Binance coin price in a challenging spot as bulls breach $300

- BNB price has retraced 50% of the current downswing.

- Binance coin price has a tapering volume pattern.

- Invalidation of the downtrend is a breach at $392.

Binance coin price is providing reasons to believe in another downswing towards $175.

Binance coin price is in a make-or-break position

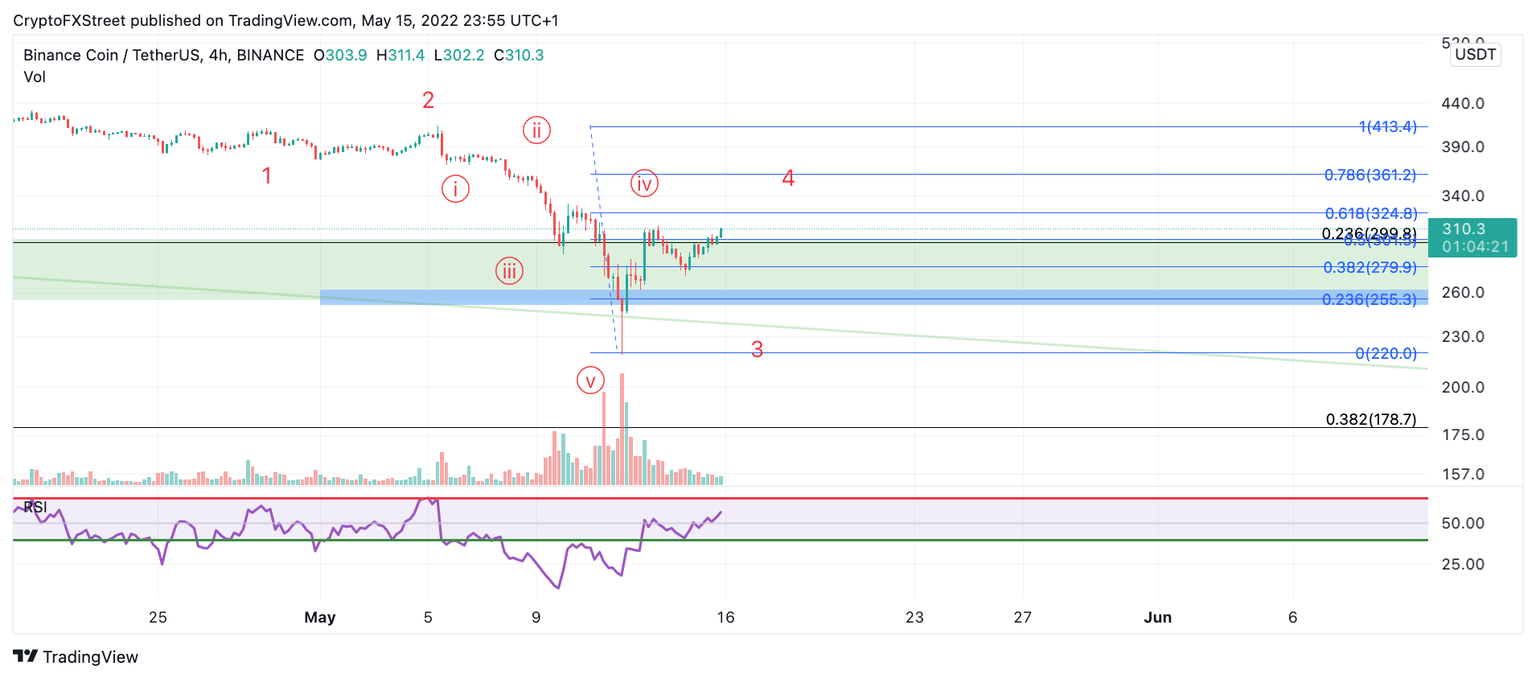

Binance coin price could be due to more decline as the technicals hint at subtle bearish control. Binance coin price has retraced 50% in a very sharp and short period of time, a textbook marker for zigzag corrections within wave three price action. Binance coin price is now finding resistance at the 50% Fibonacci level as the price trades at $302. The next hurdle for BNB price will be the 61.8% Fib level of $324.

Binance coin price also shows contrarian bearish signals as the current uptrend increases on relatively low volume. The volume pattern could be evidence of a lack of interest from the bulls at these price levels. The relative strength index does not provide enough evidence on the daily chart to open a short position, but traders should be on the lookout for new bearish evidence as early as Monday morning.

BNB/USDT 4-Hour Chart

Invalidation of the bearish downtrend lies at $392. If the bulls can breach this level, the BNB price could continue rallying to $600, resulting in a 100% increase from the current BNB price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.