Bitcoin is just seeing a ‘normal correction,’ cycle peak is yet to come: Analysts

Bitcoin’s correction from its January peak is a typical cycle pullback and is not out of the ordinary, with a price top still on the horizon, crypto analysts and executives tell Cointelegraph.

“I don’t think the bull run is over; I think the peak of the cycle has been pushed back due to macro conditions, and global liquidity isn’t pretty, which isn’t helping crypto,” Collective Shift CEO Ben Simpson told Cointelegraph.

Bitcoin experiencing expected retracement

“It is only the third or fourth correction we’ve had over 25% we’ve had in Bitcoin this cycle compared to 12 last cycle,” Simpson said.

Bitcoin (BTC $83,265) is down 24% from its all-time high of $109,000 on Jan. 20 amid uncertainty around US President Donald Trump’s tariffs and the future of US interest rates, but Simpson called it “a normal correction.”

“Things got overheated, and they needed to cool down, and the market needed to find a new foundation, and now we’re waiting for the next new narrative,” he said.

Bitcoin is down 13.58% over the past month. Source: CoinMarketCap

Derive founder Nick Forster shared a similar view, telling Cointelegraph that Bitcoin “is likely in a normal correction phase, with the cycle peak still to come.”

“Historically, Bitcoin experiences these types of corrections during long-term rallies, and there’s no reason to believe this time is different,” he said.

After Trump’s election in November, Bitcoin surged almost 36% over a month, hitting $100,000 for the first time in December. At the time of publication, Bitcoin is trading at $82,824, according to CoinMarketCap.

However, Forster added that the six-month fate of Bitcoin seems increasingly tied to traditional markets. Similarly, Independent Reserve CEO Adrian Przelozny told Cointelegraph that it isn’t just Bitcoin being impacted by the macroeconomic conditions.

“This is pervading all asset classes and may lead to a spike in global inflation and a contraction in international growth,” Przelozny said.

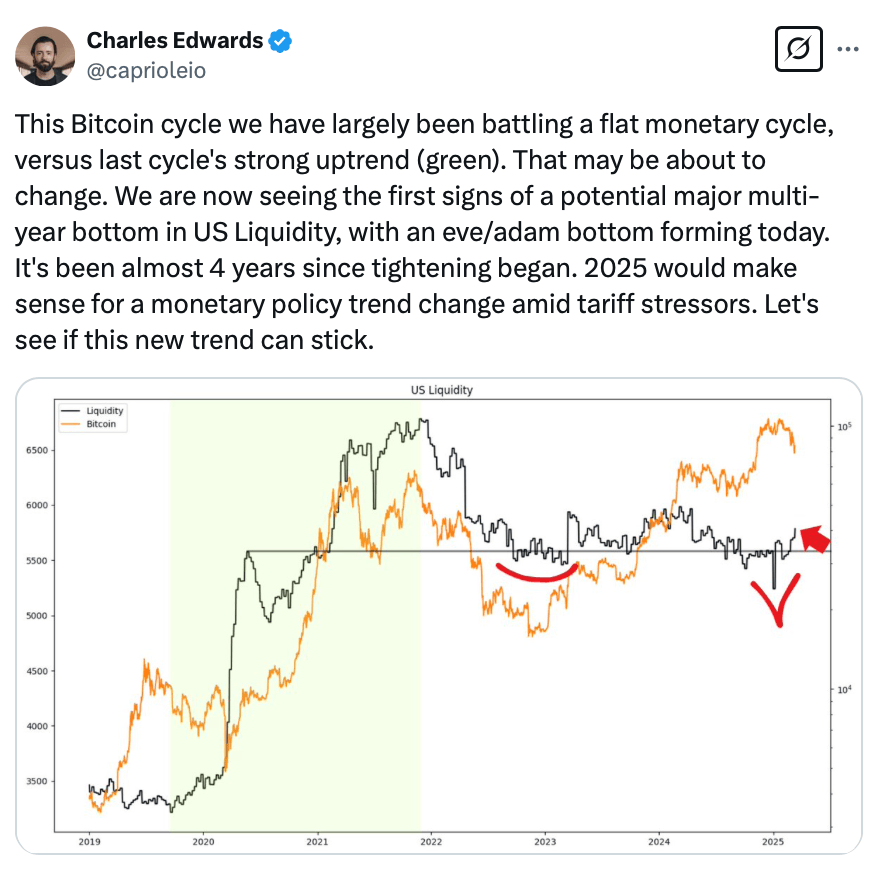

Source: Charles Edwards

Forster said Bitcoin’s current price trend aligns with past behavior before a price rally, even though it appears “tumultuous” at the moment.

Bitcoin’s current trend may “change quickly”

Collective Shift’s Simpson said the next narrative will likely revolve around US rate cuts, easing quantitative tightening, and increasing global liquidity.

However, Capriole Investments founder Charles Edwards said he isn’t so sure if the Bitcoin bull run is over or not.

The odds are “50:50, in my opinion,” Edwards told Cointelegraph.

“Yes, from an onchain perspective at present, but that could change quickly if the Fed starts easing in the second half of the year, stops balance sheet reduction, and dollar liquidity grows as a result, which I think has decent odds of happening,” Edwards explained.

The comments come a day after CryptoQuant founder and CEO Ki Young Ju declared that the “Bitcoin bull cycle is over.”

“Expecting 6-12 months of bearish or sideways price action,” Ju said.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.