Bitcoin will never see $10,000 again, affirms renowned technical analyst

- Bitcoin has been hovering above $10,000 for more than 100 days.

- The stock-to-flow model expects BTC to reach 100,000 by 2021.

A well-known analyst took to Twitter and claimed that Bitcoin would never go back below $10,000. As per their rationale, once the price has reached a particular level for more than 100 consecutive, it has never returned. In particular, this was seen with the $1, $10, $100 and $1,000 levels. Since Bitcoin has recently done the same with $10,000, the same behavior can be expected.

The stock-to-flow model further validates this prediction. Created by popular analyst Plan B, the Stock-to-flow, also known as S2F, is a cryptocurrency technical analysis (TA) that leverages BTC’s “stock” and “flow.” The S2F is a number that shows the number of years it will take the asset, at the current production rate, to achieve the current stock. Higher this number, the higher the price.

People ask if I still believe in my model. To be clear: I have no doubt whatsoever that #bitcoin S2FX is correct and #bitcoin will tap $100K-288K before Dec2021. In fact I have new data that confirms the supply shortage is real. IMO 2021 will be spectacular. Not financial advice! pic.twitter.com/GNSxLIt7NG

— PlanB (@100trillionUSD) November 8, 2020

The model predicts the premier cryptocurrency to hit $100,000 by 2021.

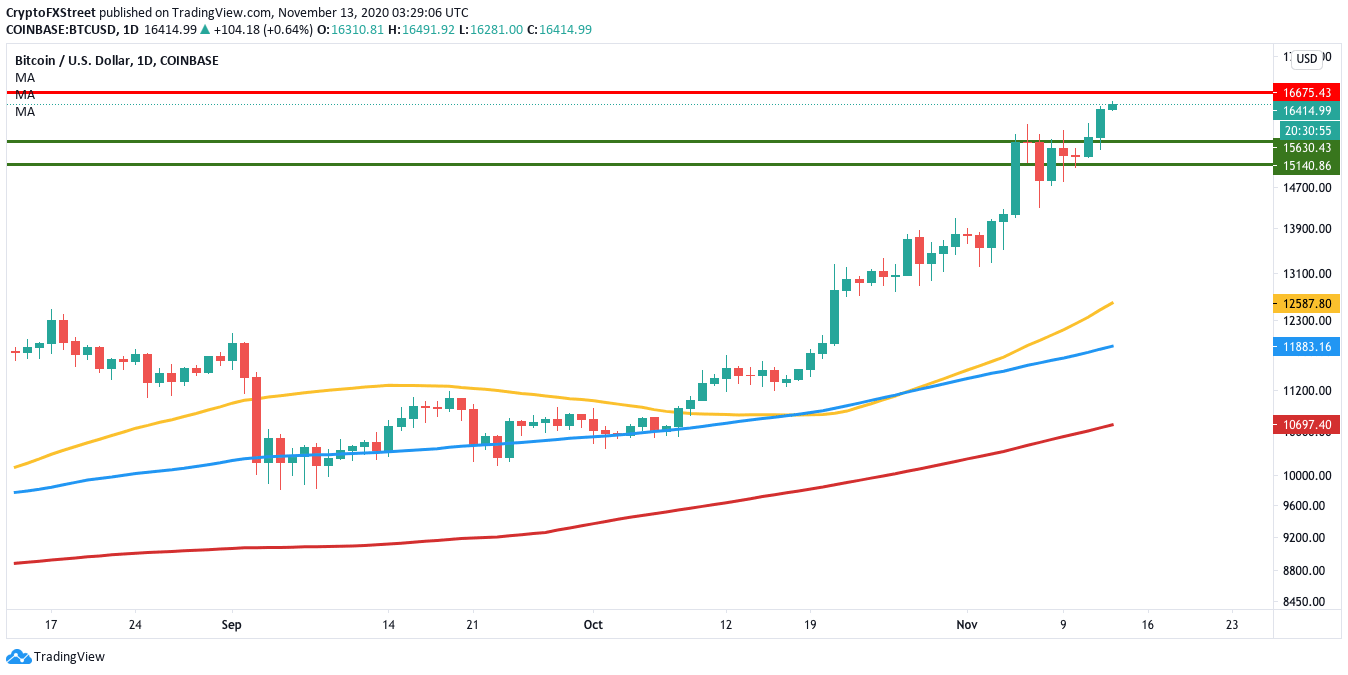

BTC breaks above $16,000

Bitcoin had a historic Thursday as the price managed to break above the $16,000 zone. As per IntoTheBlock’s IOMAP, the price faces a moderate-to-strong resistance at $16,700 before it makes a move into the $17,000 zone. This is the first time in three years that Bitcoin crossed above $16,000.

BTC/USD daily chart

Jason Lau, COO of cryptocurrency exchange OKCoin, perfectly sums up the current situation.

Bitcoin just cleared $16,000 for the first time in three years, confirming the existing bullish uptrend. It’s been a strong one, with six consecutive positive weekly closes.

He also said that with strong institutional interest, BTC futures open interest at an all-time high, and PayPal opening up crypto buys, there is a perfect storm to initiate a proper bullish rally. With minimal resistance on the road to $20,000, the signs are very positive.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.