Aptos price sets the trap for bulls with $53 million APT token unlock

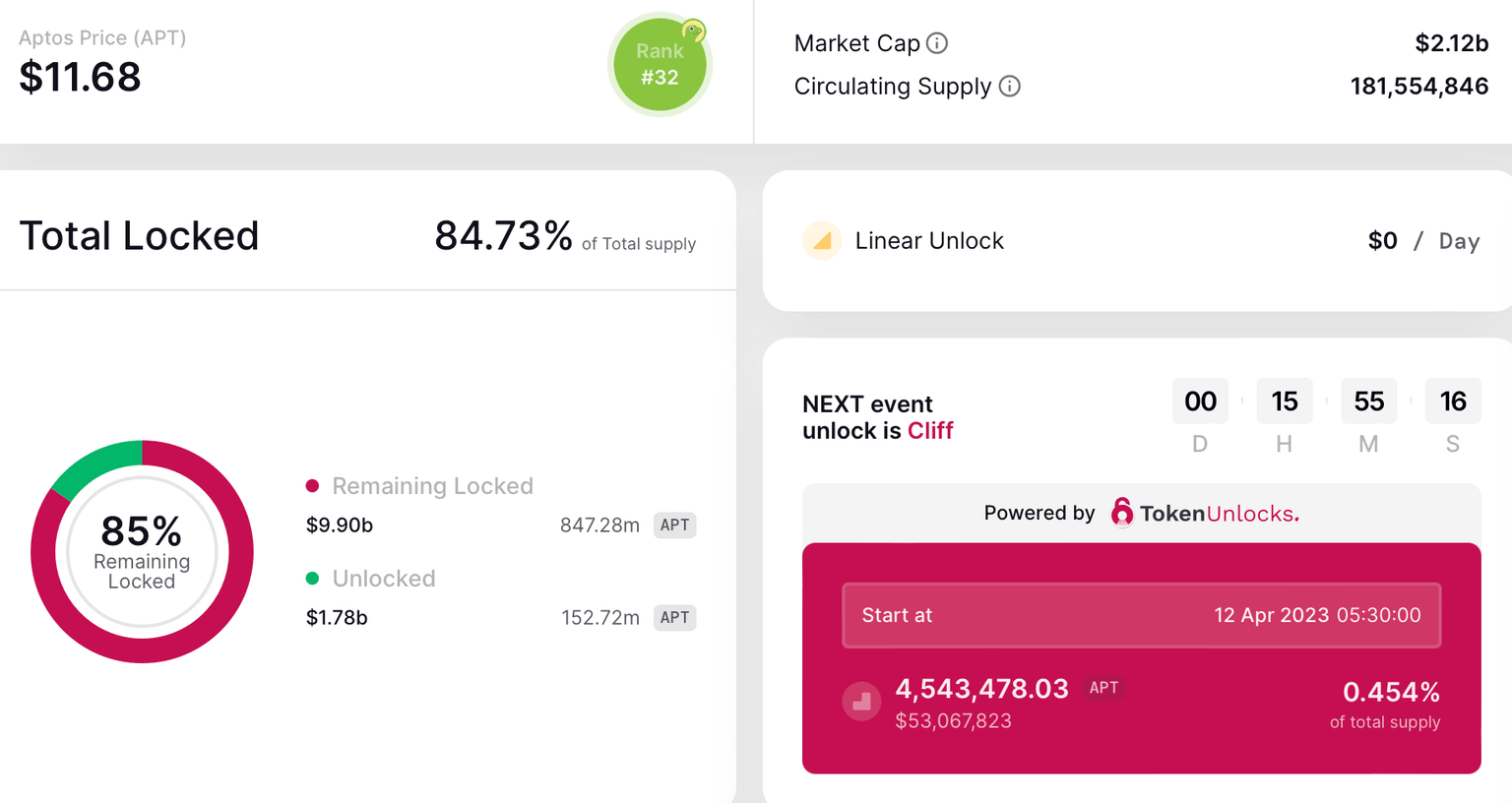

- Aptos holders gear up for 4.5 million APT token unlock scheduled on Wednesday.

- APT holders are likely front-running the event and it could turn out to be a sell-the-news for the asset following 7% gains overnight.

- The token unlock will introduce APT tokens upward of $53 million to the circulating supply of the asset.

Aptos, a web3 blockchain yielded 7% gains for holders overnight. APT holders are likely preparing for the unlock of $53 million worth of the token on Wednesday. The APT token unlock could increase selling pressure and the ongoing price rally implies holders are front-running the event.

Also read: Ethereum holders brace for selling pressure on Ethereum after run up to $1,900

Aptos token unlock slated to occur on Wednesday

Aptos holders brace for impact ahead of 4,543,478 APT token unlock worth upwards of $53 million. The unlock is scheduled for Wednesday, April 12. A token unlock is typically a bearish event for the asset.

APT price yielded nearly 7% overnight gains for holders, ahead of the scheduled token unlock. This makes it likely that APT has “set a trap” for bulls and the unlock of nearly 0.45% of the total supply of the web3 token might increase the selling pressure and result in a correction.

APT holders can therefore expect a correction in Aptos price post the token unlock and the current rally is likely traders front-running the event.

APT scheduled token unlock

The unlocked APT tokens will be distributed to the community and the foundation. The community will receive 3,210,145 APT tokens, nearly 0.32% of the total supply and the foundation will receive 1,333,333 APT, 0.13%.

Where is APT price headed

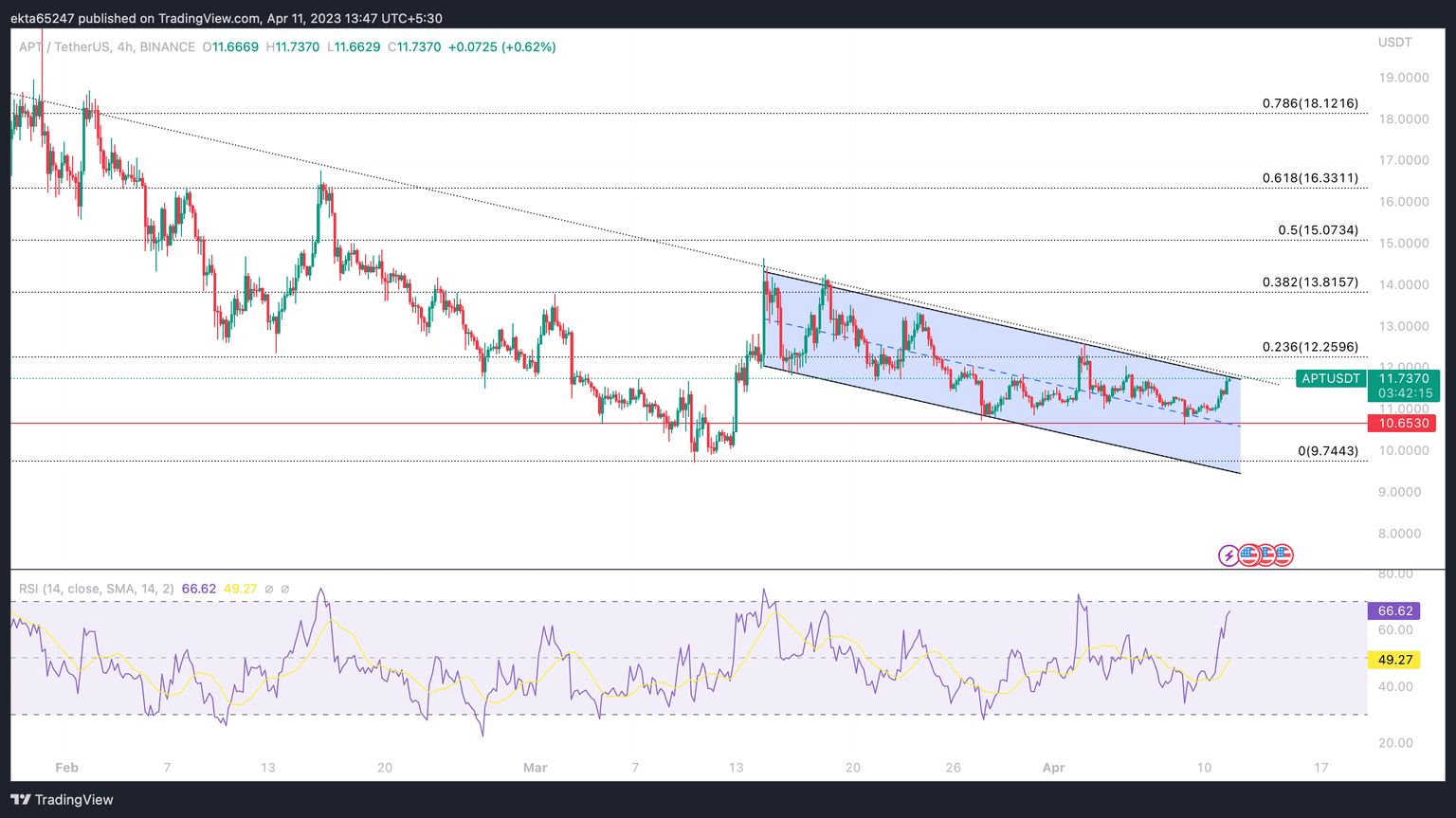

APT price is in a multi-month downtrend and in descending parallel channel as noted in the APT/USDT four-hour price chart below. The descending channel pattern is considered bullish only when price penetrates the upper trendline.

APT price is therefore at a critical point, testing the upper trendline of the channel at $11.73 as resistance.

APT/USDT 4h price chart

If APT continues its climb, the next resistance is at 23.6% Fibonacci Retracement at $12.25. However, with the upcoming token unlock, selling pressure is expected to increase and APT price could nosedive to support at $10.63. The $10.63 level has acted as support for Aptos, barring mid-March when APT witnessed a correction below this level.

The Relative Strength Index (RSI), a momentum indicator reveals a bullish divergence on the four-hour price chart, but is likely that the divergence has played out and the token unlock negatively influences APT price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.