Cryptocurrencies Price Prediction: Ripple, Polygon and Apecoin – European Wrap 12 October

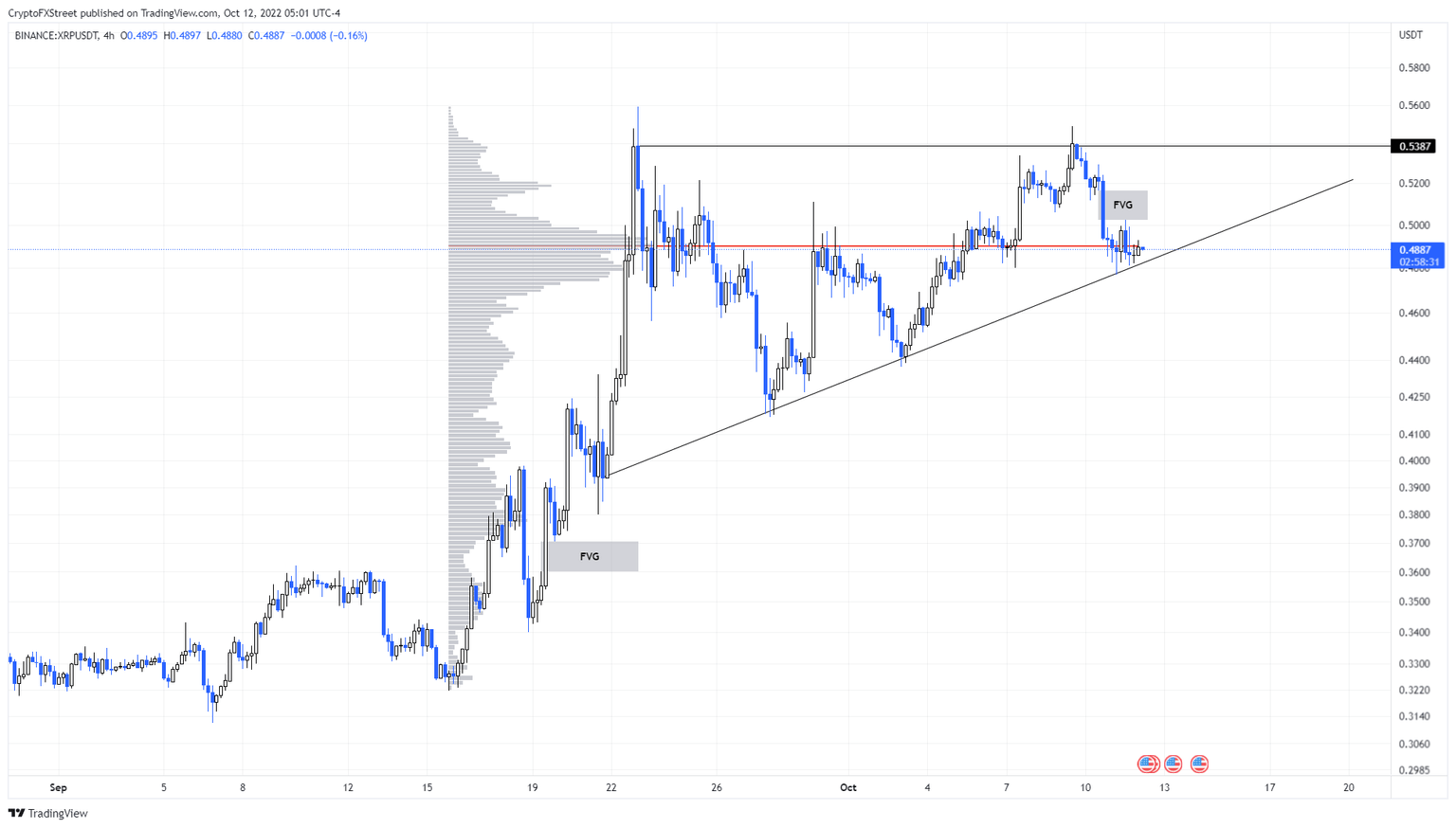

Ripple Price Prediction: XRP at a critical juncture, could trigger a 10% crash

XRP price has shown tremendous strength over the last few weeks, which has resulted in amazing rallies. However, things are at an inflection point that could trigger a correction if bulls fail to step up at this important level.

MATIC price shatters significant support, hinting at a 25% nosedive

MATIC price clearly shows bullish exhaustion and takeover from the holders booking profit. This development indicates that Polygon is likely to continue sliding lower if it does not overcome the selling pressure and reconquer old support levels.

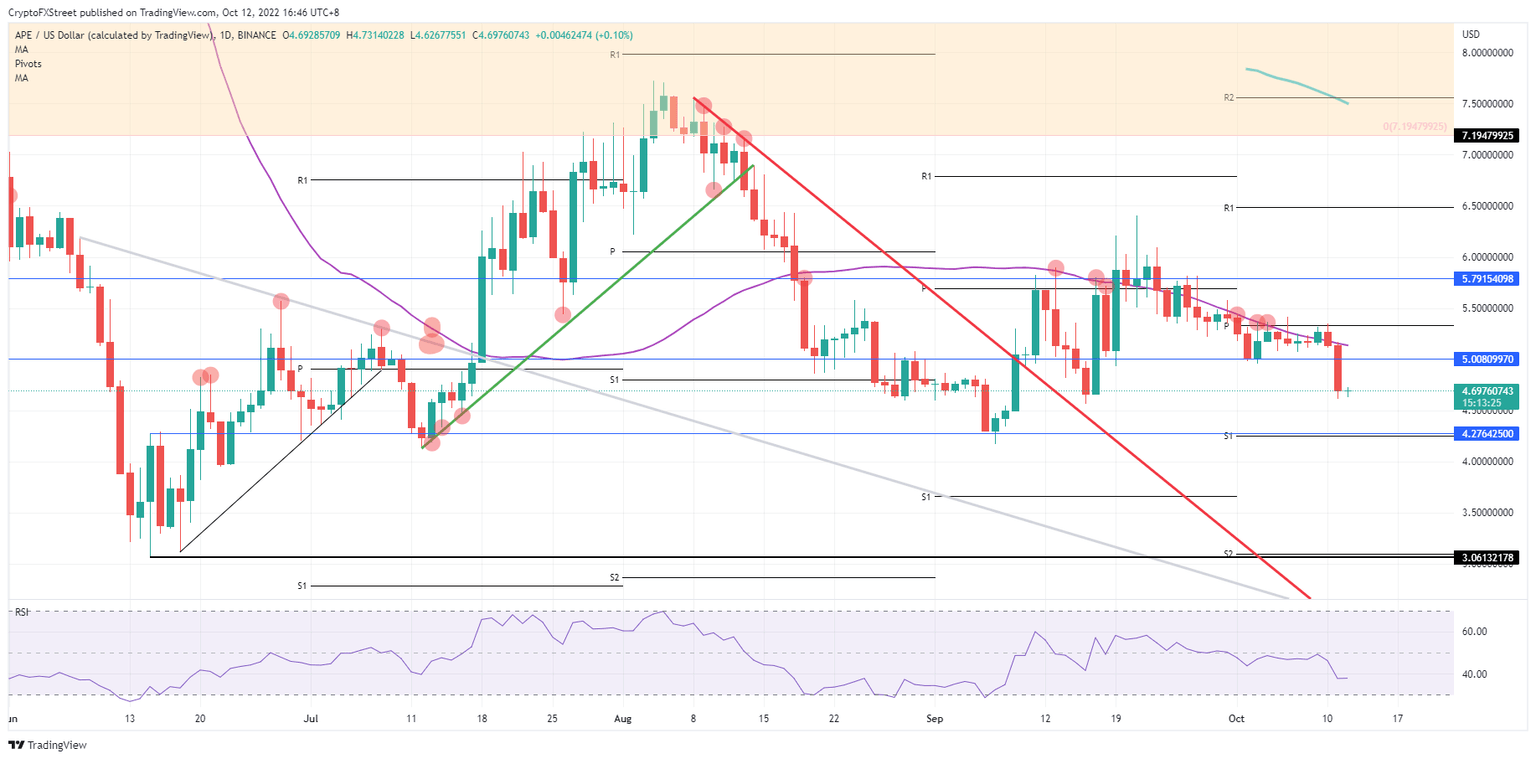

Apecoin price recovers after +11% meltdown, although recovery looks doubtful

Apecoin (APE) price action tanks massively this week as bulls get sucker-punched and slaughtered as APE price dips toward $4.60. The move to the downside came after a firm rejection on the monthly pivot and triggered a false break above the 55-day Simple Moving Average (SMA), making a bull trap. With the squeeze, plenty of bulls will have been washed out of their trade, and a small recovery is due to happen today, but a full recovery by the end of this week is doubtful.

Author

FXStreet Team

FXStreet