Avalanche price bears low-hanging fruit as a 10% gain lies just around the corner

- Avalanche price has broken the bears’ force as descending trend line breaks.

- AVAX is an outlier in the altcoins as no fade will be detected at the start of the trading week.

- Expect to see a near 10% gain as a minimum on the upside as a big technical level is due for a test this week.

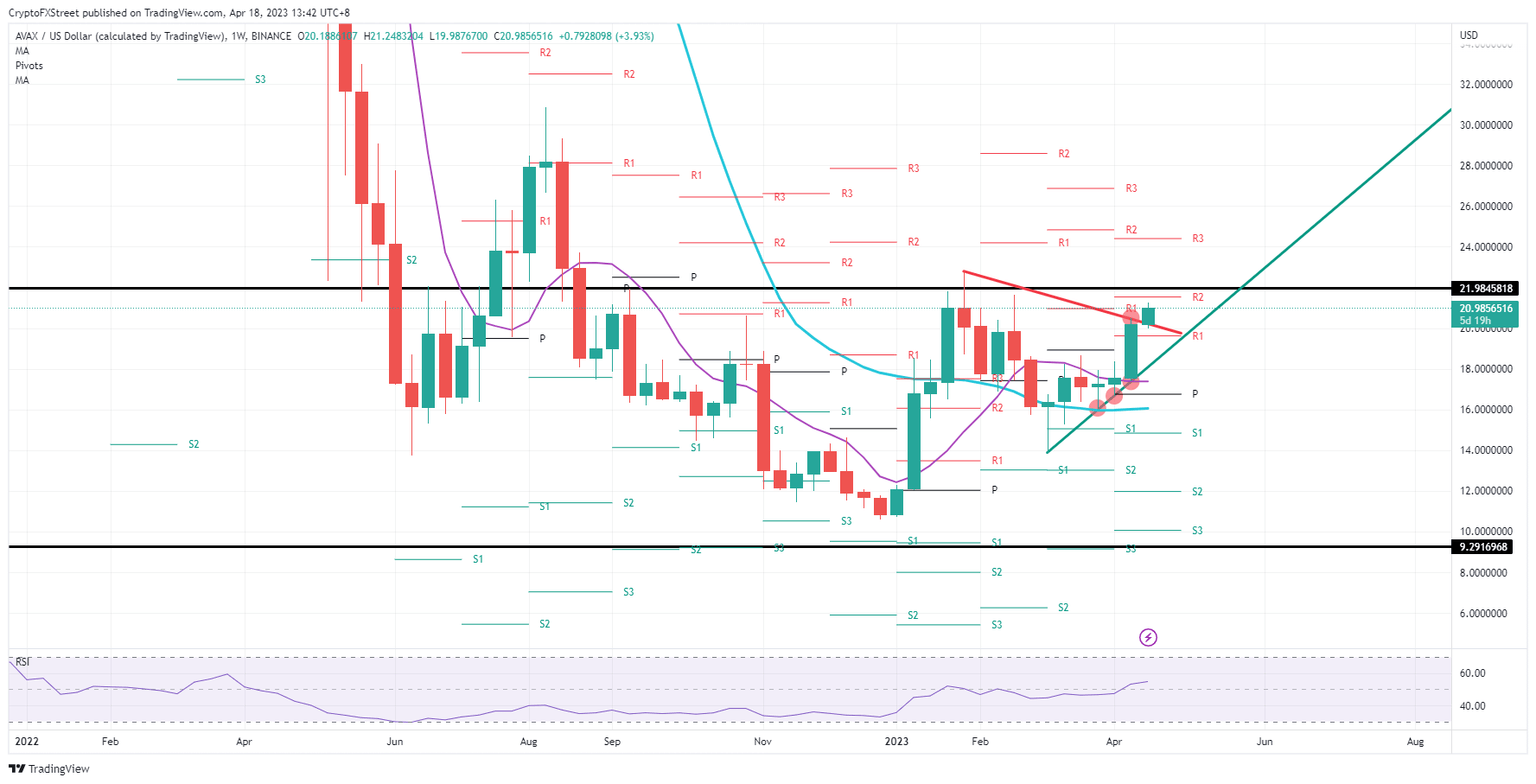

Avalanche (AVAX) price is gearing up for bulls to hand them a simple but profitable trade. After the break above the red descending trend line on Monday, this week is shaping up for another bullish candle, making it the fourth in a row. Conscious bulls want to trade the 10% gain projected and not go shooting from the start just yet. Otherwise, the rally could get overheated and stall quickly.

Avalanche trading 10% higher is still a very solid gain

Avalanche price has bulls gearing up for a fifth weekly green candle as they are disregarding the overall fade that was ongoing on Monday in several altcoins. Instead, AVAX bulls went through the import level and broke the red descending trend line. The road is paved now for more upside and could bear some low-hanging fruit in the process toward $22.

AVAX price sees bulls not having many hurdles in the way as only the monthly R2 is there near $21.50. Overall, that level is not holding much historical relevance, and the Relative Strength Index (RSI) still has room to go higher. Expect to see bulls advancing this week toward $22 and sit on a wait-and-see pattern before advancing higher, as overall sentiment and other altcoins need to rally to create that perfect tailwind for a lift higher.

AVAX/USD Weekly chart

Risk to the downside hangs by the element that this winning streak could come to an end as the price cap at $22 has been triggering quite a few rejections and false breaks. Another false break would send bulls back below $20. The worst scenario would be a break below the red descending trend line and have bears eating away at the green ascending trend line for a full swing lower toward $14 if bulls completely lose control and a massive tranche of headwinds emerge on the scene.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.