ApeCoin price back in the buy zone but are all investors on board?

- ApeCoin price is preparing for a bullish trend reversal following extremely oversold conditions.

- Whales are holding ApeCoin price from breaking out of a falling parallel channel.

- ApeCoin may have bottomed out after reaffirming support slightly above $4.00.

ApeCoin price gradually recovers after brushing shoulders with outwardly strong support marginally above $4.00. APE is retesting this key buyer congestion zone for the second time in less than two months. However, investors – especially whales, do not seem convinced an ApeCoin price recovery will hold for a move to $4.35..

ApeCoin price downtrend grinds to a halt

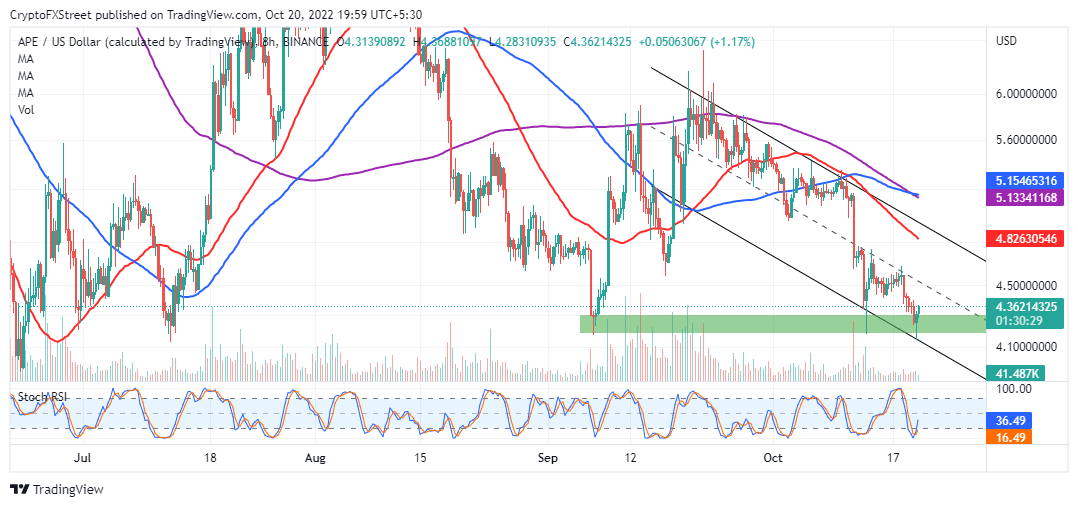

ApeCoin price could flip its technical outlook green if it successfully breaks out of a falling parallel channel. Since APE’s rejection from its October peak around $6.00, the pattern has capped price movement both to the upside and downside.

The channel’s lower boundary reinforced the support mentioned above at $4.00, allowing ApeCoin price a hiatus from the overarching selling pressure. Two successive bullish candlesticks have been printed on the eight-hour chart, hinting at the bulls regaining control.

APE/USD eight-hour chart

The Stochastic RSI reveals that ApeCoin price has been trading in oversold conditions, but it has recently risen out of the oversold region providing a buy signal. This supports the bullish thesis that APE may rebound from $4.00 to $4.35.

The MVRV (market value realized value), an on-chain metric from Santiment, places APE in a buy zone. ApeCoin price is relatively undervalued, with the MVRV ratio sliding to -14.48%. This suggests APE price may rise as asset prices generally have a tendency to revert to fair value over time..

ApeCoin MVRV model

What could invalidate ApeCoin price recovery?

Before ApeCoin price rises any further bulls must prove their ability to rise above the dominant sell-off from its September highs. Breaking out of the falling channel would be a necessary prerequisite to improving confidence in the foreshadowed move to $4.35.

ApeCoin Supply Distribution

Although ApeCoin price may have bottomed out after tapping support at $4.00, whales are not ready to let go of a six-month-long selling spree. The Supply Distribution on-chain metric shows addresses with 10,000 to 100,000 tokens continuing to fall – in line with the longer-term trend as it has fallen to 1,364 from 2,359 six months ago.

There is a risk, therefore, that the ongoing ApeCoin price rebound from its primary support at $4.00 may prematurely run out of momentum. Thus, the desired move to $4.35 may be delayed or price could force another bearish leg below $4.00.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B17.24.05%2C%252020%2520Oct%2C%25202022%5D-638018796019507273.png&w=1536&q=95)

%2520%5B18.44.05%2C%252020%2520Oct%2C%25202022%5D-638018796423551040.png&w=1536&q=95)