Analysts believe Polygon entered new bull run that pushes MATIC price to $2.56

- Coinbase integrating Polygon network as Ethereum layer-2 scaling solution, likely to have a bullish impact on MATIC price.

- As retail and institutional interest in MATIC surges, the altcoin gears up for a price rally.

- 74% of wallet addresses holding MATIC are currently profitable, analysts set a price target at $2.56.

As transaction fees on Ethereum continue to rise, layer-two scaling solution Polygon(MATIC) has become increasingly relevant. MATIC’s relative social and market activity has increased since Coinbase’s integration announcement.

Polygon gears up for a price rally as institutional interest in MATIC rises

More exchanges and institutions are now turning to Ethereum scaling solutions to tackle the rising gas fees. The world’s second-largest exchange, Coinbase, recently announced the integration of MATIC as its layer-two solution. The exchange expects to level the playing field for retail traders by offering reduced fees and transaction times.

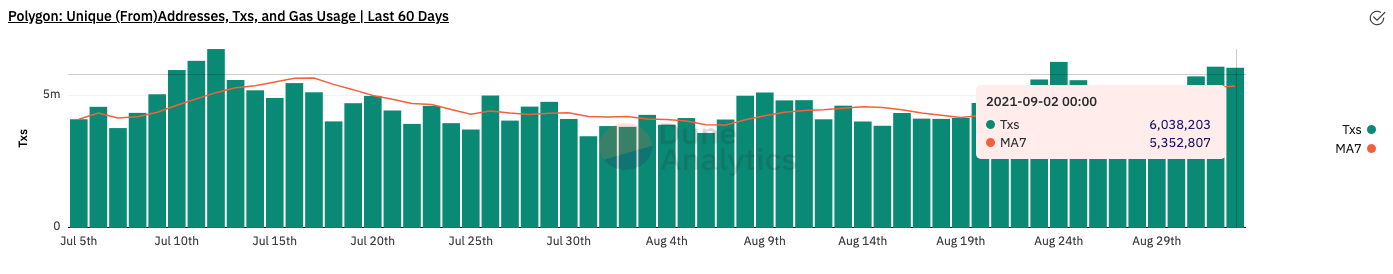

Traders expect to see a rise in transactions on the Polygon network following the integration by Coinbase. As of September 2, the number of daily transactions is 6 million, up 42% in the past 30 days based on data from Dune Analytics.

The increase in on-chain activity is indicative of the rising interest of institutional and retail traders.

Polygon: Transactions on the network

Alongside an increase in on-chain activity, the altcoin’s price has rallied consistently. MATIC is trading at the $1.44 level, posting nearly 40% gains within a month. Analysts expect the rally to be a prolonged one.

Based on IntoTheBlock data, 74% of wallet addresses holding Polygon’s MATIC are currently profitable. This implies that the altcoin has support at the price levels where these wallet addresses accumulated. Therefore, the likelihood of a price drop is relatively low.

The altcoin analyst behind the Twitter handle @AltcoinSherpa states that $1.70 is a level to watch out for.

$MATIC: To me this is still a higher low on the 4h; $1.70 remains the level to break. #MATIC pic.twitter.com/DaUAF7eCw1

— Altcoin Sherpa (@AltcoinSherpa) August 28, 2021

FXStreet analysts have predicted that Polygon has bottomed out and MATIC is showing a bullish pattern. The altcoin is primed for at least a 57% upswing, which sets the target at $2.56.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.