Bitcoin Price Prediction: BTC/USD technicals align for another assault at $9,200 – Confluence Detector

- The ongoing consolidation above $8,600 is likely to culminate in a breakout above $9,000.

- The resistance at $8,699 is the only significant hurdle holding Bitcoin back in the journey to $9,200.

Following an incredible week of bullish performance that saw Bitcoin correct upwards from $7,700 to $9,200, consolidation is setting in as traders get ready for another attack on $9,200. The recovery, not unique to Bitcoin, pushed most altcoins significantly upwards. Some like Bitcoin Cash, Bitcoin SV, Dash and Ethereum Classic, corrected above key descending trendline resistances. The growth among the altcoins has led to a decrease in Bitcoin’s dominance in the market.

The surge to $9,200 was unexpected but the correction was a reflex action due to Bitcoin not being fundamentally ready to hold above $9,000. More so, the investors are likely to have stormed to take profits after being stuck at lower positions for a while.

BTC/USD 1-hour chart

The drop below $9,000 put $8,000 in sight but the bulls made sure to defend the price from dipping lower than $8,450. Meanwhile, Bitcoin is trading at $8,640 after correcting below the Bollinger Band middle curve. It is also trading below the 50 SMA and the 100 SMA on the 1-hour chart. The pressure is pressing down on the short term support at $8,600. It is vital that the next support at $8,500 - $8,400 is defended at all costs, otherwise, the price could spiral towards $8,000.

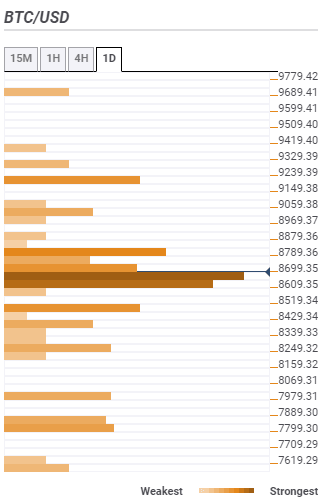

Bitcoin confluence levels

As the price tightens within the current consolidation phase, the confluence detector tool places the first resistance at $8,699. A cluster of technical indicators converges in this zone making it a hard nut to crack. Some of these indicators include the SMA200 15-minutes, Bollinger Band 15-mins lower, previous low 4-hour and the Fibonacci 23.6% one-day.

A break past the above resistance will run into a medium-strong hurdle $8,789 on its way to $9,000. The action above $9,000 is likely to remain smooth except for a bump at $9,239.

In the case of support areas, Bitcoin is initially supported at $8,609 as highlighted by the BB 1-hour lower, the Fibo 61.8% 1-day and the Fibo 38.2% one-week.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637152815438267403.png&w=1536&q=95)