Avalanche price on the cusp of significant drop as dollar sets tone

- Avalanche price action sees bulls dipping toes in to buy stakes.

- AVAX price is up for today, but a bull trap and longer-term downtrend are set to be triggered by an extensive technical event.

- Should more dollar strength come into the equation, expect to see AVAX drop below $50.

Avalanche (AVAX) is set to shed around 36% of its market cap as, although being on the front foot at the moment, a broader technical bearish signal is set to be triggered. A death cross is when the 55-day Simple Moving Average crosses below the 200-day SMA – as is currently happening on AVAX. Expect Avalanche price to hit $76 sometime today and then eventually drop to the downside as dollar strength will outweigh the current uptick.

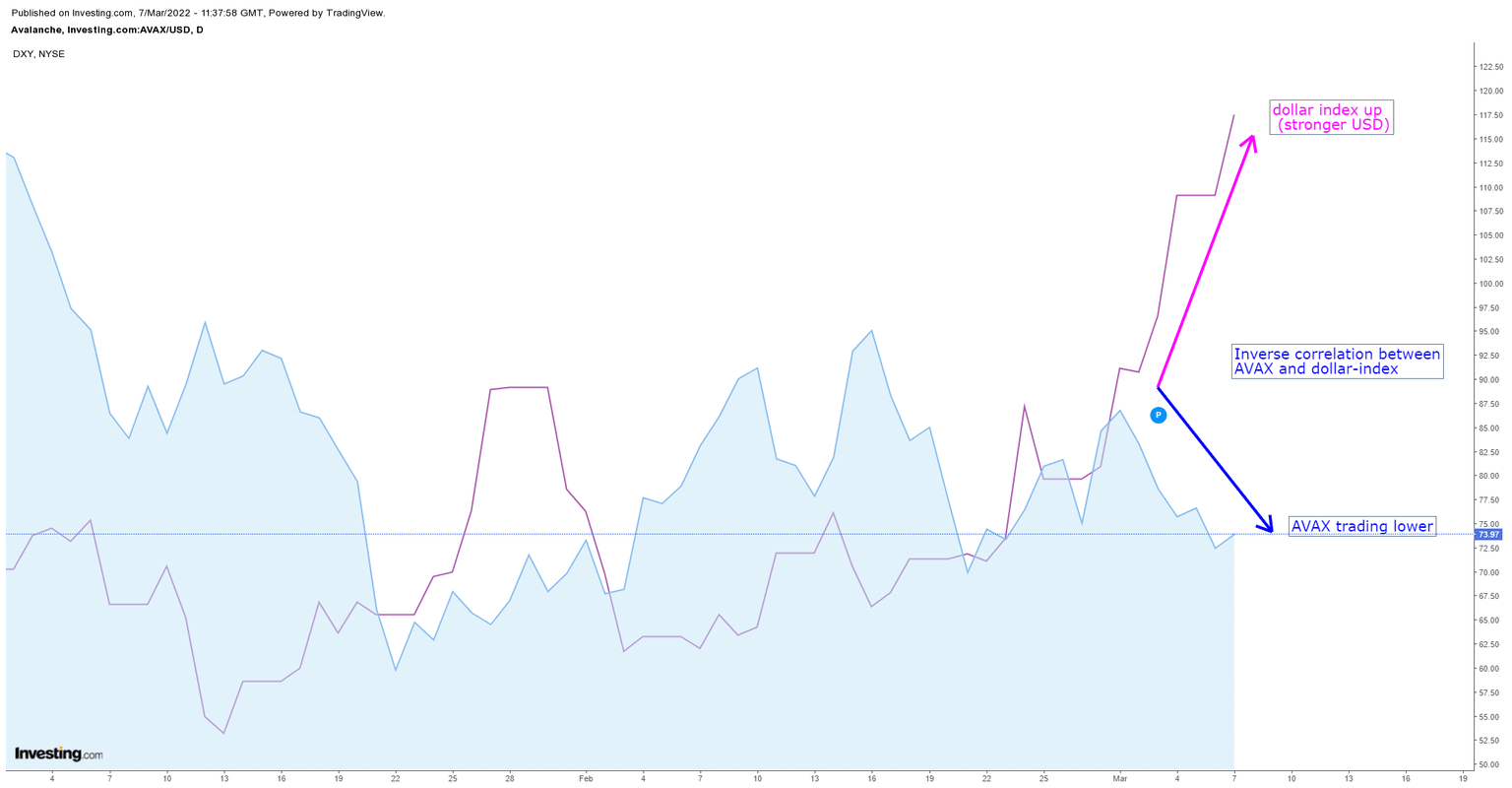

Greenback is no match for AVAX bulls and sets the stage for a further pullback

Avalanche price action is under pressure after another weekend of losses, with the price dropping below $70 intermediary support at the open. Although AVAXis bouncing a bit at the moment, a very bearish signal is just ahead as the 55-day SMA is on the cusp of dropping below the 200-day SMA, triggering a massive inflow of bears that will look to short-sell AVAX across the board, possible resulting in price action being slashed by 36%. Add to that the dollar strength, and expect bulls to be outmatched each time by the weight of the dollar, overpowering investors that look to enter too soon so as to preposition for the relief rally.

AVAX/USD compared with DXY daily chart

Levels mean AVAX price action could range between $76 to the upside and $70 to the downside. Expect with the dollar on the front foot, more dollar strength to be poured into the AVAX/USD cross and see AVAX dip towards either the monthly S1 at $66.47 or $61.62, a pivotal historical level. Should there be more dollar strength with EUR/USD going to 1.05 or even parity, expect AVAX price to dip towards $46, breaking below $50.

AVAX/USD daily chart

In the event of some relief headlines AVAX price could shift in direction, squeezing some short-term bears out of their positions and triggering a pullback to $81. The 200-day SMA and the 55-day SMA are in the way, so expect some early profit-taking when price hits those two, before reaching the actual $81-marker. Following that, the rally will probably have slowed down to such an extent that a break of the longer-term red descending trend line looks highly unlikely.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.