ApeCoin price action is perfect proof that bulls are just incompetent vs bears

- ApeCoin price is nearly down 3% in just two trading days.

- APE price action is the result of bulls being blind to technical resistances.

- The bears are back in the driving seat, and things could get ugly this time.

Apecoin (APE) price action is a harsh lesson in technical analysis. As a writer, and certainly, the people that track my articles will know by now that I regularly underline the importance of having a game plan, a good risk-reward ratio and being aware of the levels and possible outcomes before even considering entering a trade. Not even starting to talk about the current dynamics and geopolitical forces in the current markets, the price action in ApeCoin today is a clear picture of naive bulls that thought that simply going long from a pivot level would lead to an extended rally.

APE price sees bulls learning the hard way

ApeCoin price action this week is at it again, as it has been for most of 2022: to the downside. If there were one trade to take on this year, it would be to short everything and rake in the piles of money by the end of the year. It is even more of a pity to see how bulls are trying to get a strong rally started but are getting their legs cut off each time at the first technical resistance level they face.

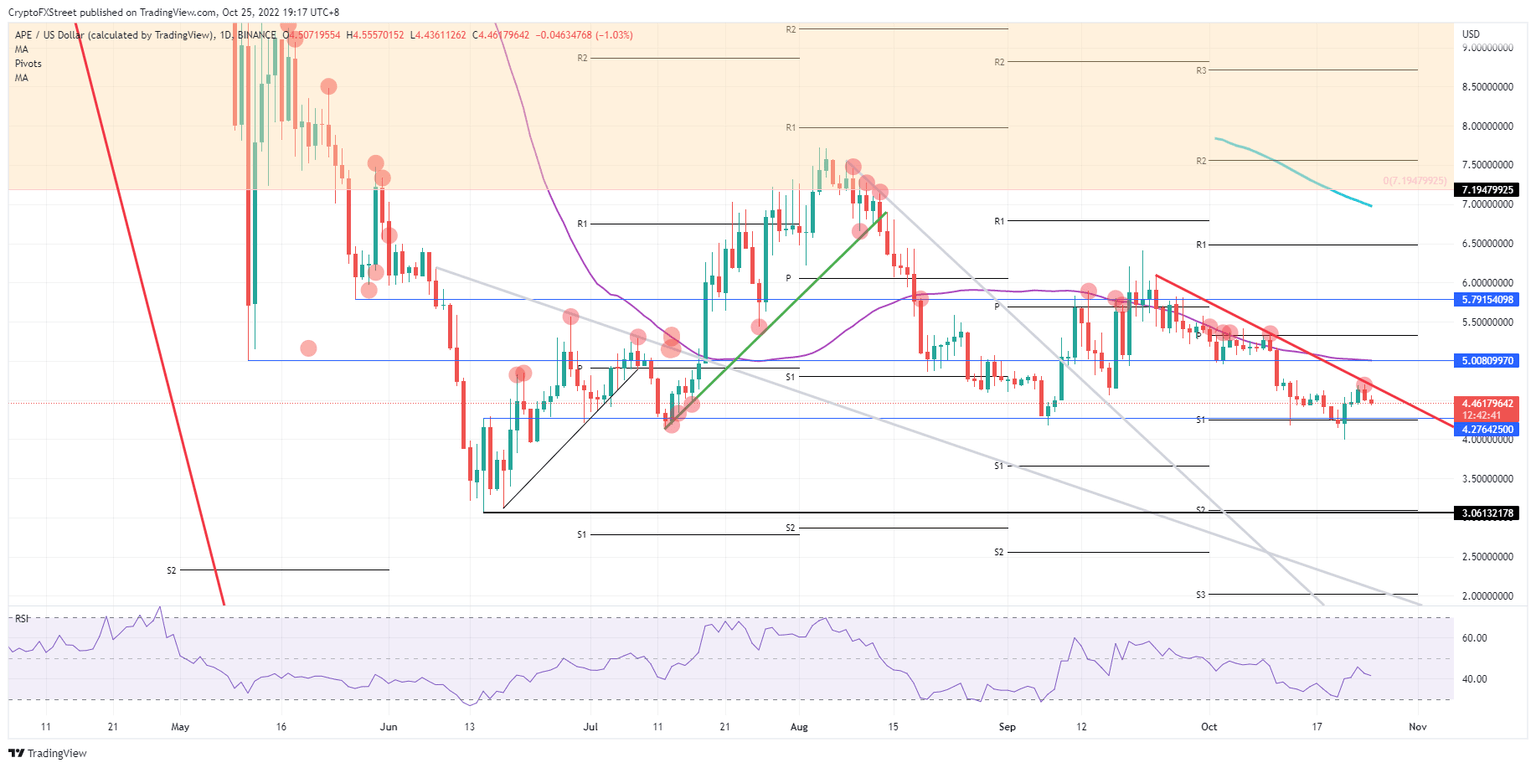

APE price action has thus seen bulls ignorantly handing the keys over to the bears. They will push price action down to $4.27 and test the S1 support level for its support. Seeing it has already been broken in the past, expect a drop rather lower towards $4 before trying to reach $3 to the downside.

APE/USD Daily chart

As the weeks pass, the end of the year is approaching, and with that, the Fed could come to the end of its hiking cycle. That means that once the Fed confirms that it is done or will slow down hiking, markets will rally firmly on the back expectations of a weaker US dollar. In such a scenario, expect a firm jump in cryptocurrencies with APE price action first breaking above $5 and through the 55-day Simple Moving Average, with $5.79 then in focus to the upside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.