Bitcoin Elliott Wave forecasting the decline after expanded flat pattern

In this technical article we’re going to take a look at the Elliott Wave charts charts of Bitcoin BTCUSD published in members area of the website. As our members know, we generally favor the long side in BTCUSD, and it has recently offered good trading opportunities. However, BTCUSD is currently correcting the cycle from the August low and is not ready for buying at this stage. Recently, we observed a recovery against the 108364 high, which unfolded as an Irregular Flat pattern. Once this flat correction was completed, the crypto declined as anticipated.

Before we take a look at the real market example of Expanded Flat, let’s explain the pattern in a few words.

Elliott Wave Expanded Flat Theory.

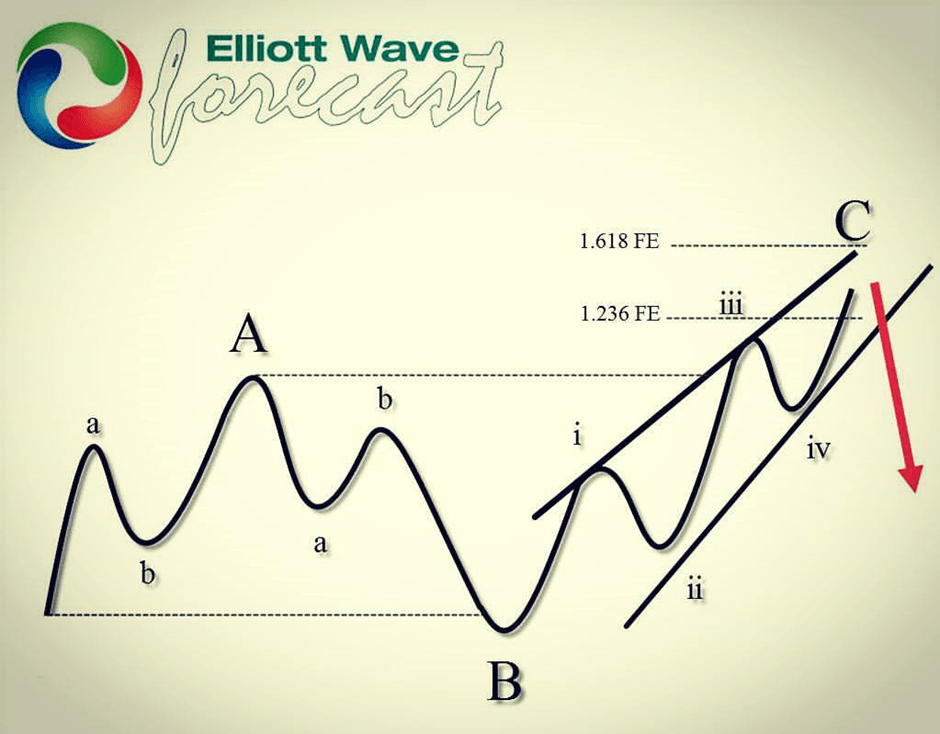

Elliott Wave Flat is a 3 wave corrective pattern which could often be seen in the market nowadays. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Irregular Flat Pattern wave B completes below the starting point of wave A. Wave C ends above the ending point of wave A . Wave C of Flat completes usually between 1.00 to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

At the graphic below, we can see what Expanded Flat structure looks like.

Now, let’s take a look what Elliott Wave Flat Pattern looks like in the real market

Bitcoin one hour Elliott Wave analysis 01.05.2025

Currently, BTCUSD is correcting the cycle from the 108364 high. The Elliott Wave view suggests that the recovery is unfolding as an Irregular Flat Pattern. When we analyze the lower time frames, we can observe that the inner subdivisions of waves A and B (red) exhibit corrective sequences. Wave B has already broken below the starting point of wave A, while wave C is expected to break above the point of wave A, which is characteristic of an Irregular Flat pattern. At this stage, we see that the C leg is still missing another wave up to complete its structure as a 5-wave move. We recommend our members avoid buying at this stage.

Bitcoin one hour Elliott Wave analysis 01.09.2025

Bitcoin made another leg up in wave ((v)) of C, completing the (X) blue recovery at the 102730 high. As anticipated, the crypto turned lower. We are now looking for a break below wave B (red) to confirm that the next leg down is in progress. At this stage, we do not favor selling and would prefer to wait for the (Y) leg to reach the extreme area before considering buying BTC again.

Elliott Wave forecast

Thank you for exploring our BTCUSD Forecast with us. While we analyze 78 instruments, it’s important to remember that not every chart represents a trading recommendation. For official trading signals, we invite you to join our Live Trading Room, where we provide actionable insights in real-time. If you’re not yet a member, take advantage of our 14-day trial to unlock new trading opportunities.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com