Chainlink price likely to rebound as whales accumulate LINK in the millions

- Chainlink whales holding between 100,000 to 10 million LINK tokens, accumulating the altcoin during the recent dip in its price.

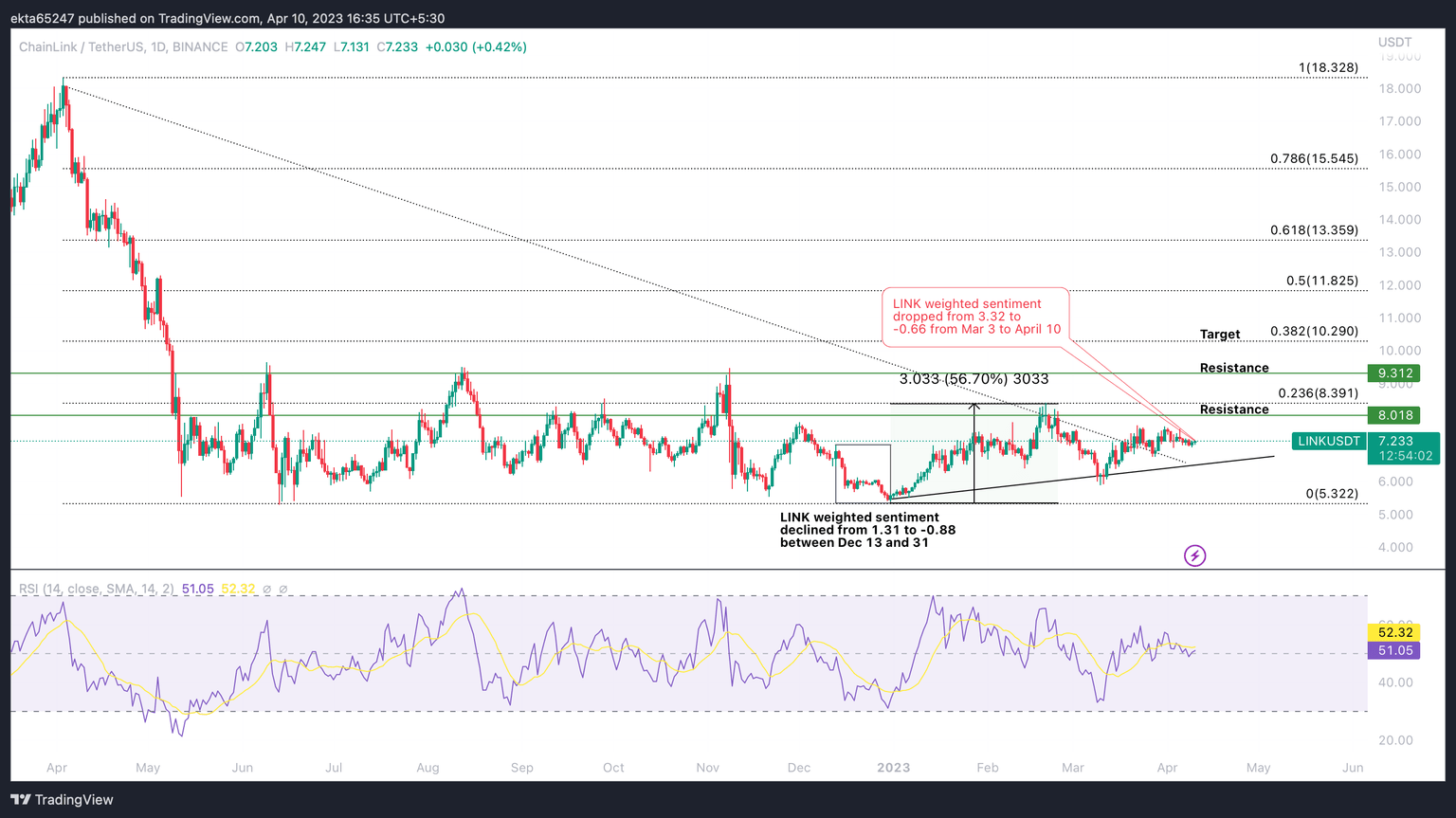

- Crypto market participants have a bearish sentiment on LINK, based on data from Santiment.

- Whales are likely to take a bullish stance on LINK and push the altcoin’s price higher despite negative weighted sentiment, as seen in December 2022.

-637336005550289133_XtraLarge.jpg)

Chainlink, a decentralized oracle network, is likely to witness a rebound in its price. While the weighted sentiment, an indicator that takes into account social volume across platforms, signals a bearish sentiment, LINK whales are accumulating the token.

A similar setup was observed in December 2022 where LINK price started a rally.

Also read: Ethereum Shapella upgrade set to go live in 48 hours, what this means for ETH holders

Chainlink whales accumulate millions of LINK tokens

Large wallet investors in Chainlink started accumulating large volumes of LINK tokens despite the recent decline in the weighted sentiment. Accumulation by whales is considered a bullish sign.

Based on data from crypto intelligence tracker Santiment, whales holding between 100,000 to 1,000,000 LINK and 1 million to 10 million Chainlink tokens engaged in accumulation since the first week of March.

%2520%5B16.39.15%2C%252010%2520Apr%2C%25202023%5D-638167228891908559.png&w=1536&q=95)

LINK accumulation by whales

Chainlink price nosedived in the first two weeks of March, and whales continued “buying the dip” increasing their LINK holdings consistently.

Investors turn bearish on LINK, is this the time for a contrarian stance?

Weighted sentiment is a metric that calculates the average sentiment among LINK holders across various social media platforms. The metric is used to gauge the sentiment of the community towards the asset.

The metric nosedived from 3.32 on March 3 to -0.62 on April 9. The drop is indicative of increasing bearish sentiment among LINK holders and the community on social media platforms.

%2520%5B16.48.23%2C%252010%2520Apr%2C%25202023%5D-638167229254595786.png&w=1536&q=95)

LINK weighted sentiment v. price

This decline in the weighted sentiment is similar to December 2022 when sentiment dropped from 1.31 to -0.78 within a month. Post the decline in sentiment in December, LINK price witnessed a massive rally.

Typically, when a large percentage of the community is bearish, whales are known to take a contrarian or bullish stance. This is one of the times when the sentiment is largely negative and whales are accumulating the altcoin, indicating that a recovery rally is likely in LINK.

What to expect from LINK price?

As seen in the LINK/USDT one-day price chart below, the token recently broke out of its multi-month downtrend. Weighted sentiment among holders went from positive to negative in the last two weeks of December 2022 preceding the 56.7% rally in LINK price to the 23.6% Fibonacci Retracement level of $8.39.

LINK is in a short-term uptrend and weighted sentiment has turned bearish yet again. In a similar fashion as December, this can be considered as a precursor of a price rally in LINK.

The Relative Strength Index, a momentum indicator reveals a slight bearish divergence in LINK. It is likely that the divergence has played out with LINK price dropping to $7.23.

LINK/USDT 1D price chart

LINK price is likely to find support on the trendline, above $6.5 in the event of a decline. If whales are successful in pushing Chainlink higher, there are two resistances at $8.01 and $9.31, levels that acted as resistance in LINK’s price chart in mid-2022. The bullish target is a modest 38.2% Fibonacci Retracement at $10.29.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.