The pandemic is fuelling the mass adoption of Bitcoin worldwide

- The Covid 19 pandemic has left the world desperate for a better store of value.

- Bitcoin is quickly gaining ground as a hedge for investors amidst inflation and negative interest rates.

- Countries like Venezuela suffer hyperinflation of over 10,000,000% amidst recovery from the pandemic.

The Covid-19 pandemic has undoubtedly hit the world's economy in numerous ways and would take a while to recover. This setback has led to a swift increase in Bitcoin's adoption as investors desperately seek a reliable store of value.

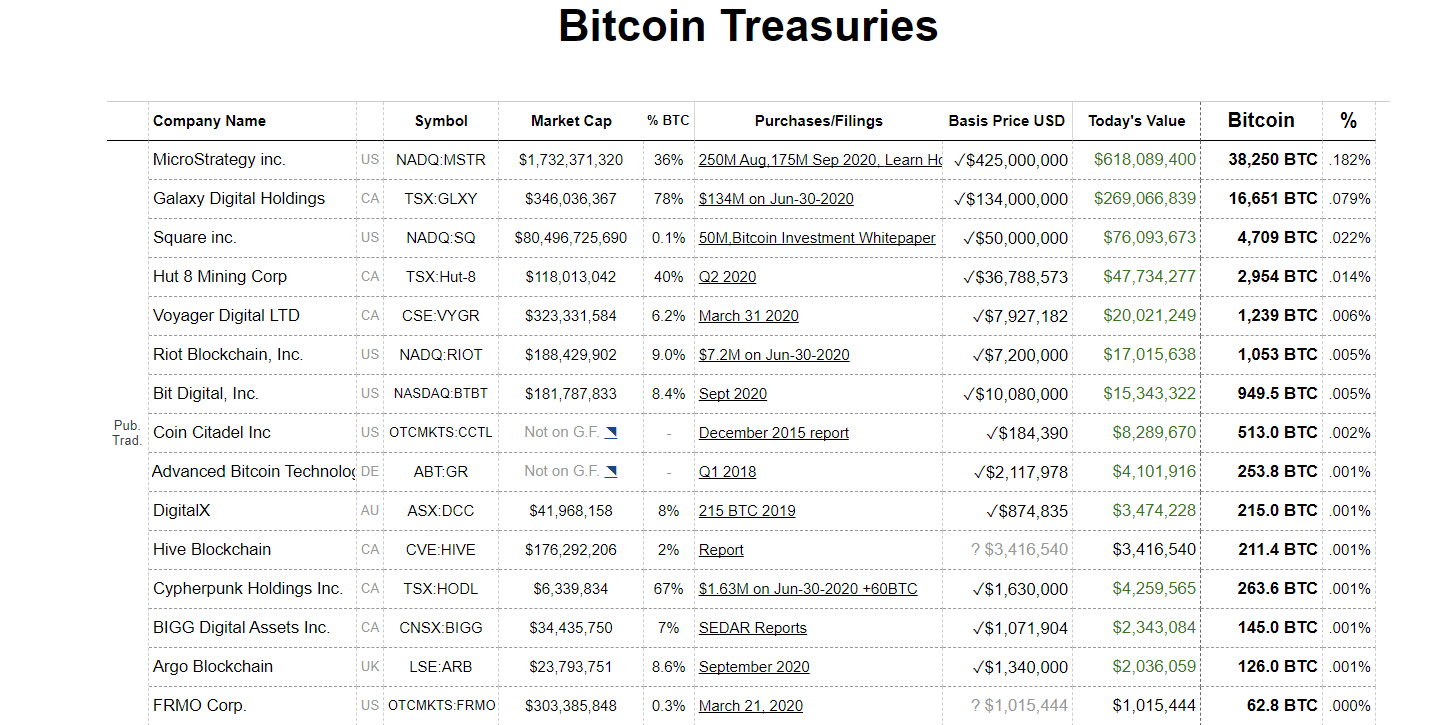

Publicly traded companies are now adding bitcoin to their balance sheet as they see the digital asset as a safe-haven.

Effects of the pandemic on the global financial markets

One of the significant aftermaths of the Covid-19 breakout is the rise in financial insecurity.

The pandemic struck a wave of recession, which has seen even dividend stocks affected. Many of them have been slashed or discontinued payout altogether.

The spike in unemployment has aggravated the need for a store value. It led to many business setbacks, especially in the real estate, travel, and hospitality sectors.

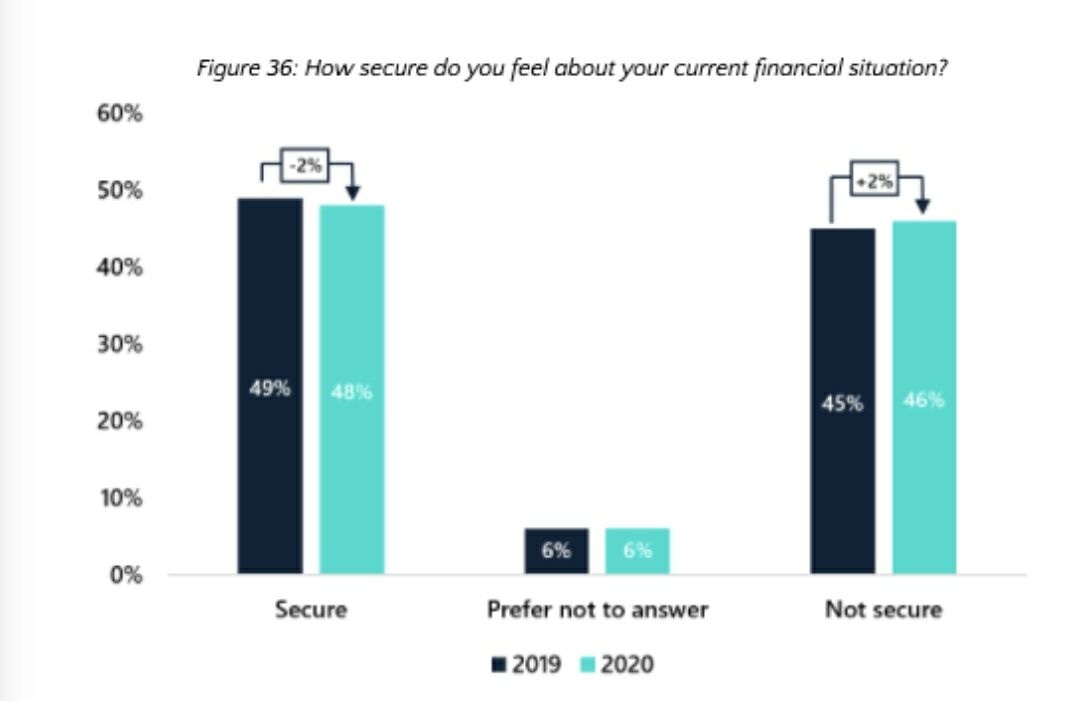

A survey from Arcane Research revealed that 48% of the respondents felt secure about their financial future this year, while 46% did not. The study showed a 2% upswing from last year to the "Not Secure" column.

Arcane Research's Study on Investors' Confidence

Recent talks about the introduction of negative interest rates coupled with the pending doom inflation are another ripple effects investors now have to suffer. To relieve citizens of the pandemic's adverse effects, some countries like the U.S. have released stimulus packages as they weather the storm caused by the Coronavirus outbreak. Although this may bring short term relief, it will create more significant problems like inflation.

Reports show that more than $3 trillion have been printed in 2020 alone, amounting to roughly 20% of all the U.S. dollars in circulation.

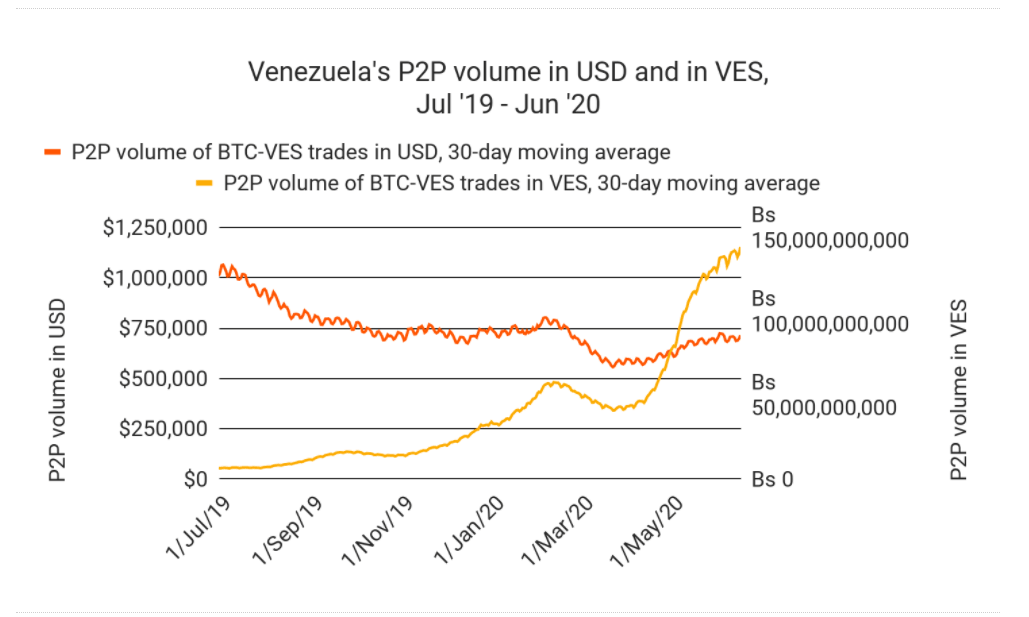

Meanwhile, in Venezuela, the loss of value of the Bolivar is a classic example. The situation in this South American nation has spiraled into one of the worst economic crises in modern history. As of last year, the hyperinflation skyrocketed over 10,000,000%.

Venezuela's Bitcoin Trading Volume

This situation has rendered the Bolivar practically worthless, leading to an exponential increase in the local Bitcoin market's peer-to-peer trading volume.

The power of Bitcoin as a hedge against inflation

The mounting uncertainty around the U.S. dollar is creating a paradigm shift as more institutional money pours into Bitcoin.

MicroStrategy's co-founder and CEO Michael Saylor compared storing cash reserves to sitting on a melting ice cube. For this reason, Saylor decided to hold 38,250 BTC on the company's balance sheets. The bold move enabled the company to generate more than 30% in returns within two months.

BTC Held by Publicly Traded Companies

As the post-pandemic global economies continue to tumble, threatening investors' wealth, the need for a deflationary safe-haven asset increases. And Bitcoin may be the solution.

Its core economic model makes it a relatively stable store-of-value asset that partially harkens back to the "gold standard." Although there is still a lot of time for this nascent digital currency to prove itself, a growing number of billionaires already use it as a hedge against inflation, which is an excellent sign for its long-term potential.

Author

FXStreet Team

FXStreet