Here’s how you can squeeze more gains from the next AVAX price move

- AVAX price has reached an inflection point of its 39% rally.

- If the bullish momentum is enough to flip the $30.20 barrier into a support level, a 20% upswing seems plausible.

- Rejection at the aforementioned level could result in a 12% correction.

AVAX price embarked on an impressive rally on August 2 and reached its forecasted destination on August 8. Interestingly, this target is a massive resistance level that is likely to test bulls’ grit. Investors need to be patient and take into consideration the reaction of Avalanche bulls to this hurdle when making their next move.

AVAX price ready to roll

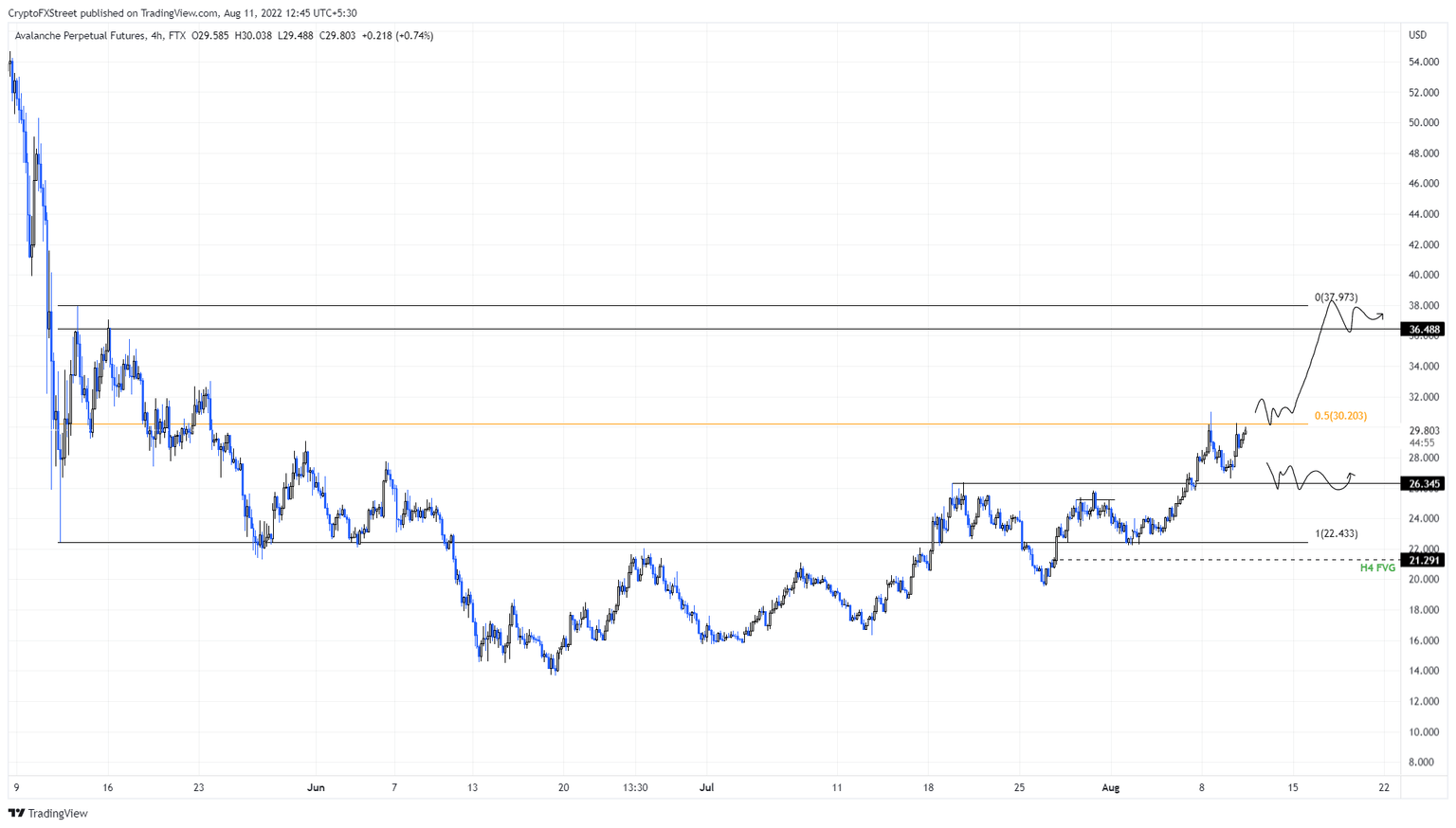

AVAX price created a range between $22.43 to $37.97 on May 12 and 13. Although it fell off the bottom of the range for a while, it successfully recovered above the range low on July 18, indicating a shift in the momentum.

This development underwent a decent amount of consolidation for the next two weeks. On August 3, AVAX price once again retested the range low – for the last time it would turn out as it subsequently took off, undergoing a 39% rally. Nevertheless, all was not plain sailing as although the move twice pierced the midpoint of the range at $30.20, both times it failed to overcome it.

Now, a pullback might be brewing for AVAX price. Investors need to wait for a rejection or a flip to decide where the altcoin is headed next. Assuming Avalanche bulls take control and overcome the $30.20 level, market participants can expect a 20% run-up to $36.48 and, in some cases, a revisit of the $37.97 hurdle.

AVAX/USDT 1-day chart

However, if AVAX price is again rejected by $30.20 again, then a 12% correction to $26.34 seems likely. Investors can short this move to maximize their returns. If the buying pressure makes a comeback, traders can mull on opening a long position here.

If the $26.34 support floor breaks down, it will invalidate the bullish thesis for AVAX price. In such a case, a retest of the four-hour fair value gap (FVG) at $21.29 is likely after a 19% downswing.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.