Bitcoin blasts past $97K amid post-election bullish signals

Bitcoin has shattered another milestone, surging past $97,000 in what has been an extraordinary week for the world’s largest cryptocurrency. While the recent U.S. presidential election provided a spark, a confluence of regulatory developments, market optimism, and institutional adoption has powered Bitcoin’s meteoric rise.

Post-election optimism fuels momentum

The outcome of the U.S. presidential election has set a bullish tone for the crypto market. President-elect Donald Trump has signaled a pro-crypto agenda, promising to overhaul cryptocurrency regulations and establish a national Bitcoin reserve. His administration is reportedly considering a White House “crypto czar” role to spearhead policy efforts, reflecting the growing importance of digital currencies in federal governance.

The market has responded with enthusiasm. Bitcoin, which had already been climbing, accelerated its rally after Trump’s election victory, soaring by 35% in just a few weeks. His pledge to make the U.S. the “crypto capital of the planet” has emboldened investors, with institutional players and retail traders alike piling in.

BlackRock ETF options: A game changer

A major catalyst driving the recent surge has been the launch of spot Bitcoin ETF options by BlackRock’s iShares Bitcoin Trust (IBIT). These derivatives debuted on the Nasdaq, allowing traders to speculate on the ETF’s price movements, further enhancing Bitcoin’s appeal as an asset class.

On its first trading day, the ETF options saw a staggering $1.9 billion in notional exposure, signaling robust investor interest. Analysts suggest this new financial product will make it easier for both institutional and retail investors to hedge risks and participate in Bitcoin’s growth.

Institutional adoption hits a new gear

Institutional adoption continues to gain traction, with regulatory advancements smoothing the path for broader participation. Earlier this year, the Securities and Exchange Commission (SEC) approved U.S. spot Bitcoin ETFs, enabling mainstream investors to access Bitcoin through traditional financial channels. Even pension funds—long considered risk-averse—are beginning to allocate funds to Bitcoin ETFs.

Meanwhile, Howard Lutnick, Trump’s nominee for Secretary of Commerce, has championed Bitcoin as a “transformative tool” for global markets. Lutnick’s support signals that the new administration may actively promote policies to integrate cryptocurrency into the broader financial ecosystem.

Trump’s connections to the crypto industry extend beyond policy promises. His Trump Media & Technology Group is reportedly nearing an acquisition of Bakkt, a leading cryptocurrency trading platform. This potential deal would mark a significant expansion into digital finance, underscoring the administration’s commitment to fostering innovation in the sector.

Beyond the U.S., global adoption of cryptocurrency is advancing rapidly. Cities like Detroit and states such as Colorado, Utah, and Louisiana now accept Bitcoin for taxes and fees, showcasing how digital currencies are becoming integrated into everyday financial systems. This broader acceptance aligns with Trump’s vision of positioning the U.S. as a leader in the global crypto economy.

Technical analysis: 100k this week?

As Bitcoin races toward the $100,000 milestone, experts are already looking ahead. Valentin Fournier, an analyst at BRN, predicts that Bitcoin could reach $120,000 by 2025, driven by growing retail participation and confidence in its long-term potential. Fournier describes the current phase as an “accumulation period” before a major breakout.

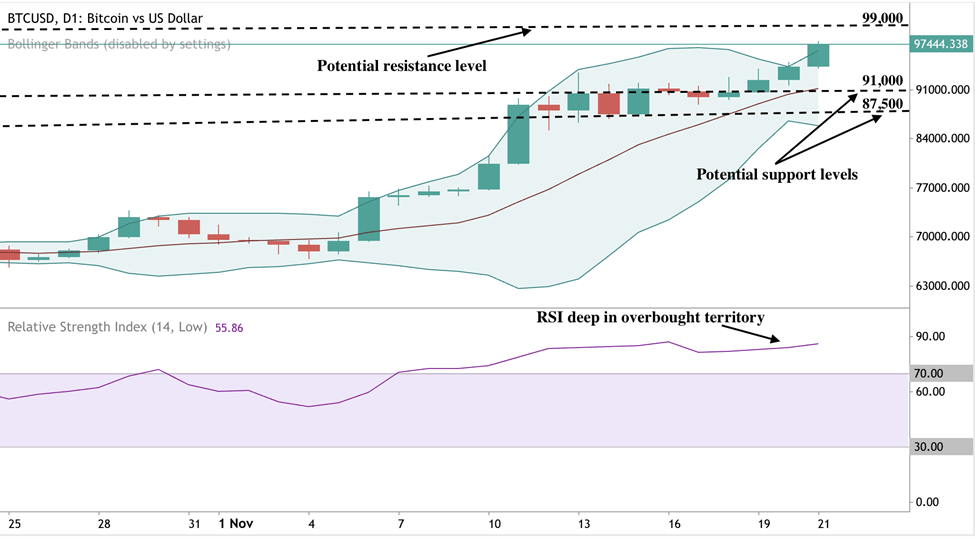

At the time of writing, BTC is rising steadily towards $98,000, with bullish signals well pronounced. However, RSI deep in overbought territory and price slightly breaching the upper Bollinger band, hint at overbought conditions.

Buyers, who are now setting new all-time highs, could face a slowdown at a speculative $99,000 mark, a price point that we’ve never seen before. Sellers on the other side, could find support at the $91,000 and $87,500 price levels.

Source: Deriv MT5

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.