Bitcoin hash rate returns to all-time high levels

The global hash rate of the Bitcoin network tanked to as low as 84 exahashes per second (EH/s) at the start of June following the Chinese government’s crackdown on the crypto mining sector.

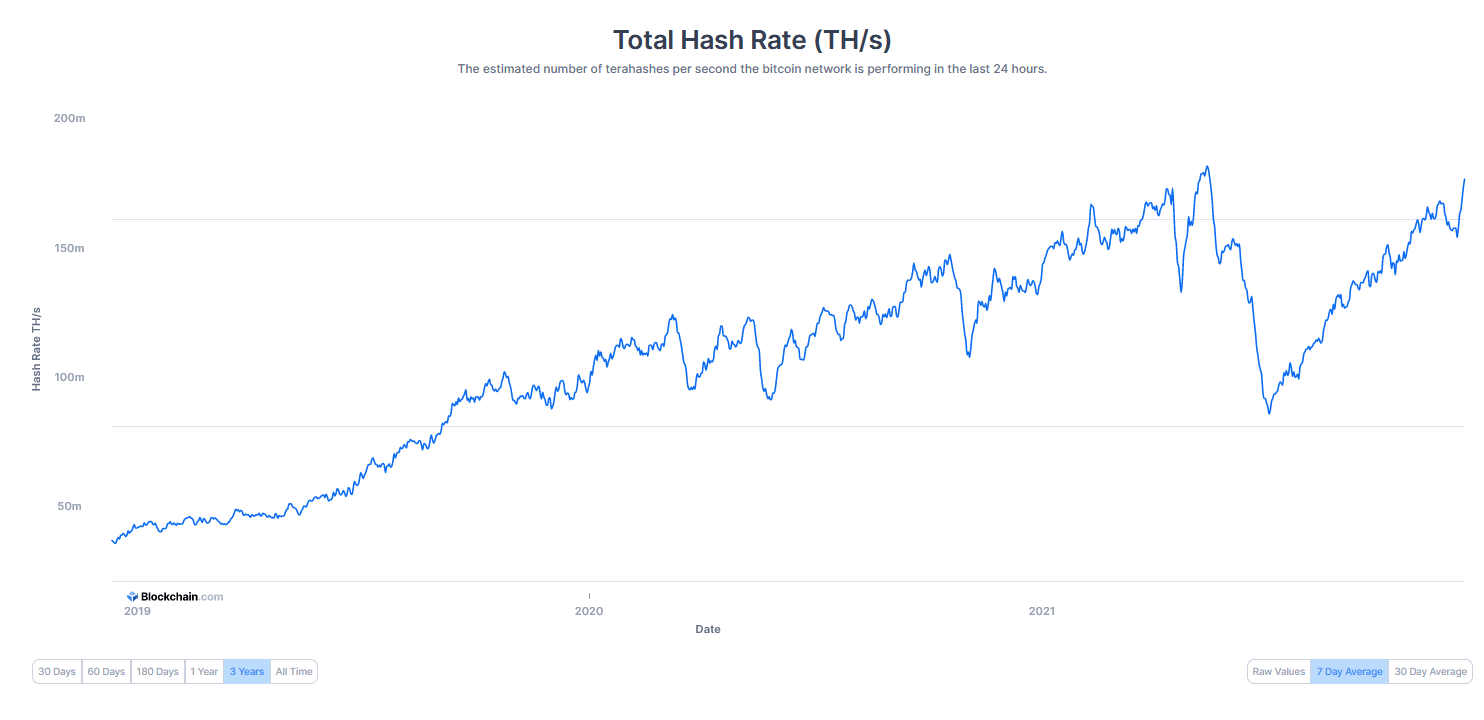

According to Blockchain.com, the global hash rate has increased by 108% since June, with the Bitcoin network performing at a rolling seven-day average of 175 EH/s as of Wednesday.

The figure is roughly 3% shy of peak levels of 180 EH/s seen at the height of the previous bull cycle in May. It is a commonly held belief that the trends in hash rate correspond with the price of Bitcoin (BTC), suggesting that there may be some positive price action on the horizon despite the overall gloomy sentiments in the market at the moment.

Bitcoin's total hash rate. Source: Blockchain.com

The actuality of the global hash rate ATH is hard to determine, however, as a lot of popular platforms differ in their estimates of the history and current performance of the Bitcoin network. According to data from BitInfoCharts, the ATH in May hit 197 EH/s before dropping to the 68 EH/s mark in June. As of Wednesday, the platform had Bitcoin’s hash rate at 191 EH/s, while YCharts has the current performance at 186 EH/s.

Prior to the ban, China-based Bitcoin miners accounted for a whopping 70% of the global hash rate. The landscape has shifted dramatically since then, with the United States becoming the nation that accounts for the majority of Bitcoin’s hash rate at 42%, per estimates from the University of Cambridge’s Bitcoin Electricity Consumption index.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.