Analyst tips Solana ETF deadline for mid-March after new filings

Spot Solana exchange-traded funds (ETFs) should see a final decision deadline around the middle of March next year after the Chicago Board Options Exchange (CBOE) filed applications on Monday to list VanEck and 21Shares' proposed ETFs.

CBOE filed two Form 19b-4 applications on July 8, one for the 21Shares Core Solana ETF and another for the VanEck Solana Trust.

The CBOE likened the prospective Solana funds to spot Bitcoin and spot Ether ETFs, which the SEC approved in January and May, respectively. It said that Solana’s decentralization, throughput and speed made it resistant to manipulation that could harm investors.

“Much like Bitcoin and ETH, the Exchange believes that SOL is resistant to price manipulation and that ‘other means to prevent fraudulent and manipulative acts and practices’ exist to justify dispensing with the requisite surveillance sharing agreement,” read both filings.

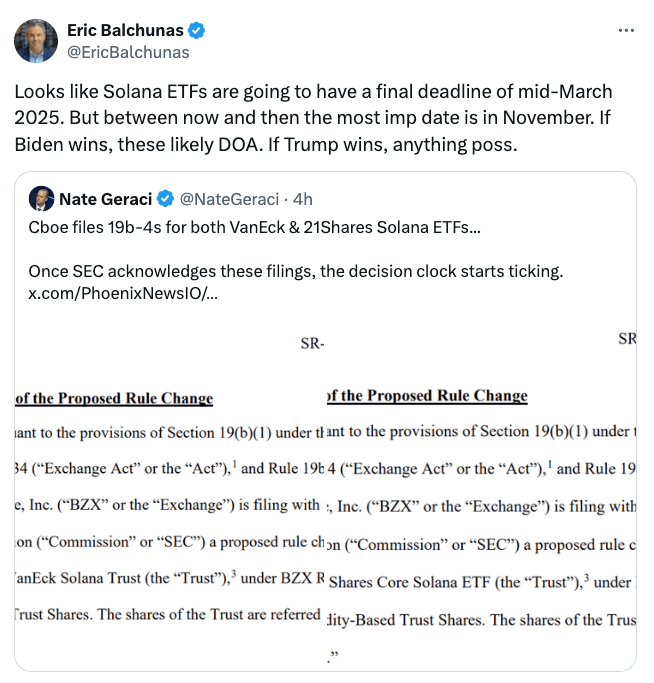

ETF analyst Nate Geraci said once the SEC acknowledges the filings, the “decision clock will start ticking.”

According to the SEC’s own rules, the agency will have 240 days to decide whether or not to approve the rule change necessary for CBOE to list the products from VanEck and 21Shares.

Solana ETF outcome hangs on Trump vs. Biden

Senior Bloomberg ETF analyst Eric Balchunas warns that the likelihood of Solana ETF approval from the SEC depends heavily on whether or not Trump is elected as U.S. President in November.

“Looks like Solana ETFs are going to have a final deadline of mid-March 2025. But between now and then the most [important] date is in November,” Balchunas wrote in a July 9 post to X.

Source: Eric Balchunas

Balchunas said that if Biden wins the election, the Solana ETFs will likely be “dead on arrival,” but if Trump wins, anything is possible.

In a June 27 research report, crypto market maker GSR Markets predicted the approval and subsequent launch of Solana exchange-traded funds (ETFs) in the United States could potentially drive up the price of SOL by a factor of nine.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.