Avalance at risk of returning to $57, AVAX could print new 2022 lows

- AVAX price weakens and drops below key Ichimoku levels.

- An extreme bearish entry signal may entice short-sellers to push Avalanche lower over the weekend.

- Upside potential is limited, while downside risks are substantial.

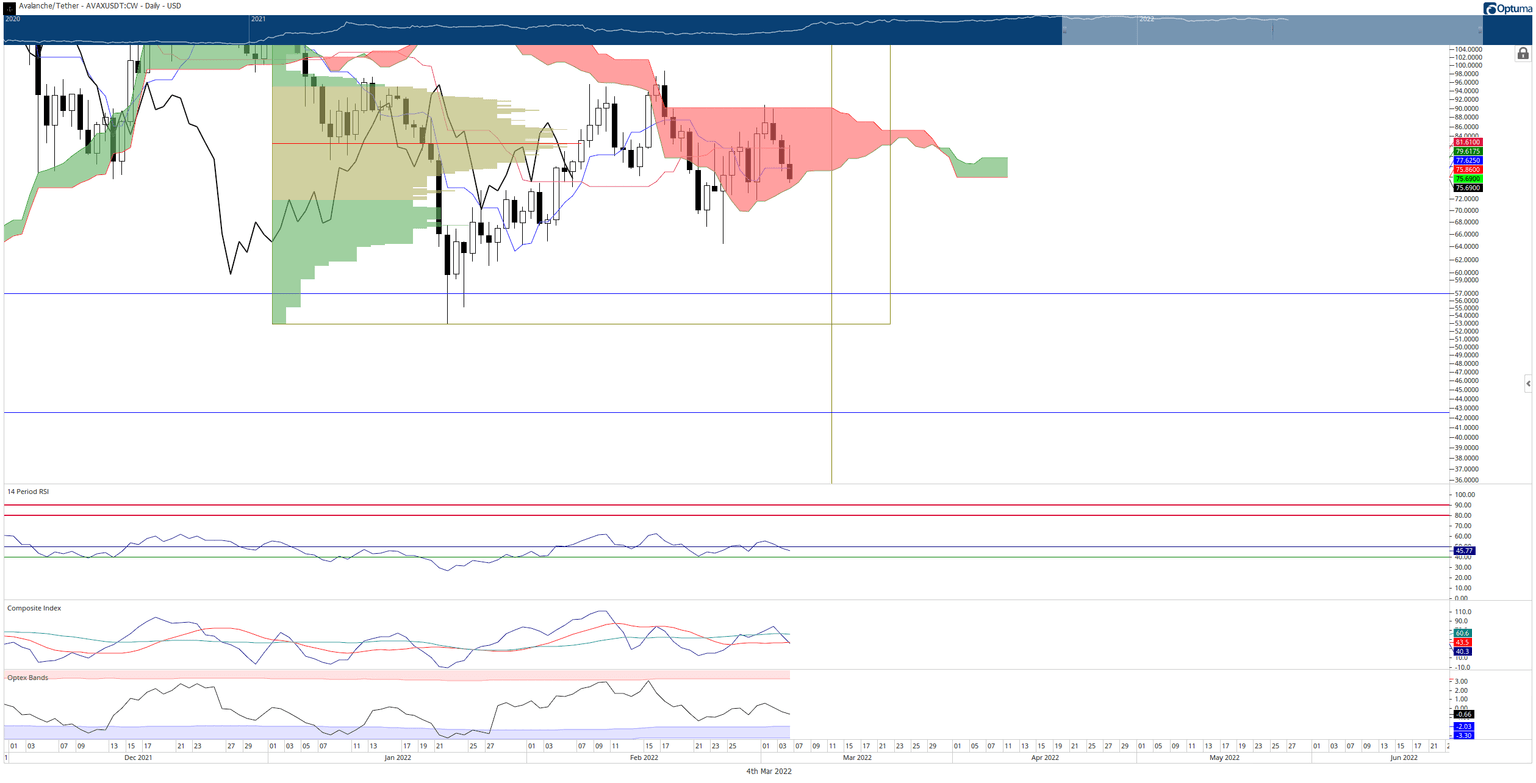

AVAX price remains stuck inside the Ichimoku Cloud, a condition it has been in since February 24, 2022. Market participants initially anticipated a strong drive up and above the Cloud after Monday’s bullish price action, but rejection against the top of the Ichimoku Cloud (Senkou Span B) has resulted in more moves south.

AVAX price could trigger a strong short signal that could drop Avalance nearly 30%

AVAX price action this week can be summed up with one word: whipsawed. Whipsaws are common types of price action when an instrument is inside the Ichimoku Cloud. The Cloud represents uncertainty, volatility, and indecision. It’s where trading accounts go to die.

As volatile as the Cloud is, it is also the zone that prices tend to wallow before initiating a bullish or bearish breakout. AVAX almost achieved an Ideal Bullish Breakout on Tuesday if the daily would have closed at $91.50. However, sellers came in and pushed AVAX lower.

AVAX/USDT Daily Ichimoku Kinko Hyo Chart

Selling pressure pushed AVAX price below two more support levels: the Tenkan-Sen and Kijun-Sen. However, neither level appeared to produce any support as prices moved lower. Now, the final support level is the bottom of the Ichimoku Cloud (Senkou Span A) at $74.

If AVAX price closes below the Ichimoku Cloud on Saturday or Sunday, at or below $74, then an Ideal Bearish Ichimoku Breakout entry would be confirmed, and bears would most certainly take control and push AVAX price to the 38.2% Fibonacci retracement at $57.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.