Ethereum holders de-risk as ETH price rallies to $1,900 ahead of Shapella upgrade

- Ethereum network’s major upgrade Shapella is slated to occur on Wednesday as the altcoin makes strides towards its $2,000 target.

- Analysts speculate likely issues surrounding the upgrade, including challenges faced by nodes returning user funds.

- Ethereum whales are accumulating Liquid Staking tokens like LDO ahead of the upgrade, likely front-running the upgrade.

Ethereum (ETH) blockchain’s Shapella upgrade is on track and set to go live on Wednesday, April 12. ETH price tackled resistance at the $1,900 level, eyeing the $2,000 bullish target.

Bloomberg analysts evaluated the likely issues surrounding the issuance of user funds by nodes on the Ethereum network.

Also read: Ethereum Shapella upgrade set to go live in 48 hours, what this means for ETH holders

Ethereum price inches closer to $2,000

Ethereum price crossed key resistance at the $1,900 level despite the rising uncertainty of token unlock. ETH hit a 24-hour high of $1,936 before its recent pullback. Analysts evaluated the Ethereum price chart and noted there is virtually no resistance between the $2,000 and $2,500 levels.

@CryptoJelleNL, a technical expert, predicts a run up to $2,500 once Ethereum price crosses the resistance at $2,000.

ETH/USDT price chart

$1,821 and $1,882 are two key levels for Ethereum’s uptrend. In the event of a correction, ETH price could be nosedive to these two levels. A sustained break above the $1,944 level could send the altcoin to its $2,000 target, according to crypto analyst Justin Bennett. The $1,944 level has acted as key resistance for the altcoin.

Analysts at Bloomberg believe Ethereum is likely to face selling pressure with the token unlock. Experts identified the challenges that nodes in the network are likely to face in returning user funds post ETH unlock.

Ethereum at risk of “turbulence”

Token unlock is available for stakers of the ETH2 deposit contract for the first time since 2020. This makes it a key event for the altcoin, in the Shapella upgrade. What’s more, Ethereum holders need to brace for “turbulence” from technical challenges faced by nodes and validators participating in token unlock.

The Shapella upgrade was tested smoothly on the Goerli testnet, however it remains to be seen how the roll-out on the Ethereum mainnet turns out. There is a risk of nodes facing challenges that take time to resolve, adding to the uncertainty surrounding the upgrade.

Ethereum network’s large wallet investors have continued accumulation of Liquid Staking tokens ahead of the upgrade.

Ethereum holders de-risk ahead of Shapella upgrade

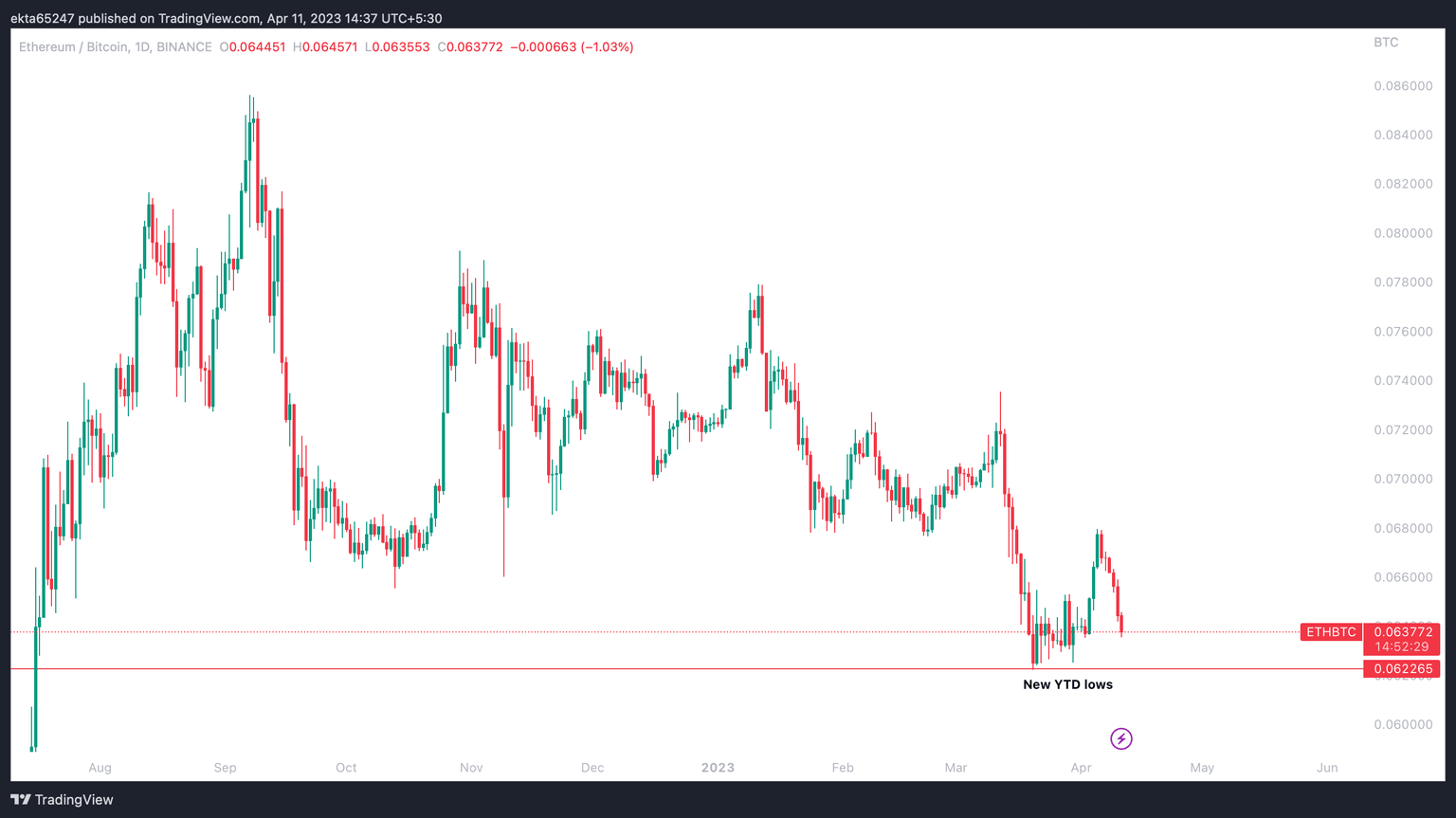

The ETH/BTC ratio implies that holders have de-risked ahead of the Shapella upgrade. ETH/BTC recently hit new Year-to-Date (YTD) lows post the upgrade’s successful deployment on the Goerli testnet. It is therefore likely that Ethereum’s community of holders have priced in the expectation of a negative impact on ETH from token unlock.

ETH/BTC 1D price chart

Why Ethereum whales are scooping up LDO

The Liquid Staking tokens narrative gained relevance with Ethereum whales scooping up tokens like Lido Finance’s LDO. This implies large wallet investors are likely front-running the upgrade and scooping up tokens of Liquid Staking protocols in anticipation of a rally, ahead of Shapella.

1/ The #Ethereum #Shanghai upgrade is coming, are whales/SmartMoneys buying or selling #LSD tokens?

— Lookonchain (@lookonchain) April 10, 2023

We analyzed the tokens of the 3 protocols with the most TVL.$LDO $RPL $FXS pic.twitter.com/cm5TwXj0zc

The behavior of Ethereum whales is a bullish sign for the asset in the short-term.

Liquid Staking Derivates v. DeFi: Ethereum rat race

Post the successful completion of the Shapella Upgrade, ETH tokens that are subsequently unlocked from the Beacon Chain will enter circulation. At this point, the ETH community and holders are likely to give topmost priority to security when deciding between liquid staking platforms available on the market. Following security, rewards and the ease of staking/ unstaking may take center stage when ETH holders determine where to stake their holdings.

While Liquid Staking Derivatives tokens and DeFi protocol tokens compete for the Ethereum tokens that are being unlocked, it remains to be seen whether the upgrade is priced in or there is room for further price rally in tokens like LDO.

Chen Zhuling, Founder and CEO of RockX, a blockchain node network was quoted as saying:

At this stage, it's difficult for anyone to say whether liquid staking tokens have priced-in the Shapella Upgrade. However, seeing as major platforms have been performing consistently across the board, it's reasonable to assume that they will continue to do so barring any big industry developments. For instance, across 2023 thus far, the top LSD tokens have posted up to 150% in gains compared to Ethereum's near-65%.

The community sees promise in liquid staking and it emerged as the second-largest crypto sector with over $14.1 billion in total value locked, signaling its relevance in the crypto ecosystem.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.