Bitcoin back in spotlight as BTC rallies close to $25,000 ahead of US CPI report

- Bitcoin and cryptocurrency prices recovered from the slump following the news of the US Federal Reserve’s new bank lending facility.

- Bitcoin price volatility climbed higher ahead of the US CPI report, the release has garnered interest from BTC holders and crypto investors.

- Economists have predicted a quarter percentage-point cut in Fed’s benchmark interest rate and a reduction in the size of its balance sheet.

Bitcoin price continued to gain momentum on Tuesday in the Asian trading session. BTC price wiped out its recent losses and the $25,000 psychological barrier came into play.

The US Federal Reserve's announcement of a new bank lending facility instilled confidence among investors and fueled the recovery in BTC and cryptocurrencies. Crypto market participants are watching the US CPI report closely to determine whether recent crypto gains are capped.

Also read: Week Ahead: Crypto markets reel from the banking crisis as investors prepare for US CPI

State of Bitcoin and crypto leading up to the US CPI release

While investors were rattled by bank failures, US equities closed mixed and Bitcoin price witnessed a recovery on Monday. There is speculation that the recent bank collapses and voluntary liquidations may cause the US Federal Reserve to pause plans to raise interest rates.

The US Treasury announced that it will step in as a lender of last resort and guarantee all US Bank deposits, even the uninsured ones. This fueled a rally in Bitcoin and crypto prices, BTC price climbed to a local peak of $24,8000 and brought the $25,000 psychological barrier into play.

@federalreserve @USTreasury @FDICgov issue statement on actions to protect the U.S. economy by strengthening public confidence in our banking system, ensuring depositors' savings remain safe: https://t.co/YISeTdFPrO

— Federal Reserve (@federalreserve) March 12, 2023

Post the implosion of the Silicon Valley Bank, Signature Bank and Silvergate Bank, the massive recovery in Bitcoin and cryptocurrencies is a surprise. The banking institutions listed above are considered crypto-friendly, and a gateway for investors to enter the crypto ecosystem.

Also read: Is Bitcoin's safe haven narrative back as US banks start to go belly-up?

What to expect from the US CPI release?

Crypto market participants have turned their attention towards the US Consumer Price Index (CPI) release for signs of a continuation of Bitcoin’s price rally. Dhwani Mehta, Senior Analyst at FXStreet said,

A softer-than-expected US inflation data could add extra legs to the ongoing downslide in the US Dollar, as Gold price could extend its journey toward the $2,000 threshold. The US Dollar bulls need an upside surprise in the US Consumer Price Index to revive hawkish Fed expectations and stem the Gold price rally.

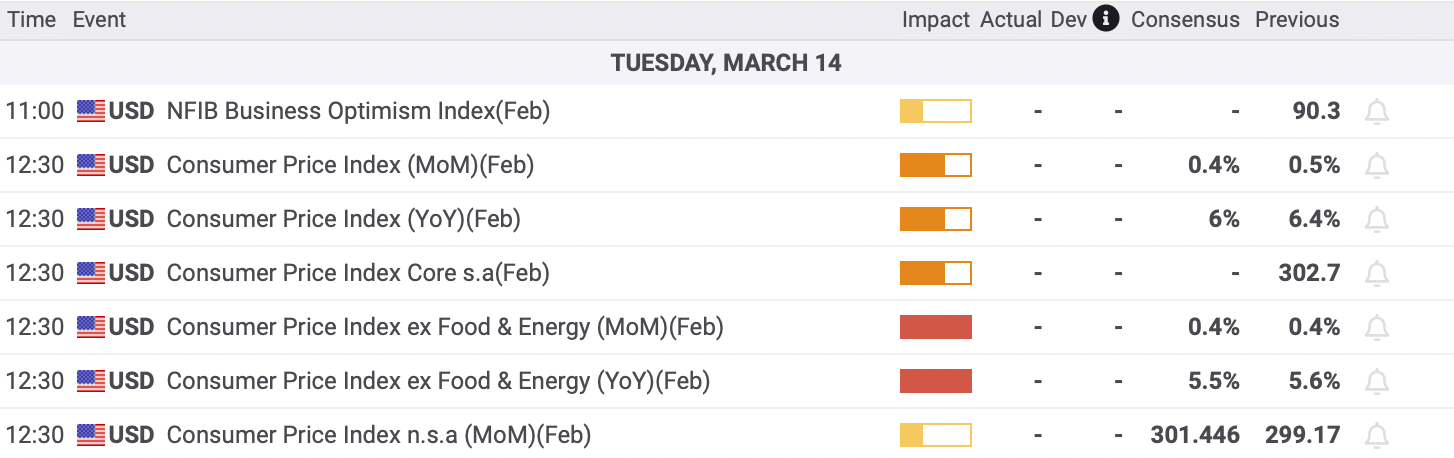

Risk assets like Bitcoin are expected to yield gains for holders in response to softer-than-expected US inflation data. According to the FXStreet economic calendar, CPI is expected to increase 0.4% in February after 0.5% in January.

US CPI forecast

The CPI is one of the most important and widely watched economic indicators. It is the best known measure of inflation and is used to adjust wages, retirement benefits, tax brackets, and other important economic indicators.

This makes CPI important for equities and crypto investors as it helps assess and control the risks posed by inflation and deflation to asset prices. If CPI comes in hotter than expected it could pump the breaks on Bitcoin’s rally to $25,000 and whipsaw prices.

Here’s how softer-than-expected CPI numbers could push Bitcoin higher

Despite no signs of a Fed pivot, it's important to note the tumultuous events of the past two weeks and the US Treasury’s decision to act as a lender of last resort. The Fed’s decision to infuse liquidity in the economy after two years of its tightening measures fueled a bullish sentiment among crypto holders.

The Fed’s two mandates are jobs and inflation. The Fed uses NFP and CPI data as inputs for its inflation rate decision. With February’s jobs report, it became clear that the economy is adding jobs faster than anticipated. However, wage inflation slowed down and the unemployment rate increased. This denotes that the jobs component of the mandates won’t add fuel to the fire of inflation rate hikes.

Based on this thesis, softer-than-expected CPI numbers could fuel a rally in Bitcoin and support the asset’s recovery.

James Bull, crypto influencer on Twitter is anticipating a bullish CPI release. Bull recently tweeted:

Next week is huge.

— James Bull (@MariusCrypt0) March 11, 2023

On Mon, FED emergency meeting and they might announce lowering interest to prevent other banks with locked-in bonds from running into the same issue.

On Tue, bullish CPI release. Markets will pump huge if it’s better than the forecast & dump if it’s weaker.

On an unrelated but useful note, Binance CEO Changpeng Zhao’s recent conversion of the $1 billion Industry Recovery Initiative fund is another bullish sign for Bitcoin recovery. The below chart from TradingLite shows a massive BTC buy order placed just below the $24,000 level; and there is speculation that this buy order was placed by CZ because of his recent announcement to convert the $1 billion fund from stablecoins and other assets to Bitcoin, Ethereum and Binance Coin (BNB).

BTCBUSD chart on Binance

How Bitcoin price has reacted to previous CPI releases

In the case of Bitcoin, the difference between actual and forecasted numbers has driven a reaction from market participants. As seen in the chart below, Bitcoin price has seen a decline if the CPI number came in hotter than expected with two exceptions seen in July and October 2022.

Bitcoin price reaction to difference between actual and forecasted CPI data

Softer-than-expected CPI data has typically favored Bitcoin bulls in the short-term, driving BTC price higher. However, as noted in the chart above, there is a net-negative change within a period of ten to fifteen days following the data release.

Crypto analyst Nagato is bearish ahead of the CPI release. Nagato cites the recent banking failure and the USDC depeg as a reminder of the bearish signs in crypto.

I summarise my understanding of what is going on and happy to be corrected because I feel this is 100% bearish only.

— Nagato (@Nostradumbass23) March 13, 2023

1. Death of signature and silver bank confirmed which leaves us with only deltec and few other lesser knowns

2. Fed didn’t announce pivot or QE you are rerarded

Akash Girimath, lead analyst at FXStreet believes Bitcoin price is at an inflection point. Traders need to watch out for signs emerging on lower time frames to determine where BTC is headed next. Read more here: Is this Bitcoin price rally sustainable? Will BTC hit $30,000?

Concluding thoughts

Based on Nonfarm Payrolls data from earlier this month and the US Treasury’s decision to guarantee all US bank deposits, the sentiment among BTC holders is bullish. There is an anticipation of a softer-than-expected CPI release that will probably push BTC price past its $25,000 resistance.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.