ApeCoin price is at the threshold, awaiting the return of whales

- ApeCoin price is back in the buy zone with support at $4.30 solidly in place.

- Selling spree continues, however, APE whales are skeptical of a bear market relief rally.

- Recovery will not come easy due to the robust seller congestion areas at $4.81 and $5.51.

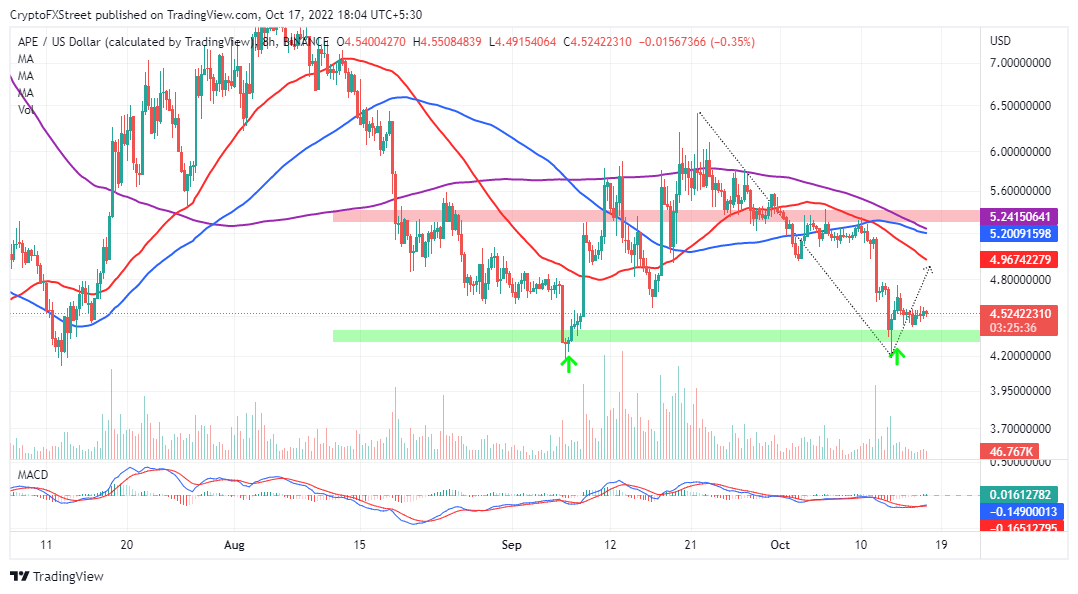

ApeCoin downtrend is slowing down after a sharp descent from highs around $5.20. Support at $4.30 has been tested twice in two months, with APE price likely to have bottomed. A consolidation period may take precedence early this week, but if investors emerge from the sidelines, ApeCoin price could make strong headway above $5.20.

ApeCoin price is back on the drawing board, but where to next?

Buyers immensely populated the area between $4.00 and $4.30 after marking the end of two other downtrends in June and September. With sellers already struggling to crack this support, it seems not inconceivable to conclude that odds are leaning on the bullish side.

The MACD (Moving Average Convergence Divergence) dons a bullish outlook based on the eight-hour chart. Traders will start to validate the possibility of a bullish trend reversal as the 12-day EMA (Exponential Moving Average), blue crosses above the 26-day EMA, red. Furthermore, ApeCoin price will gain significant momentum to the upside if the MACD crosses above the mean line.

APE/USD eight-hour chart

ApeCoin fundamentals send mixed signals

ApeCoin is back in the buy zone, as highlighted by on-chain data from Santiment’s MVRV (Market Value Realized Value). Following the recovery in September, the MVRV ratio crossed above the mean line but topped at 21.03%.

A sharp retracement occurred shortly after, with the ratio sliding to -9.92%. Investors tend to sell as the MVRV’s reading lifts above the mean line, which implies an overvalued market. On the other hand, APE is considered undervalued as the ratio drops into the negative region.

As such, a northbound move could gain momentum as APE price consolidates between $4.00 and $4.30. Perhaps investors are hoping to see a sustained uptrend before going all-in, keeping in mind the market is still technically bearish bear market run isn’t over yet.

ApeCoin MVRV ratio

A group of investors holding between 100,000 and 1 million APE tokens may be behind the stubborn downtrend. On-chain data shows that addresses in this cohort hold 3.36% of the network’s total supply, down from 4.1% in June.

ApeCoin Supply Distribution

Overhead pressure will keep mounting on APE price if the selling spree continues. Price recovery will also be a pipe dream, leaving ApeCoin with no option but to search for a floor price further downhill.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B15.34.35%2C%2017%20Oct%2C%202022%5D-638016114902803400.png&w=1536&q=95)

%20%5B15.34.30%2C%2017%20Oct%2C%202022%5D-638016115582763126.png&w=1536&q=95)