Will coronavirus cost Trump the elections? His approval rating is already falling, market implications

- President Donald Trump has been criticized for his approach to coronavirus.

- The president's approval rating is eroding while disapproval is edging higher.

- Markets may react to Trump's falling chances of being reelected.

"The Democrats are politicizing the coronavirus... and this is their new hoax" – President Donald Trump while the disease was spreading. While the Commander in Chief has eventually stepped up his game – his recent guidelines are still to be judged – it is already taking its toll.

At the time of writing – with testing only initially being ramped up – there are over 5,000 US infections and 92 deaths. The 11-year bull market has come to an end with the worst sell-offs since 1987, and signs of financial distress are beginning to surface.

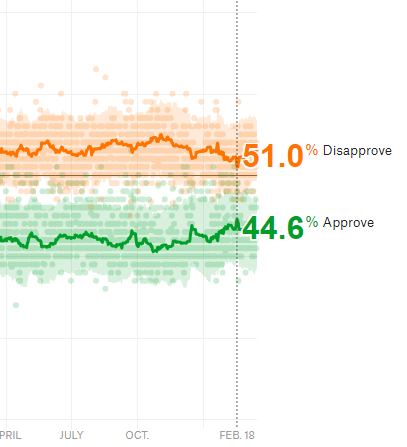

And now, it seems that Trump's approval rating is taking a hit. On February 18, the president's approval rating was 44.6% while disapproval stood at 51% – a gap of 6.4% and the lowest negative rating in nearly three years.

Source: FiveThirtyEight

After the coronavirus crisis intensified, voters are already less enthusiastic. As of March 17, approval has slipped to 42.8% and disapproval advanced to 52.9% – a 10.1% gap.

The gap has widened by 4.7% within a month.

Is it all related to coronavirus? Probably not. Looking at the broader picture, Trump's net disapproval is within familiar ranges and this could well be mean reversion.

Source: FiveThirtyEight

Nevertheless, it seems that Trump and his team have begun responding, partly in response to the pressure from Republican donors, according to CNBC. Moreover, the president's the more somber tone from March 16 onwards, and the idea of sending every American a cheque shows that something has changed.

Trump seems worried and probably for a good reason.

Potential market reaction

While these are early days, how could markets react if Trump's disapproval rating continues rising? Investors react well before the vote in November, and as opinion polls shape up.

Investors prefer a Republican president and are most enthused when the party has full control of the levers of power, as in the president's first two years in office. A unified government under the GOP may provide further tax cuts and looser regulation.

Here are four quick scenarios:

1) Trump landslide victory: In the unlikely case that the public aligns behind Trump despite the initial slow response and Republicans win both houses of Congress, markets may surge. That seems less likely now.

2) Trump wins, Democrats hold House: If the president remains on course to win but Democrats retain the House of Representatives, the focus will likely remain on the impact of the virus and the elections would only be of influence closer to the vote.

3) President Biden, Republicans retain Senate: In the chances that Trump loses – probably to former Vice President Joe Biden – rise, stocks may come under additional pressure. However, if Republicans hold onto the Senate, investors would be comforted.

4) Democratic wave: On the other extreme, Trump continues losing support and is on course not only to lose the White House but also to drag the party down with him. In this case, investors may fear stricter financial regulation under a unified Democrat-controlled government, and stocks could fall.

Conclusion

Trump's approval rating has dropped alongside the intensification of the coronavirus crisis and there is probably a significant correlation. If the trend continues, markets may respond.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.