USD/JPY Weekly Forecast: Weakening US statistics fail to dent the dollar

- Fed Chairman Jerome Powell affirms accommodative monetary policy.

- Dismal US Retail Sales, Jobless Claims have scant market impact.

- USD/JPY unchanged on the week, higher on the month.

- FXStreet Forecast Poll sees limited declines ahead for USD/JPY.

Twin specters of unemployment and a consumer recession in the United States were unable to dislodge the dollar from its recent gains and the USD/JPY ended the week at 103.85, just points from Monday's open at 103.89.

American data in the New Year has detailed the impact of the renewed business closures in California, the largest state economy, and modified restrictions in cities like New York which has again shuttered indoor restaurants.

Retail Sales for December fell in every category reflecting the worsening employment picture. Initial Jobless Claims jumped to 965,000 in the January 8 week (released January 14), the highest total in five months. National payrolls (released January 8) shed 140,000 jobs in December. It was the first decrease since the pandemic lockdown crash in March and April deleted 22.16 million employees.

Japanese economic information was anodyne with business sentiment declining for December while the view to the future was stable.

Prospects for a large economic stimulus package from the incoming Biden administration, including $1400 individual and family grants, are also providing a boost for the dollar. The stipend will help invigorate consumer spending.

In addition, a number of state and city leaders that had been in the forefront of advocating for business closures and social restrictions to control the pandemic have begun to change their minds, now saying that their economies must reopen because the damage is too costly.

The key support for the dollar has been the rise in US Treasury rates. The 10-year yield, which is the marker for many commercial rates, closed over 1% on January 6 for the first time since March and has not relented.

CNBC

Japanese deflation continues to be a restraint on incipient dollar strength.

Annual Japanese National CPI (ex-Fresh Food) in November was -0.9%, -0.7% October, -0.3% in September and -0.4% in August. From April this price measure has averaged -0.34%. That is the longest deflationary stretch from March to December 2016. The December CPI will be issued on January 21 and the forecast is -1.1%.

Even though the Bank of Japan's (BOJ) base rate is -0.1% and the fed funds mid-rate is 0.125%, the combination of US CPI inflation at 1.4% in December and Japanese deflation gives Japanese Government bonds (JGBs) a superior real yield.

Federal Reserve Chairman Jerome Powell repeated the central bank's commitment to low interest rates and an accommodative monetary policy in an interview at Princeton University on Thursday but that assertion is not new and just reiterates the latest forecast in December's Projection Materials, that has the fed funds rate unchanged through the end of 2023.

Technically, the aging down trend remains in control. Monday's close at 104.18 was the highest since December 10 and the high of 104.39 nearly reached the upper border of the channel. Tuesday's top at 104.33, as on Monday, was unable to breach the border, and the finish at 103.74 reflected the rejection. There is no technical case for a reversal which would require a firm base within the channel for a starting point. The gradual decline in the USD/JPY has been unabated for over six months with a series of new lows. Support levels below 103.00 stem from the second half of 2016 and offer scant basis for current trading.

USD/JPY outlook

The trading pattern contained by the extant down channel is unlikely to change without an alteration in the fundamental picture. The BOJ and the Japanese government are not happy with the rising yen. The BOJ issued its ritual warning about watching the currency markets, but there is little to be done. It seems the Japanese economy and the central bank have lost the capacity for surprise.

Developments in the US side of the USD/JPY will determine the direction of the pair. Until the accumulation of government action and interest rate increases are sufficient to propel the USD/JPY higher and exit the current scenario, momentum should carry the pair lower.

Japan statistics January 11-January 15

The Producer Price Index was unexpectedly strong in December and the annual rate improved from November giving some hope that deflation may be loosening its grip on the Japanese economy.

Monday

Bank lending rose 6.2% on the year in December, unchanged from November and as expected.

Tuesday

The Eco Watchers Survey Outlook registered 37.1 in December, up from 36.5 in November and much stronger than the 25 forecast. The current survey fell to 35.5 from 45.6 in November, slightly better than the 35.1 expectation. Money supply, M2 and CDs, rose 9.2% in December, less than the 9.8% projection but slightly ahead of the 9.1% increase in November.

Wednesday

The Producer Price Index (PPI) rose 0.5% on the month in December after falling 0.1% in November. The forecast was 0.2%. The annual rate fell 2% on a 2.2% forecast and November's 2.3% drop. Machinery Orders rose 1.5% on the month and fell 11.2% on the year both better than their respective -6.2% and -15.4% predictions.

Friday

The Tertiary Index fell 0.7% in November on a 0.3% forecast and November's 1.6% gain.

US statistics January 11-January 15

Retail Sales in December were far worse than expected as were Initial Claims but had little impact on the dollar. Markets remain focused on the prospective federal stimulus package and US Treasury rates.

Tuesday

The National Federation of Independent Business Optimism Index (NFIB) dropped to 95.9 in December from 101.4 prior. The forecast was 102.8. The JOLTS Job Openings saw 6.527 million places in November, down from 6.632 in October and below the 6.916 million forecast.

Wednesday

The Consumer Price Index (CPI) rose 0.4% on the month and 1.4% on the year in December up from 0.2% and 1.2% in November. Core CPI rose 0.1% and 1.6% from 0.2% and 1.6% prior. The Fed's Beige Book, prepared for the January 29-30 FOMC meeting, said the economy grew “modestly” in the final weeks of 2020, with the return of COVID-19 cases hampering activity.

Thursday

Initial Jobless Claims jumped to 965,000 in the week of January 8, the highest in five months, from 784,000 previous, 795,000 had been expected. Continuing Claims rose to 5.271 million from 5.072 million, 5.061 had been forecast.

Friday

Retail Sales fell 0.7% in December far worse than the flat expectation and the November result was revised to -1.4% from -1.1%. Control Group Sales fell 1.9% from -1.1% in November, its forecast was 0.1%. Sales ex-Autos dropped 1.4% on a -0.1% forecast. November was revised to -1.3% from -0.9%. The Producer Price Index (PPI) rose 0.3% in December after a 0.1% gain in November. On the year it was unchanged at 0.8%. The Core PPI Index was unchanged at 0.1% on the month, and 1.2% on the year after 1.4% in November. Industrial Production jumped 1.6% in December, quadruple its 0.4% forecast and more than three times the 0.5% November rate. Capacity Utilization in December fell to 79.2% from 80.7%. The Michigan Consumer Sentiment Index slipped to 79.2 in January from 80.7 prior. The forecast was 80.

FXStreet

Japan statistics January 18-January 22

Imports and Exports for December are the most pertinent information. The first rise in Exports in 24 months is forecast. The BOJ is not expected to make any changes in monetary policy or bond purchases.

Monday

Industrial Production for November is forecast to be unchanged at 0% on the month and 3.4% on the year after revision.

Tuesday

The Merchandise Trade Balance in December is forecast to rise to 942.8 billion yen from 366.8 billion in November. Imports are predicted to decrease 14% in December after falling 11.1% in November. Exports are anticipated to rise 2.4% in December following a 4.2% decline in November.

Thursday

The BOJ should leave the base rate unchanged at -0.1%. National CPI ex-Fresh Food is forecast to drop 1.1% in December, from -0.9% in November.

Friday

The Jibun Bank Manufacturing PMI for January is out, December came in at 50.

FXStreet

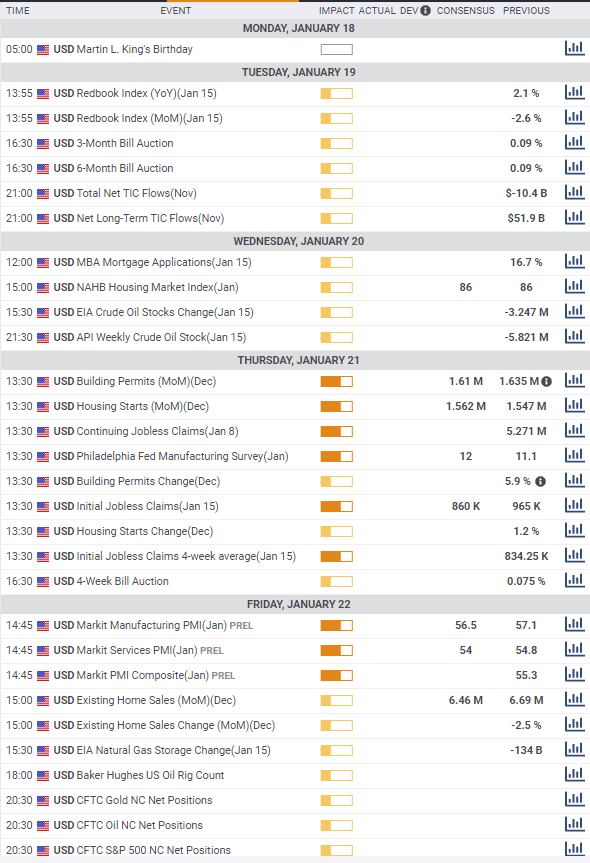

US statistics January 18-January 22

Initial Jobless Claims are front and center for the labor market.

Wednesday

National Association of Home Builders (NAHB) Housing Market Index is expected to be unchanged at 86 in January.

Thursday

Housing Starts should rise to 1.562 million annualized in December from 1.547 million in November. Building Permits are forecast to drop to 1.61 million annualized from 1.635 million. Initial Jobless Claims are projected to drop to 860,000 in the January 15 week. Continuing Claims were 5.271 million in the January 1 week.

Friday

Markit Manufacturing PMI is expected to fade to 56.5 in January from 57.1. The Services PMI is forecast to drop to 54 from 54.8. Existing Home Sales should drop to 6.46 million annualized in December from 6.69 million prior.

USD/JPY technical outlook

Within the confines of the descending channel the dominant technical aspect is the interference of the regularly spaced resistance lines. Such lines have served, throughout the long decline, as a effective impediment to the weak and periodic recoveries. The reverse is true of support which quickly enters territory without appreciable trading activity making the establishment of a technical base difficult.

The Relative Strength Index at 52.38 is a moderate buy signal. The 21-day moving average at 103.54 is good support as its coincides with a line at 103.50. The 100-day line at 104.63 backs resistance at 104.55 and the 200-day average at 105.81 awaits a change in circumstances.

Resistance: 104.25; 104.55; 104.85; 105.15; 105.50

Support: 103.70; 103.50; 103.00; 102.75; 102.00; 101.30

FXStreet Forecast Poll

The FXStreet Forecast Poll, like last week, is a limited endorsement of a lower USD/JPY. The poll predictions stay well within the descending channel. It will require a change in economic fundamentals to depart the current scenario and the poll recognizes that basic fact.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.