Bitcoin, Cryptocurrencies dragged by sellers

Bitcoin (-0.63%) and the rest of the cryptocurrencies' rally attempt keep being frustrated by heavy seles. After their round trip, most of the currencies ended up around the levels held on Friday. Among the top coins in the red were Litecoin (2.65%), Bitcoin SV (-1.58%), and Ripple (-1.41%). The notable exceptions were VSYS( +12.98%) and ATOM (+5.73%). The most bullish among Ethereum's tokens were DXChain Token (+51.9%), Aurora (+18.99%), Locus Chain (+24.13%), and iExec RLC (+16.78%).

The market capitalization is currently $239.9 billion, 3% below Friday's value, and the last 24H volume is $32.389 billion, a 35% increase. After all this action, Bitcoin dominance fell to 57.74%.

Hot News

The United Arab Emirates is preparing for the fast expansion of the demand for cryptocurrencies. Country officials are drafting regulations and guidelines for the implementation and use of crypto assets.

The Central Bank of Singapore and JP Morgan are jointly developing a blockchain-based payment system for cross-border transactions. The system would allow for payment settlements using different currencies.

Fukushima Bank will integrate the MoneyTap app, a ripple-based money payment app. The Japan Bank Consortium launched MoneyTap in March 2018, allowing its users to transfer money using phone numbers and QR codes.

Technical Analysis

Bitcoin

Bitcoin has retraced all its gains hours after a sharp upward movement after the price was rejected by its 50-period SMA. The price is now moving below the last support of $8,760 and fighting near its 200-period SMA level ($8,650). The price moves below the -1SD Bollinger line and MACD points to a bearish crossover. Therefore we can see that this corrective movement after the bullish impulsive move made the end of October has not yet concluded.

The levels to watch are 8,650 in the first place. It may be necessary for buyers that the 200-period MA holds. $ 8.760 is also essential, as it has been breached recently. If the price goes back above this level soon, it may signal that there are still buyers willing to bet for the continuation of the bullish trend.

| Supports | Pivot | Resistances |

| 8,795 | 8,964 | 9,200 |

| 8,560 | 9,370 | |

| 8,360 | 9,600 |

Ripple

Ripple continues moving controlled by the sellers. The price moves below the -1SD Bollinger line, and the Bollinger bands themselves point south. The price has retraced almost 100% of the last impulse made in the final days of October. The current situation seems to indicate the price will move to visit the $0.266 level.

| Supports | Pivot | Resistances |

| 0.2740 | 0.2800 | 0.2830 |

| 0.2660 | 0.2880 | |

| 0.2620 | 0.2950 |

Ethereum

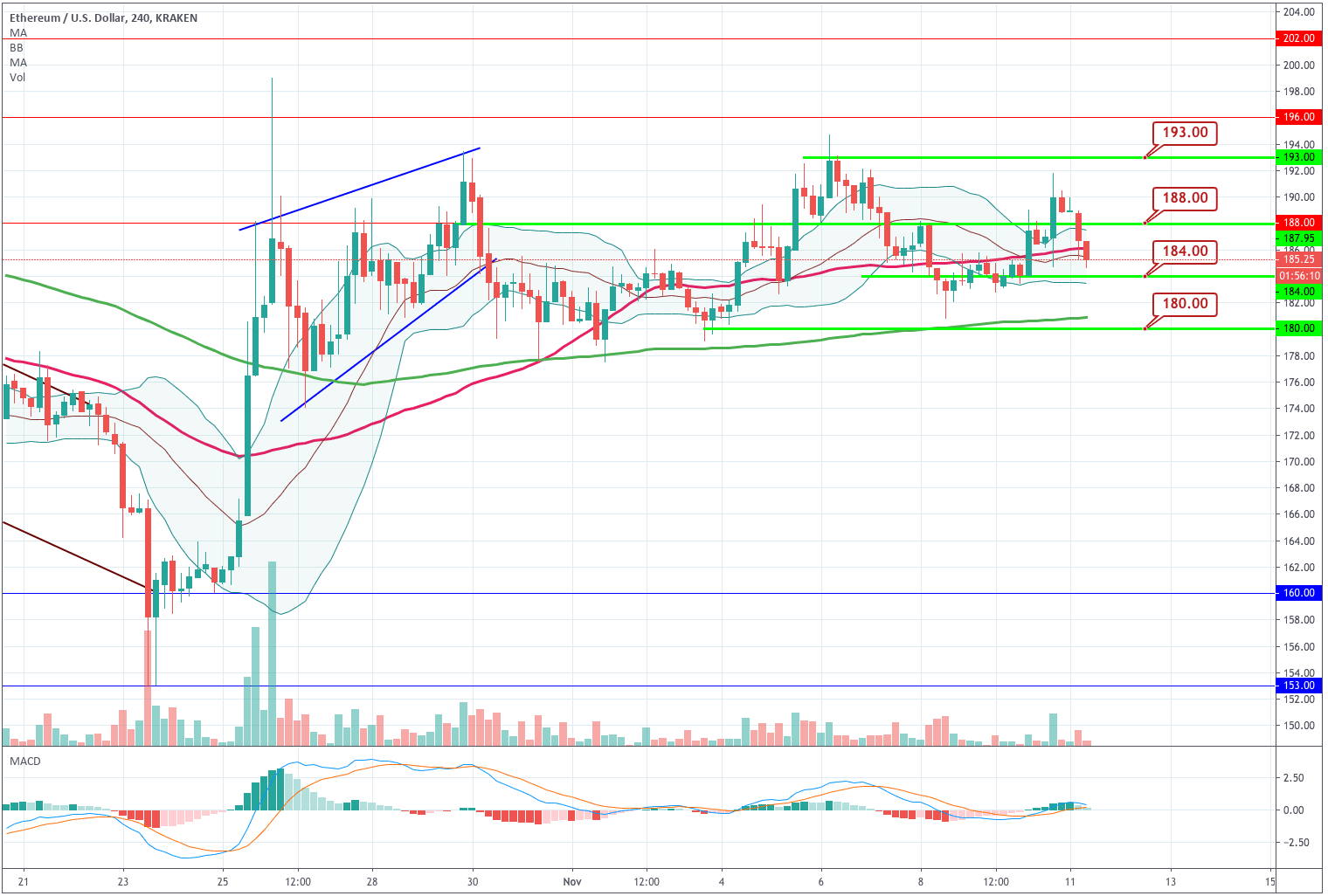

Ethereum is moving in a horizontal channel wide limited between $180 and $ 193. Currently, the price is moving in the middle of the channel and of the Bollinger bands. Ethereum seems to have a more positive outlook than the previous two coins since we can observe higher lows, although it failed to create a new high in its new upward leg. The levels to keep are $184 and $188. The volume is thinner on the red candlesticks also points sellers do not have the power to drag it down.

| Supports | Pivot | Resistances |

| 184.00 | 188.00 | 193.00 |

| 180.00 | 196.40 | |

| 176.00 | 201.00 |

Litecoin

Litecoin has been rejected from $67 in its attempt to cross the critical level for the second time. The price has backed close to its support of $60, although the volume traded was much less than the one depicted in the last spike made on Sunday. We still see LTC price making new highs, so we still keep its trend as bullish. On the other hand, we can see that $67 is a level where lots of sellers will be waiting for dumping their coins. We should also watch the $60 level, as a break below it might end the bullish movement for a while and send the price towards $58 and $56.

| Supports | Pivot | Resistances |

| 60,8 | 63,8 | 66,7 |

| 58.00 | 6,6 | |

| 55.50 | 72,5 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and