to see major growth in the Middle East, Africa and Russia and added that “the best opportunity for most miners in the United States really is this transition to HPC and AI.”

“The economics are really going to drive that forward because the US is the best market to invest in for HPC and AI, whereas Bitcoin mining is largely location-agnostic,” he said. “It’s happy to go to cheaper locations, higher-risk locations, more remote locations than HPC and AI is.”

Gagnon added that the opportunities for Bitfarms to move its Bitcoin mining elsewhere “are really few” and not “a great use of management’s resources or time.”

“The best opportunity is to basically bring forward what should be estimated free cash flow for mining operations today into cash and reinvest those into HPC and AI,” he said.

Bitfarms posts Q3 loss, misses on revenue

It comes as Bitfarms reported a net loss of $46 million in Q3, compared to losses of $24 million a year ago, equating to a loss of 8 cents per share, which was below analyst expectation of a 2-cent per share loss.

The company’s revenue increased 156% year-over-year to $69 million, but missed analyst estimates by over 16%.

Bitfarms said it earned 520 BTC at an average direct cost of $48,200 each and held 1,827 BTC as of Wednesday.

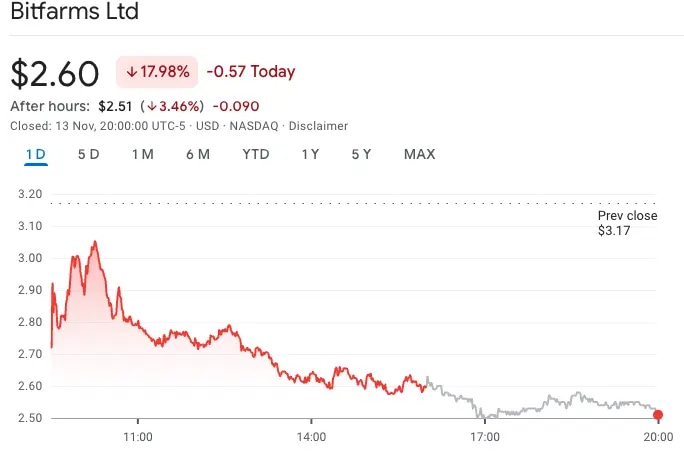

Shares in Bitfarms (BITF) declined on Thursday following the results, closing the trading day down nearly 18% to $2.60, with losses extending into after-hours trading of almost 3.5% to $2.51.

Bitfarms sank by nearly 18% on Thursday as its Q3 results reported $46 million in losses. Source: Google Finance

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.