AVAX price will give holders an opportunity to get out before another 20% crash

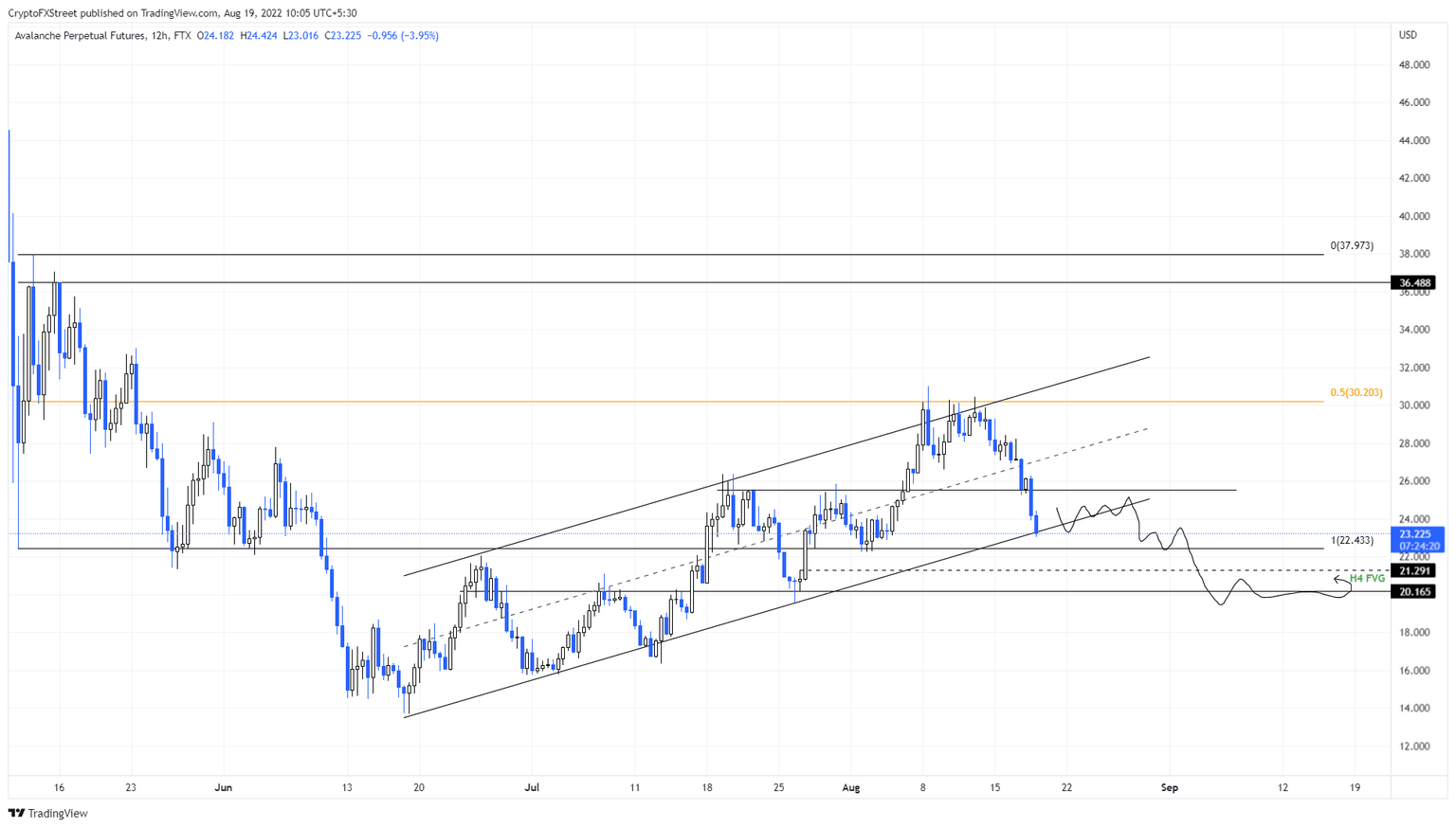

- AVAX price is at the end of an ascending parallel channel, hinting at a breakout soon.

- A breakdown of $22.43 will likely result in a further descent to $20.16.

- A daily candlestick close above $25.47 will invalidate the bearish thesis for Avalanche.

AVAX price is in a tough spot as it approaches the end of its uptrend that has been ongoing for two months. While bearish as the altcoin looks, a minor relief rally or bounce could help investors cash out before another leg down.

AVAX price prepares for more losses

AVAX price rallied 126% in less than two months and set a local top at $30.98. This upswing was in the form of higher highs and higher lows, revealing an ascending parallel channel. After hovering around $30 for a few days, Avalanche price dropped 24%, reaching the lower limit of the parallel channel.

While this drop might look like an opportunity to accumulate more, investors should give Bitcoin price another look. BTC has slid below the 30-day Exponential Moving Average and 200-week Simple Moving Average, suggesting a continuation of the downtrend.

However, a minor bounce to $25.54 might arrive as BTC consolidates after its recent sell-off. This relief rally could be an opportunity for investors to book profits and bears to initiate shorts before the AVAX price triggers another downswing to $21.29 and $20.16.

In total, investors can expect AVAX price to crash another 20% after a brief bounce to $25.54.

AVAX/USDT 12-hour chart

While things are looking awfully grim for AVAX price, a flip of the $25.54 resistance level will re-ignite the bullish outlook. This development has the potential to invalidate the bearish thesis but a confirmation will only arrive after the altcoin flips the $30.20 hurdle into a support floor.

In such a case, market participants can expect AVAX price to revisit the $36.48 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.