Bitcoin breaks down after weeks of consolidation – What’s going on?

-

BTC/USD falls below 90k to a 3-month low.

-

The selloff triggers $1.33 billion in long liquidations.

-

Trump revives global trade war worries.

-

Bybit security breach shakes sentiment.

- BTC ETF outflows could rise further as basis trade returns fall.

Bitcoin has broken out of its familiar trading range for the past three weeks, sinking to its lowest level in three months. Renewed global trade tensions and a hack at a major cryptocurrency exchange have unnerved investors, triggering a sell-off, resulting in $1.33 billion in long liquidations over the past 24 hours.

Global trade fears return

President Trump reaffirmed intentions to impose tariffs on Mexico and Canada as of March 4th despite efforts by both countries to enhance border security. Trump's announcement prompted risk-off trade, helping gold rise to a record high and the S&P 500 close lower.

While some consider Bitcoin to be ahead against economic instability, the cryptocurrency’s reaction to the latest trade war worries suggests caution among traders.

Bybit hack shakes sentiment

In addition to worries about global trade tensions, the crypto market is also facing challenges following the Bybit security breach at the end of last week. Bybit saw almost $1.5 million stolen mainly in Ethereum. However, the hack resulted in investors losing confidence and withdrawing a further 20,190 BTC from Bybit’s reserves amid fears of insolvency. The news has sent jitters across the cryptocurrency market, shaking investor sentiment despite Bybit raising enough to cover the losses. Confidence could take some time to be restored.

BCT ETF outflows jump and could rise further

According to Farside data, Bitcoin spot ETFs experienced the second-largest outflow of the year on Monday, $516.4 million. The withdrawal marks the ninth net outflow in 10 days.

These outflows come as the Bitcoin CME annualised basis, which marks the difference between the spot price and futures drops to 4%. This is the lowest since ETF started trading in January 2024. It is important because it reduces the return on the cash and carries trade, a neutral strategy that seeks to profit from the mispricing between the two markets. At the current 4% return, the basis trade yields less than the US 10-year Treasury, which is also deemed risk-free. This might persuade investors to close the basis trade in favor of higher returns from Treasury yields. Consequently, this could lead to additional outflows from ETFs, potentially exerting more pressure on the Bitcoin price.

Will BTC fall to 85k?

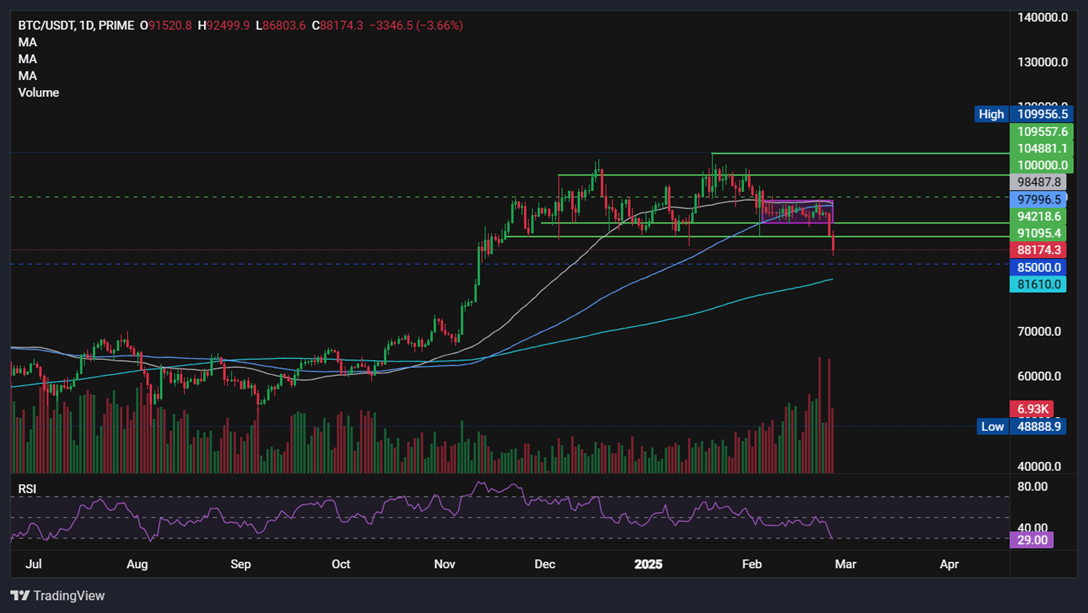

Bitcoin has taken out support at 94k, breaking below its holding pattern within which it has traded over the past 3 weeks. The price has fallen below support at 91.5k falling to a low of 88k.

The RSI supports further downside while remaining out of oversold territory. Should BTC/USD continue its bearish breakdown, the 85k round number will come into focus ahead of the 200 SMA at 81k.

Any recovery needs to rise above 94k and 98k to retest resistance at the psychological level of 100k.

Start trading with PrimeXBT

Author

PrimeXBT Research Team

PrimeXBT

PrimeXBT is a leading Crypto and CFD broker that offers an all-in-one trading platform to buy, sell and store Cryptocurrencies and trade over 100 popular markets, including Crypto Futures, Copy Trading and CFDs on Crypto, Forex, I