Bitcoin bull run comeback? Whale exchange inflow metric nears five-year high

Bitcoin is teasing bull run continuation as whale inflows to exchanges plateau this month.

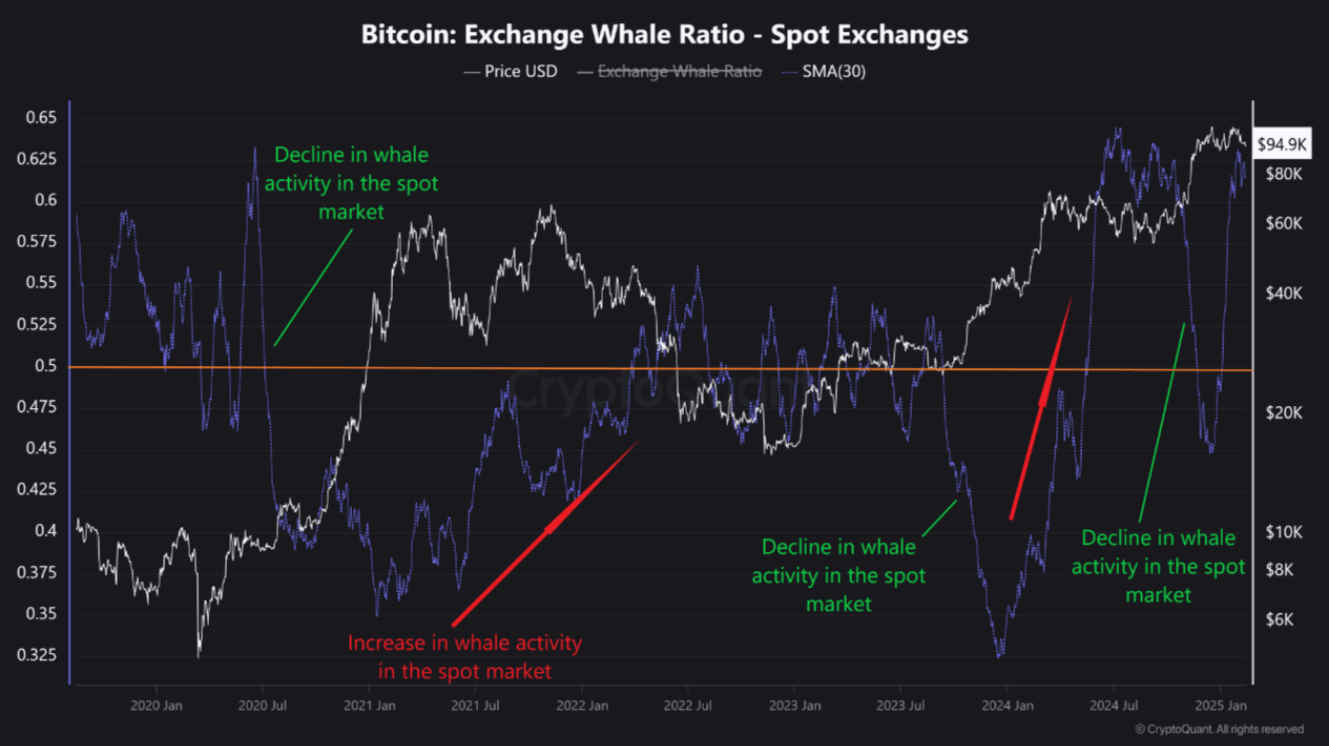

Data from onchain analytics platform CryptoQuant shows whale-sized inbound exchange transactions making a potential lower high in February.

Bitcoin whales tease next phase of bull run

Bitcoin (BTC $96,218) traditionally reaches its cycle peak once whale exchange moves drop from local highs of their own, CryptoQuant shows.

In a Quicktake blog post on Feb. 13, contributor Grizzly highlighted the 30-day simple moving average of the Whale Exchange Ratio — the size of the top 10 inflows to exchanges relative to all inflows.

This came in at 0.46 on Feb. 12, near multi-year highs and up from lows of 0.36 in mid-December when BTC/USD was trading near all-time highs.

Since then, price action has dropped and whale activity has increased. However, the trend is already showing signs of fading.

“Since late 2024, this metric has experienced a robust upward surge, though its momentum has slightly moderated over the past two weeks without a definitive reversal,” Grizzly said.

Historical trends indicate that a downturn in whale deposits on spot exchanges often precedes a bullish Bitcoin rally.

Bitcoin Exchange Whale Ratio (screenshot). Source: CryptoQuant

Cointelegraph reported on the high whale inflows earlier this week, while elsewhere, newer whales are on the radar as potential BTC price support.

The aggregate cost basis for large-volume investors holding for up to six months is just under $90,000, making that level — which has held for over three months — essential for traders.

Bitcoin miners at a bullish turning point

Another important cohort, miners, has returned to accumulation this month.

This follows a six-month spate of near-uninterrupted outflows from miner wallets and coincides with a fresh “capitulation” phase, which tends to mark local market bottoms.

BTC/USD chart with Bitcoin miner netflows data. Source: Charles Edwards/X

Last July, just before miner outflows picked up, Cointelegraph noted research concluding that the overall impact on the market was already significantly lower than institutional flows, specifically those from the US spot Bitcoin exchange-traded funds, or ETFs.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.