Bitcoin price gives back part of its 28% gains as BTC and ETH struggle against XRP's outperformance

- Bitcoin price faces headwinds as traders fail to support price action above $29,000.

- BTC could drop next week as another fade is underway.

- With all eyes on the financial system next week, risk sentiment could eat into the 28% gains from Bitcoin last week.

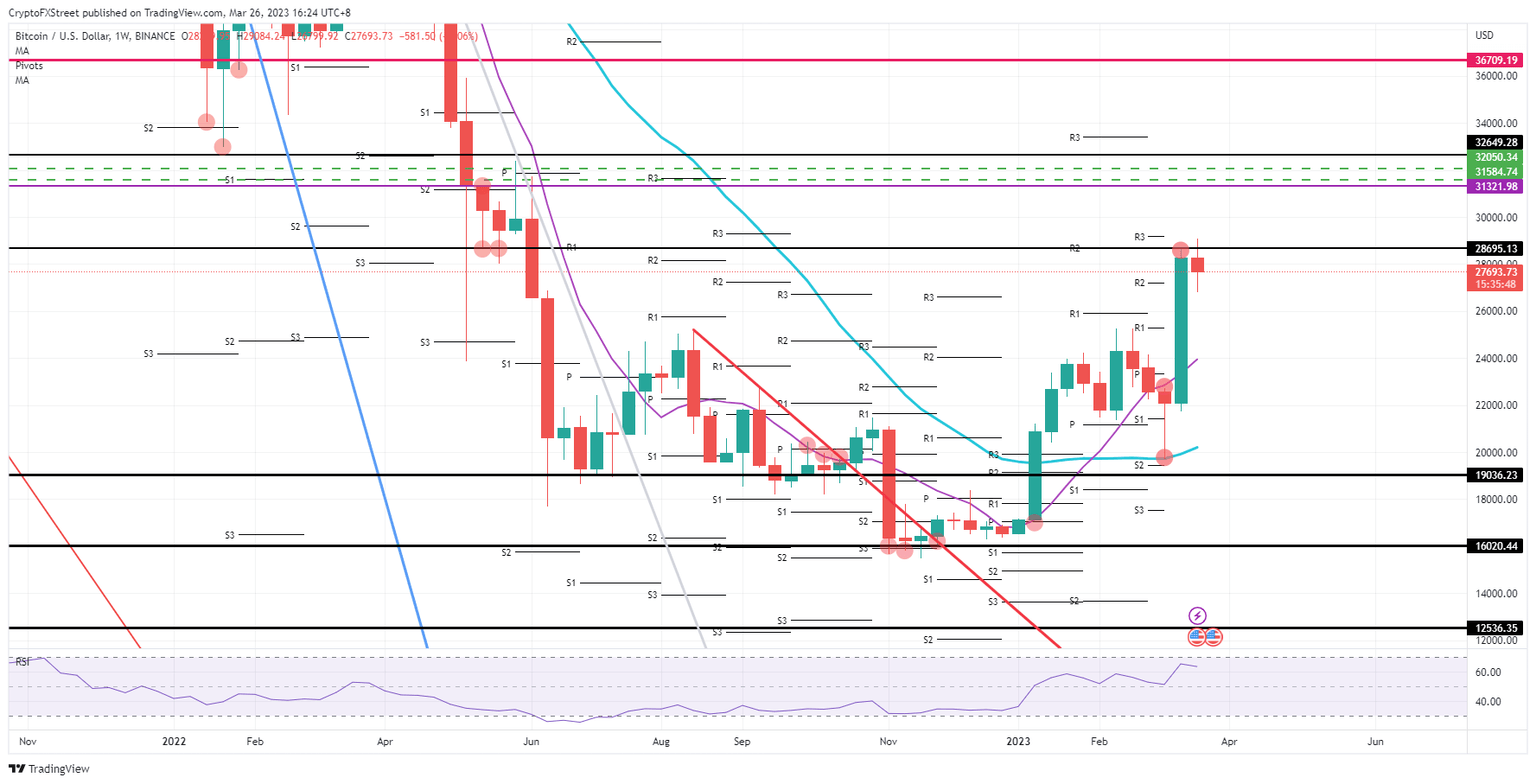

Bitcoin (BTC) price had a stellar performance last week, with over 28% gains in its books. Bulls, however, saw their dream crushed of $30,000 as $290,000 brought a firm rejection, and bulls have been unable to trade back at that level ever since. Expect going into next week to see another leg lower in the fade toward $25,300 as a support level.

Bitcoin price needs traders to hold $25,300, or else all is lost

Bitcoin price jumped firmly higher last week as Bitcoin bulls got unleashed and triggered a massive tailwind for nearly all crypto- and altcoins. Unfortunately, this week's performance is a bit of a hangover as BTC price tanks while smaller brother XRP is booking gains near the end of the weekend. All eyes will be on the financial system at the start of next week as Bitcoin could take another step back.

BTC will fade lower, but support should be nearby. A 10% drop towards $25,300 would be a good deal for bulls that were late to join the rally to do it then. A side note to be made here is that if a negative headline or another bank defaults, Bitcoin will give up all the gains it booked last week and slide back to $22,000.

BTC/USD weekly chart

With the fade still somewhat contained, should the ASIAPAC print green numbers and a recovery across the board, expect Bitcoin price to gain a tailwind. Price action would break back above $29,000. Expect $30,000 to be very difficult, but a quick gap towards $31,321 will materialize with 11% gains once broken.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.