Bitcoin price bottom due 'this week' with BTC down 20% in November

Bitcoin is on course for its worst November since 2018, but a new forecast sees a BTC price bottom this week.

Key points

- Bitcoin is on track to seal its weakest November performance since the 2018 bear market.

- December has historically produced identical price action after “red” November months.

- AI predicts that BTC/USD will form a local bottom this week.

November echoes 2018 Bitcoin bear market

Bitcoin remains in bear market territory ahead of the November monthly close, its drawdown versus October’s all-time highs hitting up to 36%.

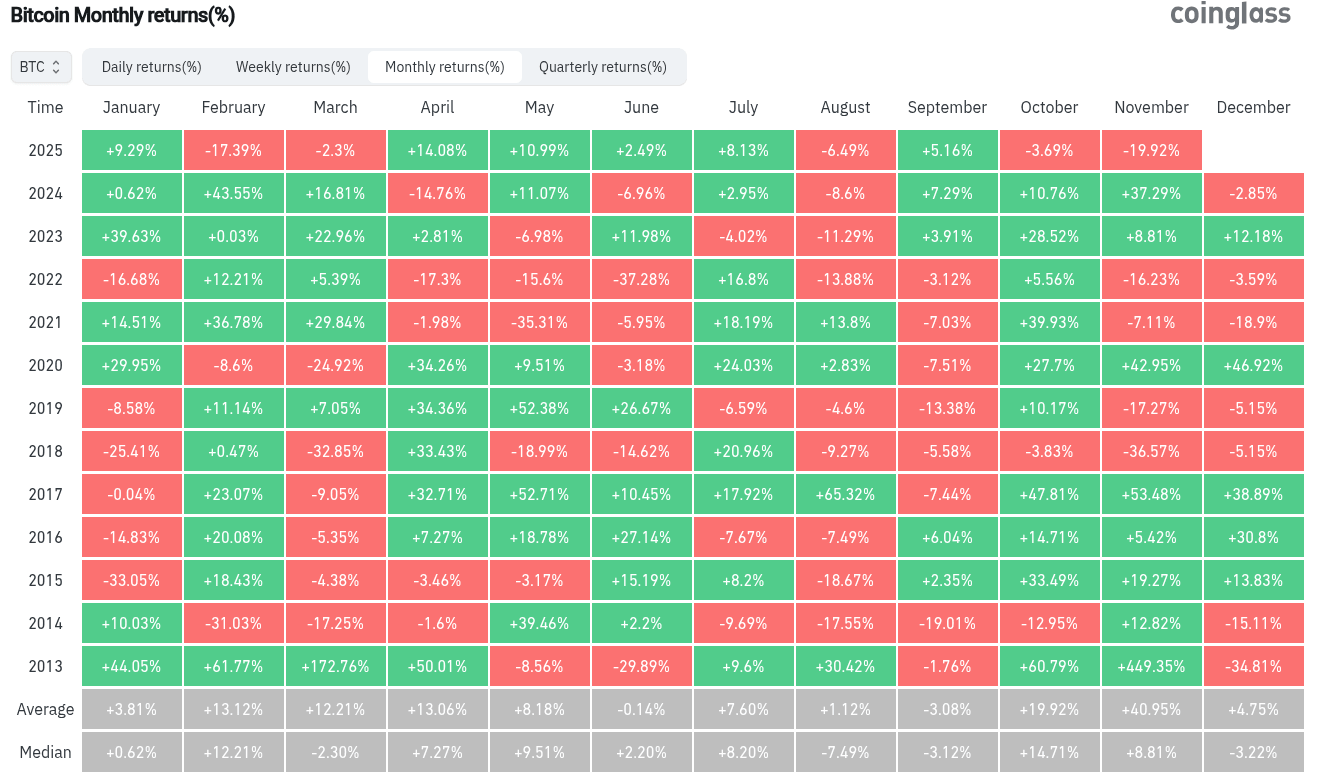

Data from monitoring resource CoinGlass shows that at $87,500, Bitcoin is still down 20% this month.

CoinGlass confirms that such bearish performance has been absent from the charts since 2018, the year following another bull run that peaked at $20,000.

“Every time Bitcoin has had a red November, December has also ended red,” Sumit Kapoor, founder of crypto trading community WiseAdvice, commented on the data in a post on X.

Since 2013, the average November gains for BTC/USD have been in excess of 40%, while December has been much more muted, resulting in just a 5% average upside.

BTC is due for a “slow recovery” into 2026

On the topic of BTC price seasonality, network economist Timothy Peterson shared some more optimistic views on how Bitcoin might conclude 2025.

A dedicated AI-based prediction tool suggests that Bitcoin’s latest local bottom is either already in or due this week.

“AI-driven Bitcoin simulation estimates the bottom is in or occurs this week, with a slow recovery through the end of the year,” Peterson reported on X Monday.

There is less than 50% chance Bitcoin reclaims $100,000 by December 31. There is at least a 15% chance Bitcoin finishes lower from here ($84,500) and an 85% chance it finishes higher.

He noted that the model does not account for external volatility catalysts, such as macroeconomic events.

Previous findings, which overlaid BTC price action this year onto 2015, likewise hinted that a major rebound could come by the end of the year.

Peterson nonetheless described the concept as “hopium.”

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.