Another rally for AVAX price is unlikely but it could happen if…

- AVAX price seems to be at the end of its 39% rally and currently hovers below the $30.20 hurdle.

- The aforementioned level decides if the altcoin will trigger a 20% rally or undergo a steeper correction.

- Investors need to be patient before sticking with a directional bias.

AVAX price has been on an uptrend since the bottoming formation in mid-June. The rally has been convincing so far and produced massive gains for directionally-positioned traders. However, the altcoin has reached an inflection point that could threaten this uptrend.

AVAX price needs to be decisive

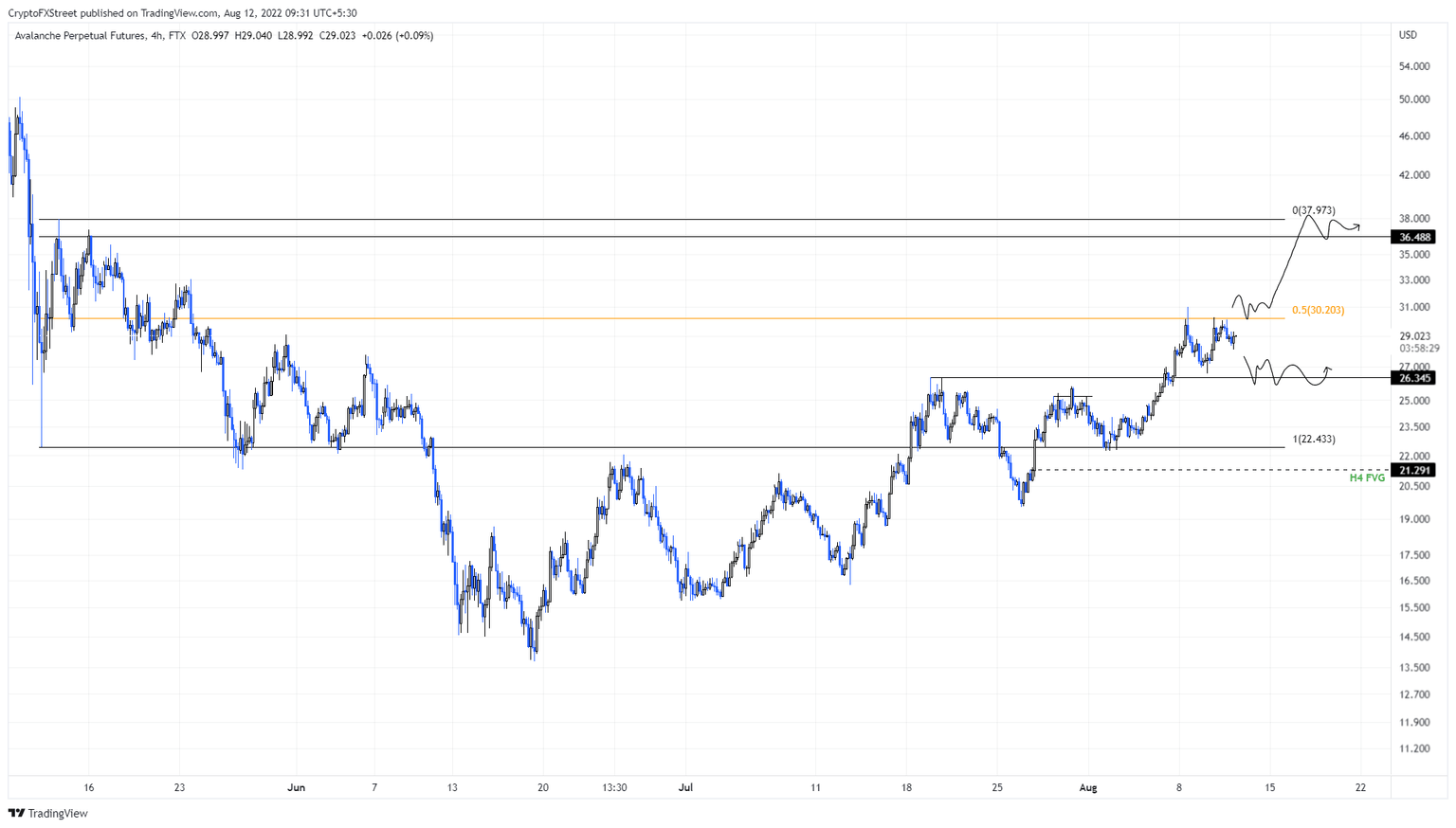

AVAX price set up a bottom at $13.68 on July 19 and triggered a 126% upswing to create a swing high at $30.98. This massive upswing has also pushed the altcoin inside the $22.43 to $37.97 range, which was created between May 12 and 13.

Interestingly, the swing high at $30.98 could be a local top as it has produced a close below the midpoint of the aforementioned range at $30.20. Hence, investors need to be careful before hopping on a directional bias.

A rejection at $30.20 could result in a 12% retracement to the immediate support level at $26.34. Although unlikely, a breakdown of this barrier could result in a further descent to the range low at $22.43 or the fair value gap, aka the price inefficiency at $21.29.

On the other hand, a flip of the $30.20 hurdle could result in a 20% upswing to the $36.48 barrier. In some cases, this move could extend to retest the range high at $37.97.

For now, any of the outcomes described above could happen. However, judging by the daily candlestick close of Bitcoin on August 11, the trend could be skewed in favor of bears.

AVAX/USDT 1-day chart

As mentioned above, a flip of the $30.20 resistance level could result in a quick 20% to 25% upswing. However, a move beyond $37.97 is unlikely, at least not without the support of the big crypto.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.