Axie Infinity price prepares to explode to the upside

- Axie Infinity price is going for a fourth consecutive day of gains.

- AXS bulls test the water for around $72 before hitting $73.62.

- Expect later this week a break higher worth 16% of gains, targeting $85.00.

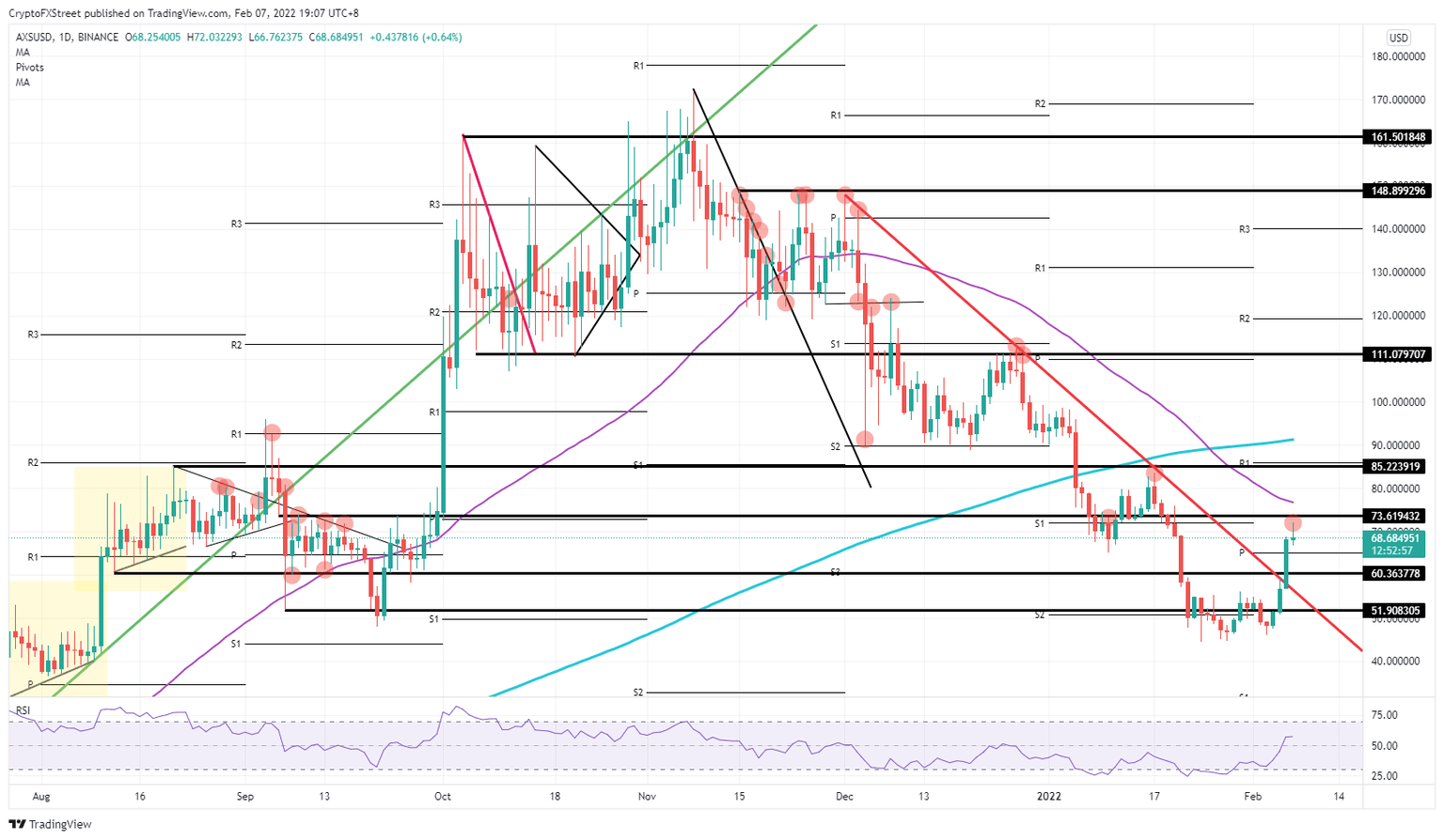

Axie Infinity (AXS) price looks set for a bullish breakout, unlocking another area and gains of potentially 16% this week. Bulls are testing the water around $72.00 as we speak, with $73.62 as a significant level that also looks likely to break. Penetration above there will open the way for more upside, turning the 55-day Simple Moving Average (SMA) into support at around $77.00.

AXS bulls set to topple some caps into support, opening up more gains to come

Axie Infinity is already returning 46% of gains since last Friday and is now looking ready to push above 50% profit, with a minimum extra 16% gains still possible this week. Bulls are already poised to achieve this after testing the $73.62 level but face a bit of profit-taking beforehand. A temporary fade will not come as unwelcome as the Relative Strength Index (RSI) is overheating a little bit, and now gets the chance to cool down, offering bulls some room to enter before price action takes off again.

AXS price will first need to face the actual $73.62 resistance level, and could break above it as the current pullback offers the opportunity to reenter the long trade. Resistance at $77.00, however, looks heavy with the 55-day SMA capping it. A break above later this week, would turn the 55-day SMA into support, acting as a launching platform to hit $85.25. This is a key historical level and the monthly R1 is a strong resistance level too. Such a rally, however, would likely return another 16% of gains on top of 46% already booked.

AXS/USD daily chart

Alternatively, the current rejection could be proven too big, and see a significant fade towards the monthly pivot at $65.13. A further break lower could see a push towards $60.36, which would erase around half of the current gains. The risk is then of a complete collapse towards $51.90.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.