Bitcoin Weekly Forecast: Fed’s interest decision will be key to BTC directional bias

- Bitcoin price has failed to muster the strength to push through the $29,630 to $30,480 bearish breaker.

- As a result, investors can expect BTC to linger below the $30,000 psychological level with a potential for a retest of $25,000.

- Macroeconomic events scheduled in the first and second week of May will likely induce volatility in anticipation.

Bitcoin price shows no signs of bullish momentum as it hovers below a critical psychological level. This lack of buying pressure could be a result of exhaustion after BTC’s impressive rally in Q1 of 2023. With two major macroeconomic events on the horizon, traders are likely going to position themselves in the direction of the most probable outcome.

Also read: Bitcoin price action from 2019 hints what could happen to BTC in 2023

Bitcoin price and what technicals indicate

Bitcoin price has failed to sustain its uptrend after its recent plummet from $30,000 to $27,200. Although bulls tried to run BTC back up, they faced a lot of selling pressure around the bearish breaker, extending from $29,630 to $30,480. After two failed attempts, the big crypto is currently hovering around $29,200.

Investors expect a consolidation or a slow bleed that sweeps Monday’s low at $26,933. If bears are persistent, they might get Bitcoin price to target the sell-stop liquidity resting below equal lows at $26,555.

The ideal Bitcoin price target for long-term accumulation, as mentioned in previous publications, would be $25,175 and the Fair Value Gap (FVG) extending from $23,966 to $22,139.

Read more: CFTC’s largest Bitcoin fraud case requires CEO to pay $1.73 billion penalty

BTC/USDT 1-day chart

Macroeconomic events and their impact on Bitcoin price

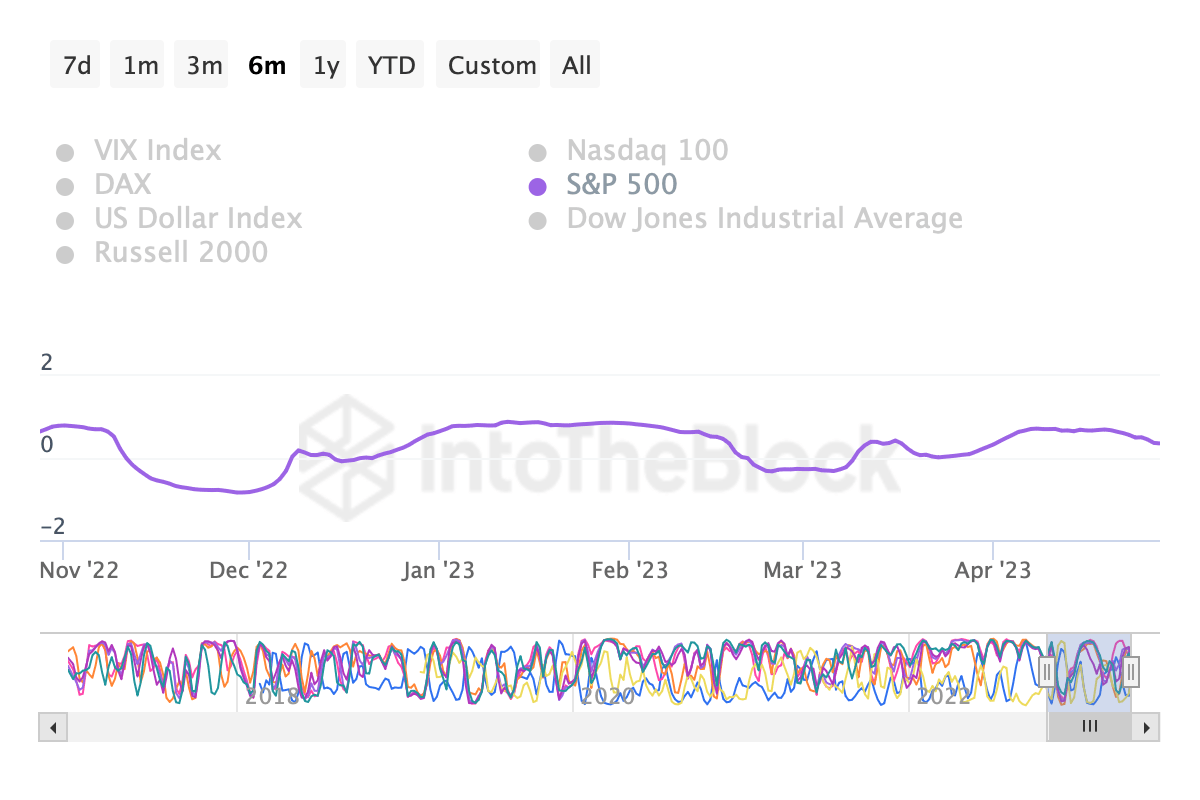

The Federal Reserve’s decisions have had a significant effect on Bitcoin price due to the historic correlation between the BTC and the S&P 500. However, this correlation saw a stark decline from a peak of 0.87 in January to 0.36 in April.

BTC vs. S&P 500 correlation chart

The Fed’s interest rate decision in the second quarter of 2023 will probably see a 25 basis point hike, pushing the interest rate from 5% to 5.25%. If the Fed deviates from this plan and proposes a more-than-25-basis-point hike, it would be a hawkish stance that denotes a stronger US Dollar, causing the stock market and the Bitcoin price to plummet.

So, investors need to be careful trading Bitcoin price next week due to the volatility this macroeconomic event could bring. In addition to the interest rate decision on May 3, the jobs report or Nonfarm Payrolls (NFP) on May 9 and the Inflation rate on May 10 will be another event to watch for volatility traders.

Read more: PCE Preview: Crypto market outlook around US Personal Consumption Expenditures release

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.