USD/JPY Weekly Forecast: A time to bide

- US Congressional negotiations over stimulus package appear to fail.

- USD/JPY restricted range gives technical indicators heavier trading influence.

- Improved US data gave the dollar some support at week end.

- FXStreet Forecast Poll shows weak negative sentiment.

Tired of waiting for the US Congress to arrange a second stimulus package, currency markets ignored the apparent failure of talks and their own prior risk assessment, letting the Japanese yen close the week's trading with a small gain.

Previous sessions had treated the three-way negotiations between the House Democrats, the Senate Republicans and the Trump White House as a safety-trade event. When news was positive and it seemed a deal might be reached, the dollar sold off on the logic that stimulus would improve the US economy, reducing general risk. When negotiations reached any of several impasses or when President Donald Trump temporarily withdrew from the talks, the USD/JPY shot higher as traders sought the supposed safety of US assets.

On Thursday it seemed that the expected compromise between the House Democrats' $2.2 trillion package and the White House's $1.8 trillion offer had failed.

When Senate Republican Majority Leader Mitch McConnell was asked about the prospect for a deal after President Trump said he was willing to increase his limit he said, “I don’t think so," "That’s where the administration's willing to go. My members think what we laid out, a half a trillion dollars, highly targeted, is the best way to go."

The two sides are still in contact but with Democratic House Speaker Nancy Pelosi telling her caucus there are still many differences, Treasury Secretary Stephen Mnuchin heading to the Middle East in a few days, with less than three weeks before the election, and no new meeting scheduled, the possibility for a deal diminishes daily.

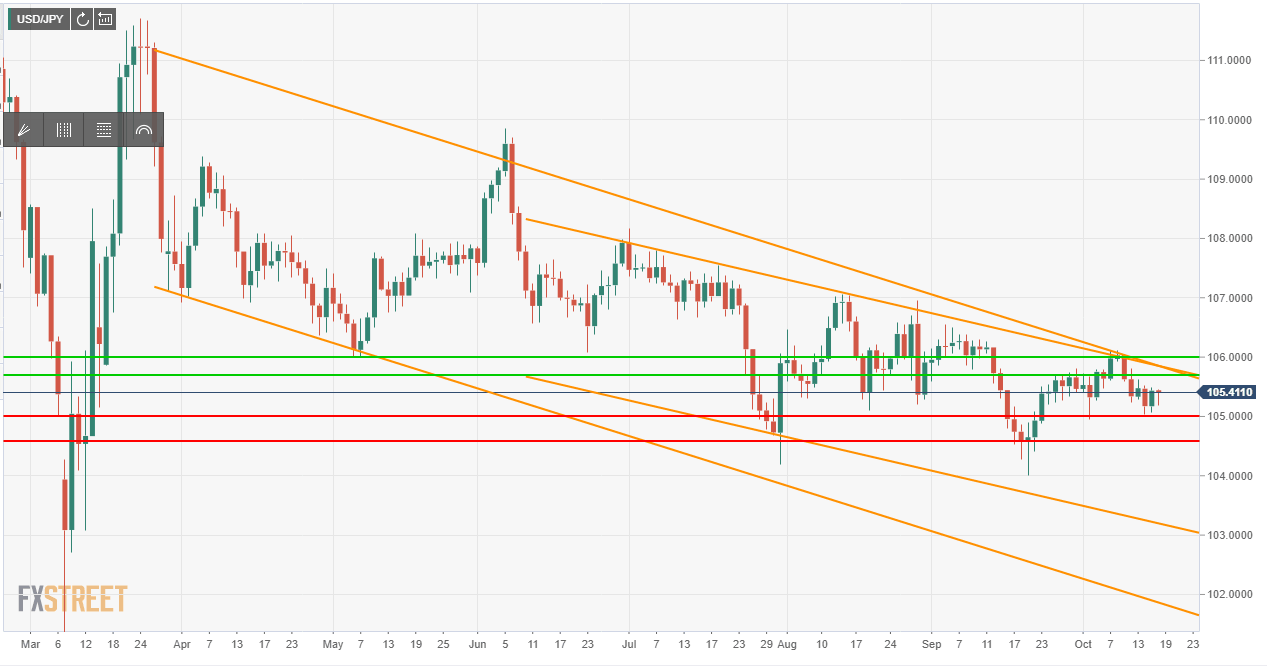

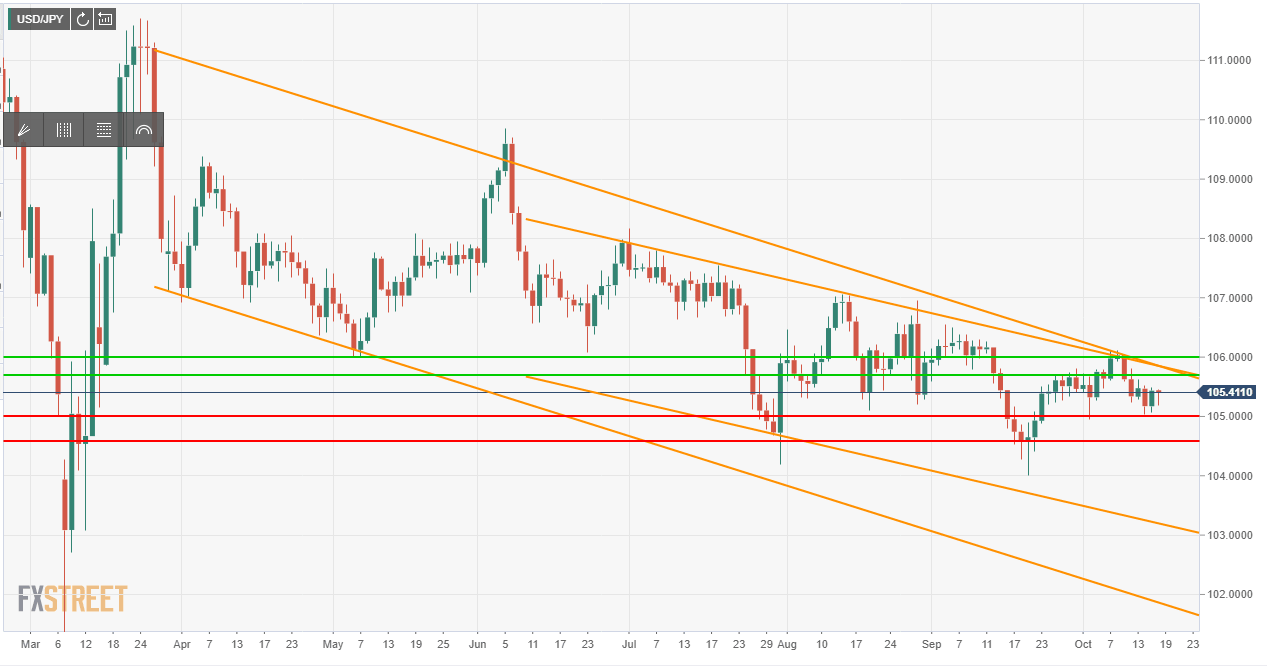

In the USD/JPY last Friday's rejection at the upper border of the six-month descending channel is still the main trading point. The close that day of 105.62 has defined the upper limit of this week's action.

By the end of the coming week the limit of the channel will have dropped to that 105.62 resistance line increasing its potency.

The descending channel remains the main technical motif and with support at 105.00 and 104.55 relatively weak and a large, sparsely traded area to the next support at 103.00, the path of least resistance is down.

Japanese and US statistics October 12-October 16

Japanese and US statistics October 12-October 16

Japanese statistics had no market impact this week as the two releases covered August.

Industrial Production sank 13.8% in August, worse than the 13.3% forecast though an improvement on July's 15.5% decrease. On the year Industrial Production rose 1%, missing its 1.7% prediction and far below the 8.7% July gain.

The Tertiary Index, which tracks the domestic service sector, rose 0.8% in August following July's 0.5% decline.

American data had negligible impact on the USD/JPY this week. Inflation for September came in as expected with the Consumer Price Index registering 1.4% on the year and the core rate reading 1.7%. Initial Jobless Claims rose unexpectedly to 898,000 in the week of October 9, ahead of the 825,000 forecast and the prior week's 845,000. Continuing Claims were lower than predicted in the October 2 week at 10.018 million, on a 10.7 million projection and 11.183 million prior.

Friday's Retail Sales figures supplied the only surprise and were much stronger than forecasts in all three categories. Overall sales rose 1.9% nearly triple the 0.7% forecast and so the 0.6% August gain. The GDP component Control Group jumped 1.4%, far more than the 0.2% consensus forecast and the revised -0.3% August result. Finally, Sales ex-Autos climbed 1.5%, thrice the 0.5% prediction and the identical August score.

As might be expected from such buoyant retail numbers, US consumers were happier than anticipated in October. The preliminary reading from the Michigan Survey reached 81.2 from 80.4 in September. The forecast from the Reuters Survey was 80.5.

USD/JPY outlook

The fundamental picture has not changed from last week though the alternating risk-on and off from the Washington stimulus talks had worn out by Friday.

Markets have not replaced the general safety trade outlook with an analysis based in comparative economics. With new COVID-19 diagnoses in Europe now outstripping those in the US, where they are rising also, the overall risk sensitivity is not likely to fade in the near future.

Technical considerations are the main force edging the USD/JPY lower. The descending channel that dates to late April and the market panic around the early COVID-19 scare, has governed trading in the absence of countervailing factors and that should continue.

Until there is a sense that the virus has run its course, if not in diagnoses at least in the forcing of more economic closures, the primary market expression will remain tied to these external risk parameters.

In a strict economic comparison the US and the dollar would likely perform far better than Japan and the yen, but that somewhat nostalgic approach is weeks or months away.

Japan and US statistics October 19-October 23

The pending statistics from Japan, one each for August, September and October will not affect markets.

The All Industry Activity Index, which tracks production changes in all industries, rose 1.3% in July. The August specific will be released on Thursday.

National CPI for September is out on Friday. The overall annual rate was 0.2% in August and the core rate was -0.1%.

The Jibun Bank Manufacturing PMI preliminary score for October is forecast to be 47.3, down from 47.7 in September. If correct it would be the 18th straight month of contraction for this index.

The main even in the US is the second and final Presidential debate on Friday at 9:00 pm EST. Markets disregarded the first debate between President Donald Trump and former Vice-President Joe Biden while it was occurring and the various post-mortem analyses had no greater impact. The policy arguments, charges, countercharges and rhetoric in this meeting will be ignored as well. The one possibility for market effect is a breakdown by either candidate, a noticeable mental lapse by Biden or an aggressive tirade from Trump. The odds for either are low.

Housing Starts and Building Permits on Tuesday and Existing Home Sales on Thursday, all for September, track the booming US home market. Starts are forecast to be 1.451 million annualized following August's 1.416 million and permits are expected to be 1.5 million, after 1.476 million prior. Existing Home Sales are predicted to climb to 6.16 million annualized from 6 million in August. All three figures would be among the highest numbers since the housing bubble of over a decade ago.

Federal Reserve Chairman Jerome Powell will speak at the International Monetary Fund meeting on Monday. The bank issues its Beige Book of economic anecdotes for the November 4-5 FOMC meeting on Wednesday. With the Fed on self-declared hold until the end of 2023, neither will overly concern traders.

Friday brings the Markit preliminary PMIs for October. Little change is expected, 53.3 from 53.2 in manufacturing and 54.5 from 54.6 in services.

USD/JPY technical outlook

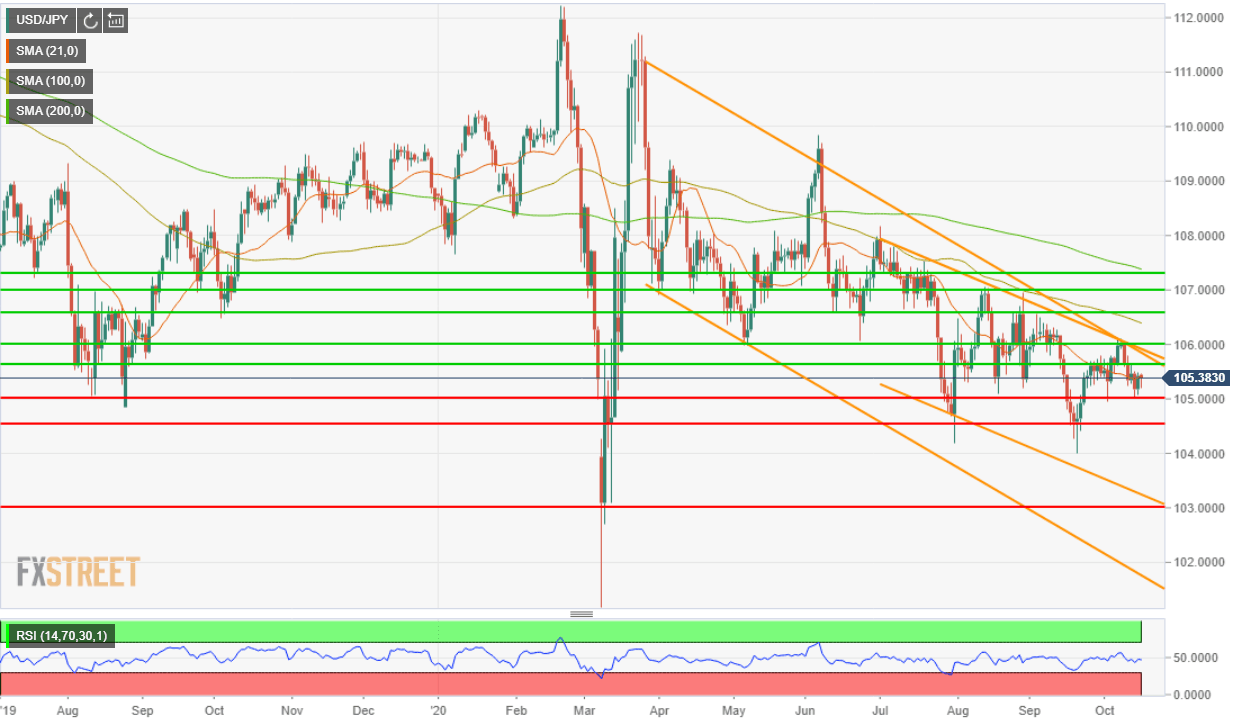

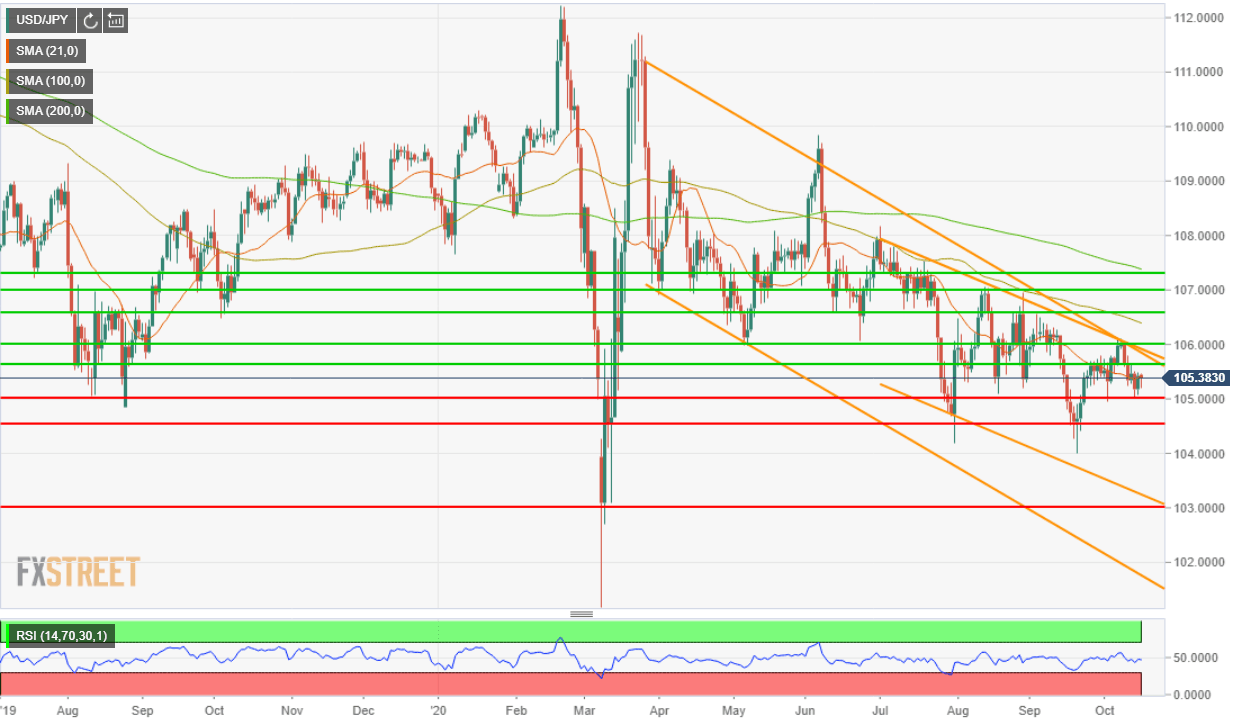

The nearly sideways motion of the USD/JPY over the last three weeks is indicative of the exhausted fundamental logic of the continuing move lower. The technical barriers of the descending channel, resistance lines above and weak and sparse support are sufficient to keep the pair headed south but it is a direction without conviction.

The Relative Strength Index at 46.91 is weakly negative and not a signal for pending declines. The moving averages are all above the current market. The 21-day average at 105.42 is a directional rather than resistance. The 100-day at 106.39 is part-way between resistance at 106.00 and 106.60 and the 200-day at 107.30 coincides with resistance.

Resistance: 105.62; 106.00; 106.60; 107.00; 107.30

Support: 105.00; 104.55; 103.00

USD/JPY Forecast Poll

USD/JPY Forecast Poll

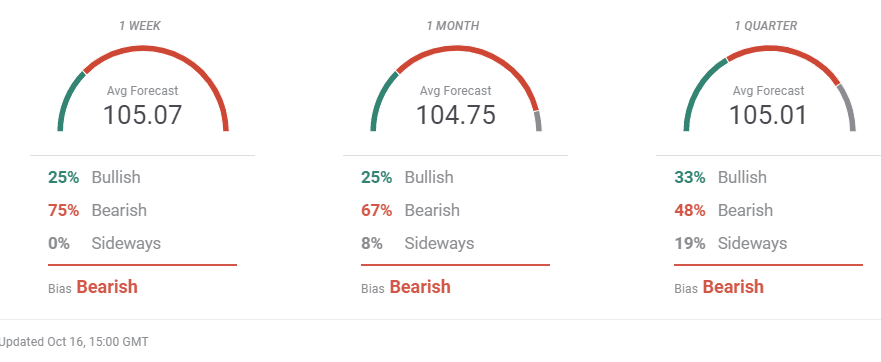

The fatigue of the USD/JPY descent is evident in the uniformly bearish FXStreet Forecast Poll. Negative across three time frames, the range of the predictions is a mere 32 points. There is no trend here, just a meandering move lower in wait for developments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.